Mortgage Rates At Highest Level Since 2003

Freddie Mac says 30-year-fixed rate at 7.09%

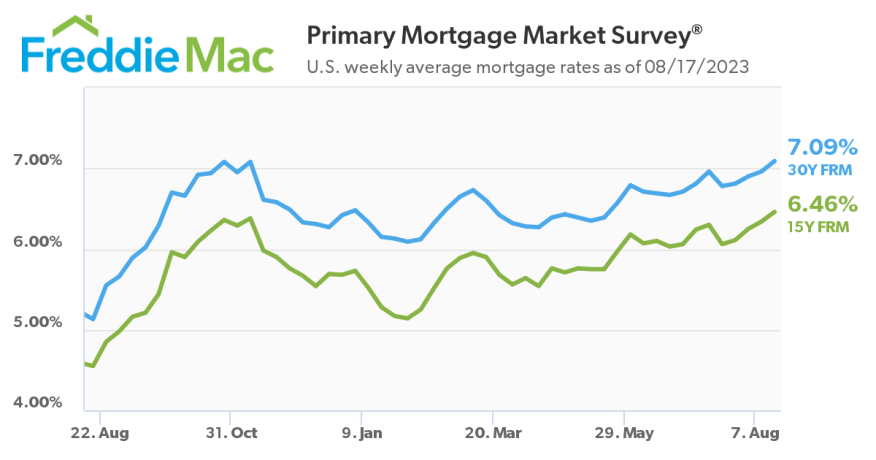

Freddie Mac today released the results of its Primary Mortgage Market Survey (PMMS), showing the 30-year fixed-rate mortgage (FRM) averaged 7.09%, reaching its highest level in over 20 years.

“The economy continues to do better than expected and the 10-year Treasury yield has moved up, causing mortgage rates to climb,” said Sam Khater, Freddie Mac’s chief economist. “The last time the 30-year fixed-rate mortgage exceeded (7%) was last November. Demand has been impacted by affordability headwinds, but low inventory remains the root cause of stalling home sales.”

Before Freddie Mac released it rates, Bob Broeksmit, president of the Mortgage Bankers Association, had issued this statement on rates and applications. “Mortgage application activity continued to decline last week as mortgage rates reached their highest levels since last October. These higher rates continue to keep many prospective buyers on the sidelines. On the bright side, we have seen a slight uptick in government purchase applications as well demand for ARM products, which could indicate that some buyers remain active in their homebuying search despite higher rates.”

Earlier this week, the MBA reported mortgage applications had hit their lowest mark in six months. However, the FHA share of total applications increased to 13.8% from 13.6% the week prior. The VA share of total applications remained unchanged at 11.8% from the week prior. The USDA share of total applications remained unchanged at 0.4% from the week prior.

Rate Facts

- 30-year fixed-rate mortgage averaged 7.09% as of Aug. 17, 2023, up from last week when it averaged 6.96%. A year ago at this time, the 30-year FRM averaged 5.13%.

- 15-year fixed-rate mortgage averaged 6.46%, up from last week when it averaged 6.34%. A year ago at this time, the 15-year FRM averaged 4.55%.

- The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.