Mortgage Economic Review For May 2023

A summary and review of key economic data from April that affects the mortgage and real estate business.

By Mark Paoletti

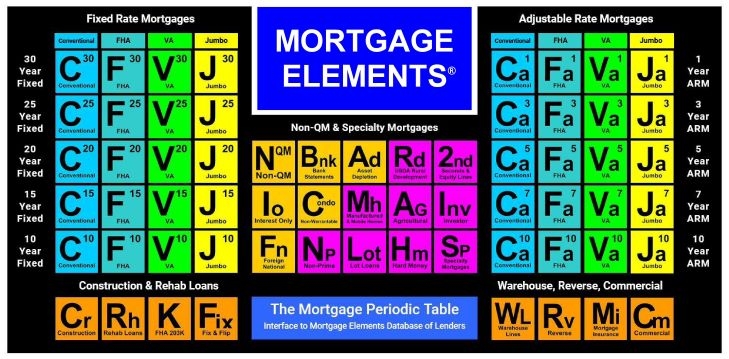

Mortgage Elements Inc.

The Mortgage Economic Review is a monthly summary of key economic indicators, data, and events pertinent to mortgage and real estate professionals.

At A Glance — Key Economic Events & Data released During April 2023:

- Interest rates: The 10-Year Treasury yield fell to 3.44% (April 28) from 3.48% (March 31).

- Housing: Existing home sales fell 2.4% (-22% year over year), new home sales jumped 9.6% (-3.4%YoY), and pending home sales fell 5.2% during March. Home prices continue to rise slowly.

- Labor: The U.S. economy created 236,000 new jobs in March. The unemployment rate fell to 3.5%, and wages increased 4.2% YoY.

- Inflation: March consumer price index (CPI) rose 0.1% (+5% YoY), and producer price index (PPI) fell 0.5% (+2.7% YoY).

- The economy: U.S. gross domestic product (GDP) grew by a 1.1% annualized rate in the first quarter of 2023, up 1.6% YoY.

- Consumers: Retail sales fell 1%, consumer confidence fell, consumer sentiment rose.

- Stock markets ended slightly higher in April: Dow +2.5%, S&P +1.5%, Nasdaq +0%.

- Oil prices rose slightly in April to $77/barrel (April 28) from $76/barrel (March 31).

Interest Rates and Fed Watch:

All eyes are on the May 3 Federal Open Market Committee (FOMC) meeting. Fed watchers expect another 0.25% bump to the federal funds rate, followed by a "pause" as the Fed watches how the economy performs with higher rates. About a year ago, the Fed started raising interest rates and tightening the money supply to battle high Inflation. Everyone knew higher interest rates would eventually slow the economy and possibly create a recession. If that recession did occur, the plan called for a mild recession or "soft landing." All risky monetary maneuvers come with consequences (intended or unintended). One consequence of a restrictive monetary policy is the recent string of bank failures. The Fed needs to ensure this situation does not spiral out of control and impact confidence in the banking system. If consumers lose faith in the banking system, spending will probably plummet, resulting in a "hard landing." In the meantime, consumer spending, the labor market, and the economy, in general, have shown incredible resilience.

- 10-year Treasury Note yield fell to 3.44% (April 28) from 3.48% (March 31).

- 30-year Treasury Bond yield closed at 3.67% (April 28) from 3.67% (March 31).

- 30-year fixed mortgage rose to 6.43% (April 27) from 6.32% (March 30).

- 15-year fixed mortgage rose to 5.71 (April 27) from 5.56% (March 30).

Housing Market Data Released in April 2023:

Some good news in the housing market — new home sales jumped almost 10% in March. People can't find an existing home to buy, so they are purchasing a new home since there are a near-record number of new homes under construction. Lumber prices are down to pre-pandemic levels. Supply-chain issues are resolved, and building supplies are readily available. Construction labor is still tight, but that is slowly loosening. If interest rates drift lower in late 2023 or 2024, expect the new home market to continue to grow.

- Existing home sales (closed deals in March) fell 2.4% to an annual rate of 4.44 million homes, down 22% in the last 12 months; 27% were all-cash sales. The median price for all types of homes is $375,700, down 0.9% from a year ago. The median single-family home price is $380,000, down 1.4% YoY. The median condo price is $337,300, up 2.1% YoY. Homes were on the market for an average of 29 days, and 65% sold in less than a month. Currently, 980,000 homes are for sale.

- New home sales (signed contracts in March) rose 9.6% to a seasonally adjusted annual rate of 683,000 homes, down 3.4% YoY. The median new home price is $449,800. The average price is $562,400. There are 432,000 new homes for sale, a 7.6-month supply.

- Pending Home Sales Index (signed contracts in March) fell 5.25% to 78.9 from 83.2 the previous month, down 23.2% YoY.

