Mortgage Rates Post 1st Decline In 7 Weeks

Ongoing economic uncertainty cited as 15-year and 30-year fixed rates fall.

The volatility of mortgage rates continued this week, as rates fell slightly for the first time in seven weeks, according to Freddie Mac.

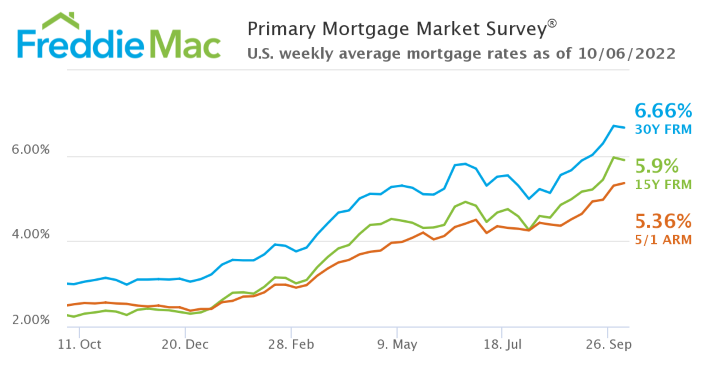

The government-sponsored enterprise today released its weekly Primary Mortgage Market Survey (PMMS), showing that the 30-year fixed-rate mortgage averaged 6.66%, down just a bit from 6.7% last week.

“Mortgage rates decreased slightly this week due to ongoing economic uncertainty,” said Sam Khater, Freddie Mac’s chief economist. “However, rates remain quite high compared to just one year ago, meaning housing continues to be more expensive for potential homebuyers.”

According to the survey:

- The 30-year fixed-rate mortgage averaged 6.66%, with an average 0.8 point as of Oct. 6, down from last week when it averaged 6.7%. A year ago at this time, the 30-year FRM averaged 2.99%

- The 15-year fixed-rate mortgage averaged 5.9% with an average 1 point, down from last week when it averaged 5.96%. A year ago at this time, the 15-year FRM averaged 2.23%.

- The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 5.36% with an average 0.3 point, up from last week when it averaged 5.3%t. A year ago at this time, the 5-year ARM averaged 2.52%.

Realtor.com Chief Economist Danielle Hale said that while rates took a small step back this week, they remained high, “still more than double year-ago levels this week.”

“In the last month, yields on 10-year Treasuries soared from 3.25% to nearly 4% before sliding back to roughly 3.75% this week,” Hale said. “This volatility stems from uncertainty about how the U.S. and global economies will fare in response to higher benchmark rates set by the Federal Reserve, alongside fiscal and monetary policy adjustments abroad. With a wide range of economic possibilities ahead, investors and analysts are looking for clues in each incoming piece of data, which has led to the ups and downs we’ve experienced in recent weeks.”

“Much like a driver navigating dense fog might over-correct when adjusting to changes in the roadway,” she continued, “signs that we are closer to the end of the tightening cycle — such as a surprisingly steep decline in job openings — tend to cause rates to slip, whereas rates bounce higher on signals like robust activity in the services sector.”

Hale added that a larger share of home buyers are staying on budget by using an adjustable rate mortgage instead of a fixed rate mortgage.

“With the spread in rates between the two products larger than has been typical over the last 17 years, the upfront monthly cost savings of leveraging this type of financing have never been larger,” she said. “Whether an adjustable rate mortgage will be the better option over the life of the loan is harder to determine and can depend on factors specific to each homebuyer’s situation."

Freddie Mac’s PMMS focuses on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit. Average commitment rates should be reported, along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Borrowers may still pay closing costs, which are not included in the survey.