Mortgage Rates Hit Lowest Level Since August, Just Above 7% Threshold

Decline in mortgage rates driven by economic signals, but lenders await further drops.

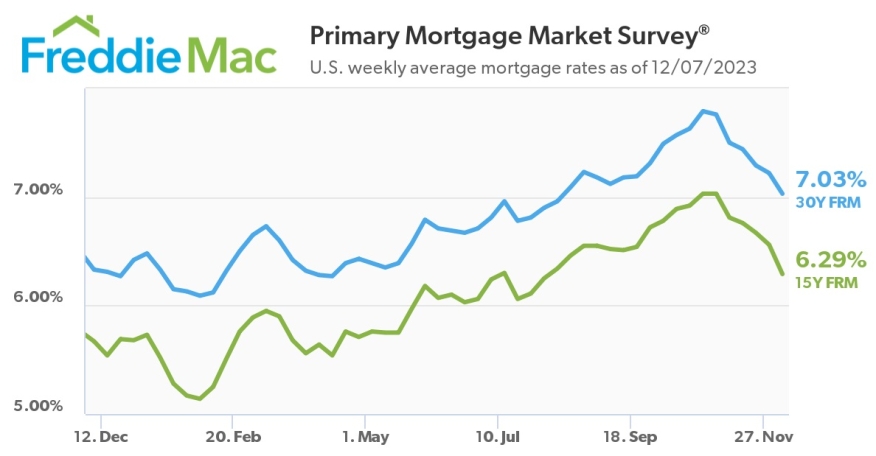

The latest data from Freddie Mac reveals a significant dip in mortgage rates, reaching their lowest level since August and hovering just above the 7% mark. According to Freddie Mac's Primary Mortgage Market Survey, the 30-year fixed-rate mortgage averaged 7.03% for the period ending December 7, marking a noteworthy decrease of 19 basis points from the previous week's rate of 7.22%.

This recent decline follows a remarkable trajectory as, since late October when it hit a 23-year high, the 30-year average has plummeted by more than 75 basis points. However, it's important to note that despite this drop, the current rate still remains 70 basis points higher than the 6.33% rate observed one year ago.

Meanwhile, the 15-year mortgage rate experienced an even more substantial decline, falling by 27 basis points to 6.29% from the prior rate of 6.56% as reported by the Primary Mortgage Market Survey. In the same week of the previous year, the 15-year average stood at 5.67%.

The declining mortgage rates can be attributed to signs that the U.S. economy is moving closer to the "Goldilocks scenario" that policymakers had been aiming for, leading to a decrease in Treasury yields. The 10-year yield, which typically influences the direction of mortgage rates, has dropped from $4.33 at the end of November to a low of $4.10 at the close of Wednesday.

While lower rates appear favorable for consumers, Freddie Mac Chief Economist Sam Khater emphasized that the trend will need to be sustained for a longer period to reach a level that is satisfactory for mortgage lenders. He noted that although lower rates have initially boosted purchase applications, the improvement in demand has waned in the past week, indicating that further rate drops may be needed to consistently reinvigorate demand.

“When rates began to rapidly drop, purchase applications rebounded initially, but this improvement in demand diminished in the last week. Although these lower rates remain a welcome relief, it is clear they will have to further drop to more consistently reinvigorate demand," Khater said.

The Mortgage Bankers Association's latest data reported flat week-over-week levels for purchase applications, but this was offset by a surge in refinancing activity, marking the highest level of refinances seen in months.