Mortgage Rates Climb Again, But Pace Slows

Freddie Mac says the 30-year fixed-rate mortgage is still under 7%; others say it's crossed that threshold.

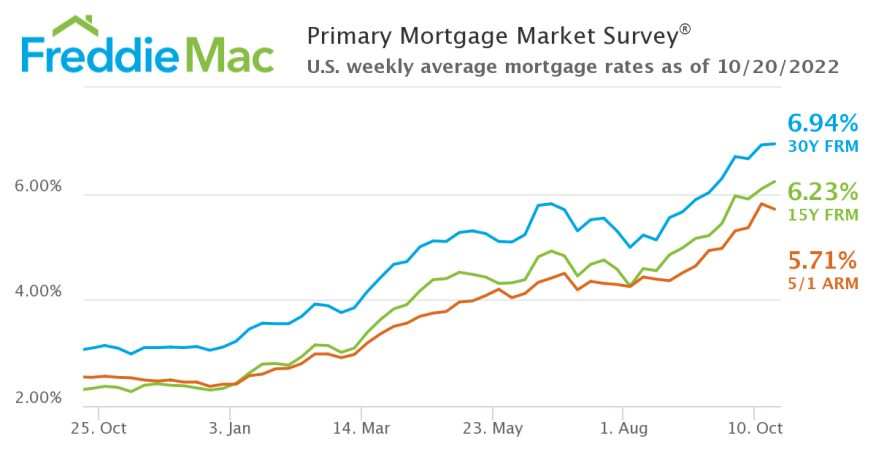

The average rate for the 30-year fixed continues to climb toward 7%, ticking up slightly again this week.

According to Freddie Mac, the average rate for the 30-year fixed is now at 6.94%, up 0.02 percentage points from last week. The average for the 15-year saw a bigger jump, climbing 0.14 points to 6.23%.

Others tracking rates show they've already crossed 7%. Bankrate says the current average for the 30-year rate is 7.08%.

To consumers, it likely matters little whether the rate is just above or below the mark.

“The 30-year fixed-rate mortgage continues to remain just shy of 7% and is adversely impacting the housing market in the form of declining demand,” said Sam Khater, Freddie Mac’s chief economist. “Additionally, homebuilder confidence has dropped to half what it was just six months ago and construction, particularly single-family residential construction, continues to slow down.”

Some mortgage experts are surprised to see rates this high, especially after things cooled off over the summer. After reaching a high of 5.81%, the average rate for the 30-year fixed mortgage fell as low as 4.99% in early August.

“The end of July we actually had seen a really nice dip in rates, and it seemed like we peaked in June,” said Hammer J. Helmer, founder and CEO of Originator Success.

Other experts, though, said they saw this coming, because inflation remains at its highest level in 40 years.

Barry Habib, founder and CEO of MBS Highway, noted that mortgage rates traditionally shadow inflation. The Federal Reserve helped pause that trend earlier this year when it continued with quantitative easing.

Now that the Fed is selling off its share of residential mortgage-backed securities, mortgage rates have caught back up to inflation.

“Once they took QE and stopped, mortgage rates did what they always do, they follow inflation — inflation goes up, mortgage rates go up; inflation goes down, mortgage rates go down,” Habib said.

So will mortgage rates continue to climb? Habib thinks inflation has peaked, noting that consumer price index (CPI) numbers through October were still compared with low numbers from last year.

He also said that some key information, like shelter, tends to lag, and the CPI numbers are just catching up to where the market’s been. He’s confident next month’s CPI will show improvement, and mortgage rates will also level off.

Helmer agrees. He said rates could trickle up to 8%, but we’re pretty close to the peak so long as inflation has also peaked.

“If we see the inflation, core inflation specifically, (is) not improving, if we see that the labor market still is extraordinarily strong, the rest of the economic reports show that consumer spending — that could actually see mortgage rates push up into 8s,” Helmer said.

That may not be the news borrowers want to hear, but experts say originators can still find opportunities.

Helmer said originators do have to build their customer pool. He also said borrowers will eventually get over their sticker shock once they get used to the idea of a 7% mortgage.

“People go through five stages of grief when rates go up — they get angry, they bargain, they’re in denial, and then they eventually get to acceptance,” he said.

Habib says originators also need to be the experts and explain to clients why now is still a good time to buy. “This is not the time to act out of fear, this is the time to seize an opportunity,” he said.

Rates and prices are likely to stay where they are unless market conditions change. If this means demand stays down, buyers can take advantage by negotiating a lower price.

They can also try to get a rate buydown, lowering their monthly payment in the first year or two. After that, should mortgage rates come back down, borrowers can refinance at the lower rate.

“So you get the house of your dreams, you get it at a better price, you get the payment that you should have had it at anyway,” Habib said. “You didn’t have any of those things last year.”

Habib, though, also points out that things remain fragile. He’s confident in his predictions, but things could be thrown off by another shock to the economy.

"There’s always black swan events,” he said. We didn’t see the Russia-Ukraine situation, we didn’t see our government stimulating the economy further in an inflationary environment, we didn’t see the Fed being asleep at the wheel.”

The results from Freddie Mac's Primary Mortgage Market Survey this week:

- 30-year fixed-rate mortgage averaged 6.94% with an average 0.9 point as of Oct. 20, 2022, up from last week when it averaged 6.92%. A year ago at this time, the 30-year FRM averaged 3.09%.

- 15-year fixed-rate mortgage averaged 6.23% with an average 1.1 point, up from last week when it averaged 6.09%. A year ago at this time, the 15-year FRM averaged 2.33%.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 5.71% with an average 0.4 point, down from last week when it averaged 5.81%. A year ago at this time, the 5-year ARM averaged 2.54%.