Mortgage Economic Review For July 2023

A summary and review of key economic data that affects the mortgage and real estate business.

By Mark Paoletti

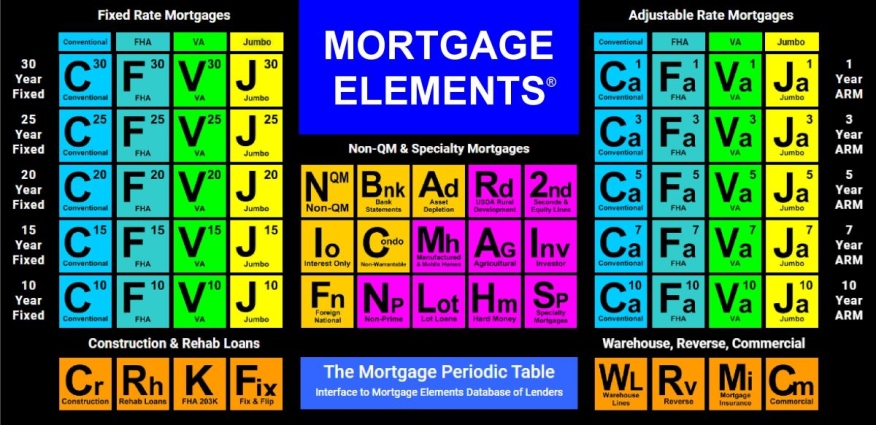

Mortgage Elements Inc.

The Mortgage Economic Review is a monthly summary of key economic indicators, data, and events pertinent to mortgage and real estate professionals.

At A Glance: Key Economic Events & Data Released During June 2023

- Interest rates: The 10-Year Treasury yield rose to 3.81% (June 30) from 3.64% (June 1).

- Housing: Existing home sales rose 0.2% (-20.4% year over year), new home sales jumped 12.2% (+20% YoY), pending home sales fell 2.7% (-22.2% YoY), home prices are up 1.7% (- 3.1% YoY).

- Labor: The U.S. economy created 339,000 new jobs in May, the unemployment rate rose to 3.7%, and wages increased by 4.3% YoY.

- Inflation: The May Consumer Price Index (CPI) rose 0.1% (+4% YoY), and Personal Consumption Expenditure (PCE) Price Index rose 0.1% (+3.8% YoY).

- The economy: U.S. Gross Domestic Product (GDP) grew by a 2% annualized rate in the first quarter, up 1.8% YoY.

- Consumers: Retail sales rose 0.3% (+1.6% YoY). Consumer confidence and sentiment rose.

- Stock markets rose in June: Dow +3.8%; S&P +6.1%; Nasdaq +6.1%.

- Oil prices rose in June to $70/barrel (June 30) from $68/barrel (May 31).

Interest Rates and Fed Watch

Fed watchers had a lot to talk about in June. The last Federal Open Market Committee (FOMC) meeting wrapped up June 14, and as expected the Fed left interest rates unchanged. There were also several speaking engagements with Fed officials, including Chairman Jerome Powell's testimony before the House Financial Services Committee, and policy meetings in Spain and Portugal. In Spain, Powell said: “A strong majority of committee participants expect that it will be appropriate to raise interest rates two or more times by the end of the year.” In Portugal, he commented that the main driver of inflation is "a very strong labor market.” Several other central banks — Bank of Canada, Bank of Australia, European Central Bank, and Bank of England — raised interest rates in June. The next FOMC meeting is July 25-26. In the meantime, expect more interest Rate hikes this year and rates to stay elevated for a while.

- 10-Year Treasury Note Yield rose to 3.81% (June 30) from 3.61% (June 1).

- 30-Year Treasury Bond Yield rose to 3.85% (June 30) from 3.84% (June 1).

- 30-Year Fixed Mortgage fell to 6.71% (June 29) from 6.79% (June 1).

- 15-Year Fixed Mortgage fell to 6.06% (June 29) from 6.18% (June 1).

Housing Market Data Released In June 2023

In December 2022, housing analysts made predictions for home prices during 2023. Those predictions were all over the board — from a decline of 20% to an increase of 8%. We are halfway into 2023 and home prices are still rising, but at a much slower pace than 2020-22. Housing analysts so far have underestimated the demand for homes. That is partially due to the strong labor market. People still want to own their homes. As long as households are secure in their jobs, they will keep buying. If they can't find an existing home, they will purchase a new home. Higher interest rates haven't scared off potential homebuyers, because they plan to refinance when rates drop.

- Existing home sales (closed deals in May) rose 0.2% to an annual rate of 4.3 million homes, down 20.4% in the last 12 months; 25% were all-cash sales. The median price for all types of homes is $396,100, down 3.1% from a year ago. The median single-family home price is $401,100, down 3.4% YoY. The median condo price is $353,000, unchanged YoY. Homes were on the market for an average of 18 days, and 74% sold in less than a month. Currently, 1.08 million homes are for sale.

- New home sales (signed contracts in May) rose 12.2% to a seasonally adjusted annual rate of 763,000 homes, up 20% YoY. The median new home price is $428,000. The average price is $487,300. There are 428,000 new homes for sale, a 6.7-month supply.