- Building permits (issued in March) fell 8.8% to a seasonally adjusted annual rate of 1.4 million, down 24.8% YoY. Single-family permits rose 4.1% to an annual pace of 818,000 homes, down 29.7% YoY.

- Housing starts (excavation began in March) fell 0.8% to an annual adjusted rate of 1.4 million, down 17.2% YoY. Single-family starts rose 2.7% to 838,000 units, down 27.7% YoY.

- Housing completions (completed in March) fell 0.6% to an annual adjusted rate of 1.5 million units, up 12.9% YoY. Single-family completions rose 2.4% to an annual adjusted rate of 1.05 million, down 0.2% YoY.

- S&P/Case-Shiller 20-City Home Price Index rose 0.1% in February, up 0.4% YoY.

- FHFA Home Price Index rose 0.5% in February, now up 4.0% YoY.

Labor Market Economic Data Released in April 2023:

The economy created 236,000 new jobs during March, which aligned with expectations. Economic data released in April shows the Labor Market is softening slightly, but remains incredibly resilient. There are still almost 10 million job openings, wages are growing about 4%, unemployment is low, and more people are entering the workforce. As long as the consumer continues to spend, the labor market will remain strong.

- The economy created 236,000 new jobs in March.

- The unemployment rate fell to 3.5% in March.

- The labor force participation rate rose to 62.6% in March.

- The average hourly wage rose 0.3% in March, up 4.2% YoY.

- Job openings fell to 9.93 million in February from 10.8 million in January.

Inflation Economic Data Released in April 2023:

The latest CPI data showed prices rose by 0.1% in March, up 5% YoY. The Fed's weapon of high-interest rates is slowly winning the war on inflation. This report is the lowest CPI reading in almost two years and is the ninth-straight month of falling Inflation. The cooler inflation rate is being helped by lower energy prices — gasoline prices are down 17%. Food prices are still high, but have leveled off after spiking in 2022. The problem is still shelter. Rents have declined slightly, but home prices are stubbornly high. Strong demand by millennial household formation and lack of inventory for sale exacerbate the situation. Expect inflation to trend lower in the spring, provided we don't get another energy shock.

- CPI rose 0.1%, up 5% YoY | Core CPI rose 0.4%, up 5.6% YoY

- PPI fell 0.5%, up 2.7% YoY | Core PPI fell 0.1%, up 3.4% YoY

- PCE rose 0.1%, up 4.2% YoY | Core PCE rose 0.3%, up 4.6% YoY

GDP Economic Data Released in April 2023:

The first estimate for first quarter 2023 GDP showed the U.S. economy grew at a 1.1% annualized rate, up 1.6% YoY. The economy is slowing down, and that's precisely what the Fed wants. The economy has not come to a screeching halt, just slowing down. The Fed's goal is to slow the economy enough to cool Inflation without throwing it into a recession — a "soft landing.” Can they do it? Maybe. There are different opinions and disagreements among economists. The most unsettling issue is the recent spate of bank failures. So far, the consumer (and economy) has been remarkably resilient. However, if consumers' faith in the banking system gets rattled, they will reel in spending quickly. Since the economy is 70% consumer driven, this could turn a "soft landing" into a "hard landing.”

Consumer Economic Data Released in April 2023:

Consumers were slightly more cautious with their purchases in March. The good news is that they continued to spend. Retail sales were down 1%, but much of that decrease can be attributed to lower gasoline prices. Consumer spending will remain high as long as consumers feel secure in their jobs. Consumer confidence was down, while consumer sentiment rose.

- Retail sales fell 1% during March, up 2.9% in the last 12 months.

- Consumer Confidence Index fell 2.6% to 101.3 from 104 the prior month.

- Consumer Sentiment Index (University of Michigan) rose 2.4% to 63.5 from 62 the previous month.

Energy, International, and Things You May Have Missed:

- West Texas intermediate crude rose to $77/barrel (April 28) from $76/barrel (March 31).

- North Sea Brent crude was unchanged at $80/barrel (April 28) from $80/barrel (March 31).

- Natural gas rose to $2.41/MMBtu (April 28) from $2.22/MMBtu (March 31).

- Several major oil-producing countries (including Saudi Arabia) made a surprise announcement to cut crude production.

- To reduce expenses and bolster its stock price, Disney continued its plan to lay off 7,000 workers to save $5.5 billion.

- After years of speculation, Bed Bath & Beyond filed for bankruptcy court protection.

- Violence intensified in Sudan as various factions fight for control of the country.

The Mortgage Economic Review is produced by Mortgage Elements Inc. and MortgageElements.com, and is a concise summary of key economic data that influences the mortgage and real estate industries. The information is gathered from sources believed to be credible; some are opinion-based and editorial in nature. Mortgage Elements Inc. does not guarantee or warrant its accuracy or completeness.