Mortgage Rates Continue Downward Trend

The 30-year, fixed-rate mortgage rate dipped to 6.31%.

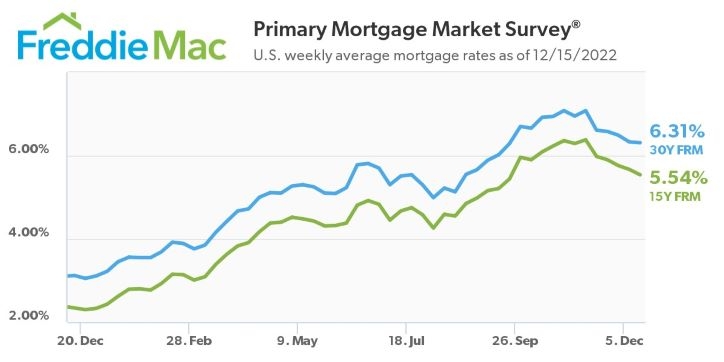

Mortgage rates continued to pull back this week from their early November peak, falling for the fifth consecutive week, according to the latest report from Freddie Mac.

The government-sponsored enterprise on Thursday released the results of its weekly Primary Mortgage Market Survey (PMMS), showing the 30-year fixed-rate mortgage (FRM) averaged 6.31%, down slightly from the previous week.

“Mortgage rates continued their downward trajectory this week, as softer inflation data and a modest shift in the Federal Reserve’s monetary policy reverberated through the economy,” said Sam Khater, Freddie Mac’s chief economist.

Inflation showed more signs of slowing in November, with the Consumer Price Index (CPI) rising just 0.1% after increasing 0.4% in October, the U.S. Bureau of Labor Statistics (BLS) reported this week.

Over the past 12 months, the all-items index increased 7.1% before seasonal adjustment, down from a 7.7% annual increase in October.

That report was followed by the Federal Reserve’s Federal Open Market Committee (FOMC) announcing its seventh increase this year in its benchmark federal funds rate. The FOMC approved a 50-basis-point increase after four consecutive 75-basis-point hikes.

Fed Chairman Jerome Powell also said the Fed had raised the target range for the rate to between 5.1% and 5.4% for 2023. Housing market analysts, however, said they don’t expect further Fed rate hikes to cause more volatility in mortgage rates.

“The good news for the housing market is that recent declines in rates have led to a stabilization in purchase demand,” Khater said. “The bad news is that demand remains very weak in the face of affordability hurdles that are still quite high.”

Highlights of the PMMS report:

- The 30-year fixed-rate mortgage averaged 6.31% as of Dec. 15, down from last week when it averaged 6.33%. A year ago at this time, the 30-year FRM averaged 3.12%.

- The 15-year fixed-rate mortgage averaged 5.54%, down from last week when it averaged 5.67%. A year ago at this time, the 15-year FRM averaged 2.34 percent.

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit, Fannie Mae said.