“Private MI plays a critical role in facilitating homeownership for first-time and low- and moderate-income borrowers while shielding lenders, the government-sponsored enterprises (GSEs), and taxpayers from credit risk. The implementation of important enhancements over the past 15 years has made the private MI industry stronger and more resilient,” said Seth Appleton, president of USMI. “Not only does private MI provide stability to the housing market, but it is also very well positioned to meet borrower demand as proven by the more than 1 million Americans who relied on private MI in 2022 to purchase or refinance a home.”

The Urban Institutes’ 2023 “Mortgage Insurance Data at a Glance” report states that private MI “is highly effective in reducing losses to the GSEs,” as “the loss severity the GSEs experience is lower for loans with [private MI] than for those without because mortgage insurance recoveries reduce losses.”

Reduces GSE Losses

The Urban Institute says, “During the past 66 years, the private mortgage insurance industry has enabled homeownership for more than 38 million borrowers who lack sufficient funds for a 20% down payment on a conventional mortgage.”

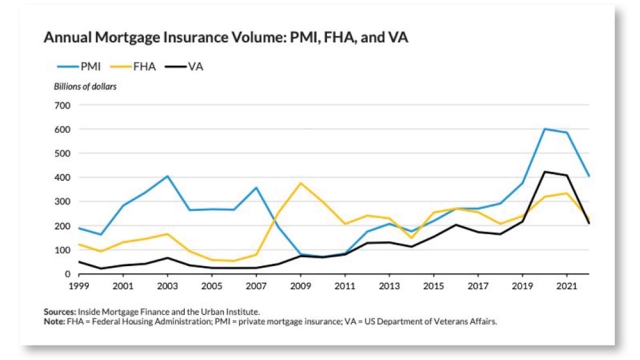

According to the report, total loss severity for the 1994-2022 origination period of GSE loans without private MI was 37.6%, while loans with private MI were 26.4%, meaning loans without private MI experienced a 42.4% higher rate of loss severity when compared to the loss severity rate of loans with private MI during this time period. Further, the Urban Institute’s report also found that mortgages backed by private MI have been the most common execution for low down payment borrowers since 2018.

The Urban Institute also looked at how private mortgage insurers have become increasingly proactive in managing and distributing credit risk. In 2015, the industry expanded its credit risk transfer capabilities and issued $298.9 million in insurance-linked notes (ILNs), covering $32.4 billion of insurance in force. By 2021, the annual issuance increased to $6.3 billion, protecting $652.2 billion in mortgage loans.