Mortgage Rates Decline After 3 Weekly Increases

The 30-year fixed-rate mortgage averaged 6.71%, down 8 basis points from the previous week.

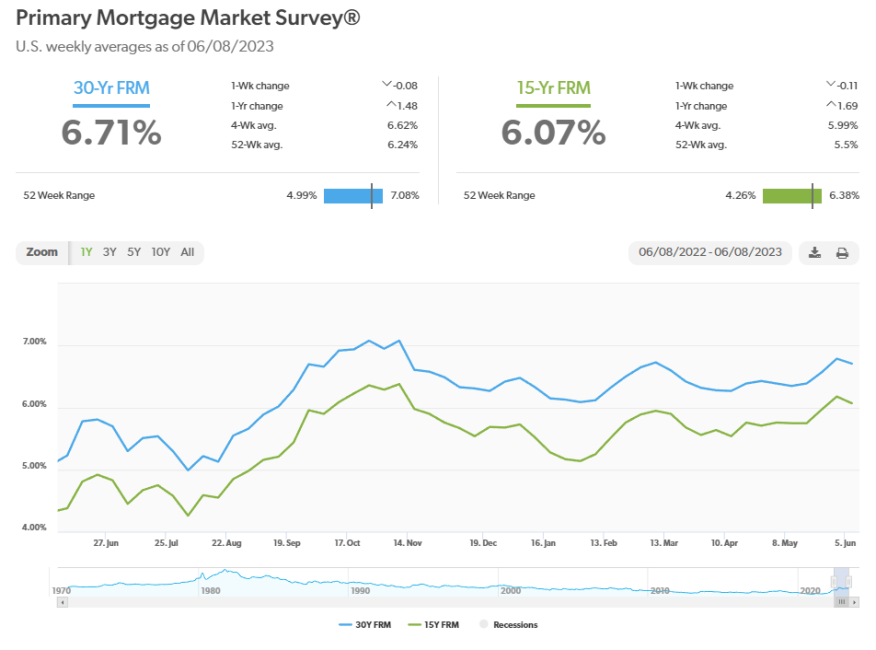

Mortgage rates slipped back just a bit this week after three straight increases, Freddie Mac said Thursday.

According to its Primary Mortgage Market Survey (PMMS), the 30-year fixed-rate mortgage (FRM) averaged 6.71%, a drop of just 8 basis points from the previous week.

“Mortgage rates decreased after a three-week climb,” said Sam Khater, Freddie Mac’s chief economist. “While elevated rates and other affordability challenges remain, inventory continues to be the biggest obstacle for prospective homebuyers.”

According to the PMMS:

- The 30-year fixed-rate mortgage averaged 6.71% as of June 8, down from 6.79% last week. A year ago, it averaged 5.23%.

- The 15-year fixed-rate mortgage averaged 6.07%, down from 6.18% last week. A year ago it averaged 4.38%.

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

George Ratiu, chief economist of Keeping Current Matters, noted that despite the decline, the 30-year fixed rate remained above 6.5% for a third straight week.

“Investors have kept the 10-year Treasury on a sideways trajectory this week, casting a wary eye toward next week’s Federal Reserve’s FOMC [Federal Open Market Committee] meeting,” Ratiu said.

“While the bill to resolve the debt ceiling standoff offered a noticeable relief to capital markets, concerns linger over the Fed’s next rate decision,” Ratiu continued. “Several leading members of the central bank have voiced support for a rate pause this month, giving some investors hope that rate hikes may be over.”

He cautioned, however, that with inflation still near 5%, “the bank’s rate-setting committee remains focused on taming price growth toward its 2% target and is not likely to back away from the task. Even with a June pause, additional rate hikes are on the table for the second half of 2023.”

The spread between the 10-year Treasury and Freddie Mac’s 30-year mortgage rate remains at an elevated level, Ratiu said, mirroring investor uncertainty. He said to expect mortgage rates to hold in the 6% to 7% range for the next few weeks.

“Housing markets are navigating the uncertain waters by balancing solid buyer demand — boosted by a strong jobs market — with lower affordability,” he said. “Homebuyers continue to look for their first or next home and are adjusting to market conditions.”

At the same time, however, “many are finding tight credit availability conditions,” Ratiu said. “The MBA’s Mortgage Credit Availability Index dropped to the lowest level since the start of 2013, as many banks and lenders are shoring up their balance sheets and remain concerned about taking on additional risk. Meanwhile, homebuyers’ financial health has never been stronger, with the median FICO score at 765 for mortgage borrowers in the first quarter of this year.”

With financially strong homebuyers active in the market, Ratiu added, “well-priced homes are still moving apace, spending a median of only 43 days on listing portals. Not surprisingly, in many markets, prices are seeing positive momentum, building on the continued imbalance between demand and insufficient supply.”