- Pending home sales index (signed contracts in May) fell 2.7% to 76.5 from 78.9 the previous month, down 22.2% YoY.

- Building permits (issued in May) rose 5.2% to a seasonally adjusted annual rate of 1.49 million units, down 12.7% YoY. Single-family permits rose 4.8% to an annual pace of 897,000 homes, down 13.2% YoY.

- Housing starts (excavation began in May) rose 21.7% to an annual adjusted rate of 1.63 million, up 5.7% YoY. Single-family starts rose 18.5% to 997,000 units, down 6.6% YoY.

- Housing completions (completed in May) rose 9.5% to an annual adjusted rate of 1.52 million units, up 5% YoY. Single-family completions rose 3.9% to an annual adjusted rate of 1.01 million homes, down 3.3% YoY.

- S&P/Case-Shiller 20-City Home Price Index rose 1.7% in April, down 1.7% YoY.

- FHFA Home Price Index rose 0.7% in April, now up 3.1% YoY.

Labor Market Economic Data Released in June 2023

The Economy created 339,000 New Jobs during May, much higher than the 194,000 that was expected. The strength of the Labor Market has continued to surpass Economists' predictions for the past 18 months. Higher Interest Rates have not quelled the demand for workers. With 10,100,000 Job Openings, there are roughly 1.6 jobs available for every unemployed worker. Most Economists agree that Inflation can't return to the 2.0% Fed target until the Unemployment Rate is above 4.0% - 4.5%. Wages are increasing at 4.3%, but that's not enough to keep up with Inflation. Consequently, several Unions have threatened to strike for higher pay. Higher wage demands are an ominous sign that the Wage-Price Spiral is becoming entrenched. Once that happens, Inflation becomes harder to control. Don't expect the Fed to stop raising Interest Rates until we see the Unemployment Rate above 4.0%.

- The Economy created 339,000 new jobs in May.

- The unemployment rate rose to 3.7% in May from 3.4% in April.

- The labor force participation rate was unchanged at 62.6% in May.

- The average hourly wage rose 0.3% in May, up 4.3% YoY.

- Job openings rose to 10.1 million in April from 9,745,000 in March.

Inflation Economic Data Released In June 2023

The inflation data is slowly getting better. The key word is "slowly." There is a long way to go to the Fed's target of 2%, but we are headed in the right direction. A bright spot in the data was Producer Price Index (PPI), which is up only 1.1% YoY. The PPI tracks the cost of materials that producers pay. The CPI typically lags the PPI by several months. If the PPI stabilized, then the CPI should stabilize several months down the road. How many months? Six to 12 months is typical, but this economy is not typical. The Fed doesn't think inflation will be within the target range until 2025. That's assuming we don't get another market shock.

- CPI rose 0.1%, up 4.0% YoY | Core CPI rose 0.4%, up 5.3% YoY

- PPI fell 0.3%, up 1.1% YoY | Core PPI rose 0.1%, up 2.8% YoY

- PCE rose 0.1%, up 3.8% YoY | Core PCE rose 0.3%, up 4.6% YoY

GDP Economic Data Released In June 2023

The third and final estimate for first quarter 2023 GDP showed the U.S. Economy grew at a 2% annualized rate, up 1.8% YoY. The jump in GDP to 2% from the last estimate of 1.3% surprised most analysts since the market was expecting a 1.4% GDP. The strong economy gives the Fed justification for additional rate hikes. Despite talk of an impending recession, the economy keeps chugging along. At this point, economists are still divided as to whether there will be a recession in the second half of 2023.

Consumer Economic Data Released In June 2023

The consumer's mood improved in May. Consumer confidence and sentiment rose substantially. Why? Inflation is trending lower, and workers feel secure in their jobs. The big price increases from 2022 are over, and wages are still increasing. Although consumers are feeling better about their jobs and the economy, some clouds are gathering on the horizon. Consumer debt is at record levels and rising. High prices have strained household budgets, and people turned to credit cards to make up the difference. While not a problem yet, economists are concerned about growing consumer debt levels.

- Retail sales rose 0.3% during May, up 1.6% in the last 12 months.

- Consumer Confidence Index rose 7% to 109.7 from 102.3 the prior month, up 22.5% YoY.

- Consumer Sentiment Index (Univ. of Michigan) rose 8.8% to 64.4 from 59.2 the previous month.

Energy, International, And Things You May Have Missed

- West Texas intermediate crude rose to $70/barrell (June 30) from $68/barrel (May 31).

- North Sea Brent crude rose to $75/barrel (June 30) from $73/barrel (May 31).

- Natural gas rose to $2.771/MMBtu (June 30) from $2.26/MMBtu (May 31).

- Saudi Arabia announced they would cut crude oil production by another 1 million barrels/day to keep prices in the mid-$70s.

- The European Central Bank, the Bank of England, and the Bank of Canada raised interest rates in June.

- A mini-coup in Russia that lasted one day was quickly resolved.

The Mortgage Economic Review is produced by Mortgage Elements Inc. and MortgageElements.com, and is a concise summary of key economic data that influences the mortgage and real estate industries. The information is gathered from sources believed to be credible; some are opinion-based and editorial in nature. Mortgage Elements Inc. does not guarantee or warrant its accuracy or completeness.