Mortgage Rates Post 1st Dip In 3 Weeks

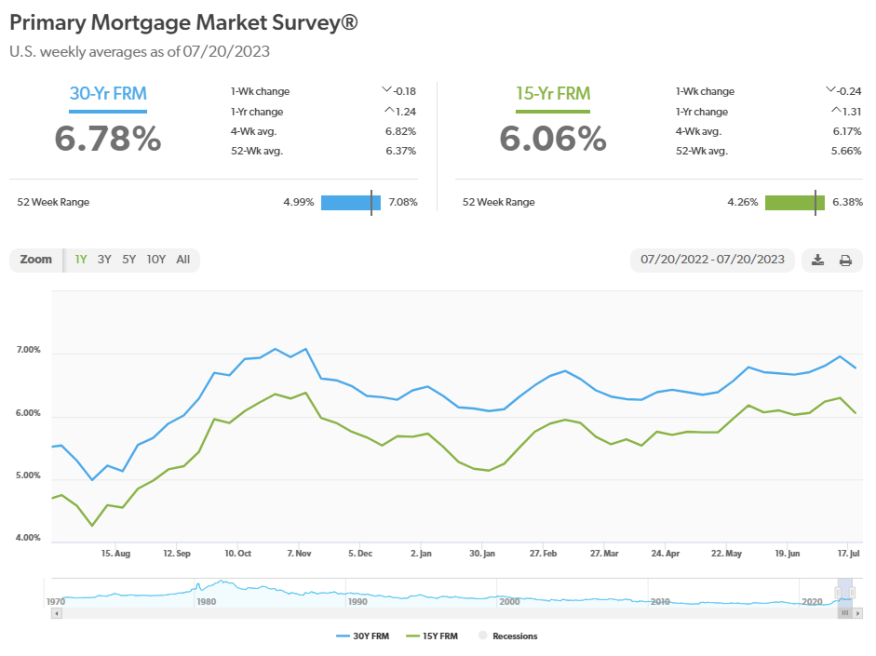

Freddie Mac survey finds the average rate for a 30-year mortgage slipped to 6.78%.

- The 30-year fixed-rate mortgage averaged 6.78%, down from 6.96% last week.

- The 15-year fixed-rate mortgage averaged 6.06%, down from 6.3% last week.

Mortgage rates retreated slightly this week, the first decline after three straight weeks of increases, Freddie Mac said Thursday.

The government-sponsored enterprise’s weekly Primary Mortgage Market Survey (PMMS) found that:

- The 30-year fixed-rate mortgage averaged 6.78% as of July 20, down from 6.96% last week.. A year ago, rate averaged 5.54%

- The 15-year fixed-rate mortgage averaged 6.06%, down from 6.3% last week. A year ago, it averaged 4.75%.

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit. For more information, view our Frequently Asked Questions.

Last week, the 30-year fixed mortgage average reached its highest level since Nov. 10, when the rate was 7.08%. That same week last year, the 15-year fixed mortgage averaged 6.38%.

“As inflation slows, mortgage rates decreased this week,” said Sam Khater, Freddie Mac’s chief economist. “Still, the ongoing shortage of previously owned homes for sale has been a detriment to homebuyers looking to take advantage of declining rates.”

“On the other hand,” he added, “homebuilders have an edge in today’s market, and incoming data shows that homebuilder sentiment continues to rise.”

George Ratiu, chief economist at Keeping Current Matters, a real estate insights and analytics company, said the ongoing uncertainty in the financial markets is the reason rates remain elevated.

Since June 1, the average rate for a 30-year mortgage has held in a narrow range between 6.67% and 6.96%.

“While inflation has been slowing noticeably,” Ratiu said, “the spread between the 30-year, fixed-rate mortgage and the 10-year Treasury remains north of 300 basis points, a clear signal that investors are still pricing a premium for the higher macro risk.”

He said buyers in today’s real estate markets are” internalizing” the 6% to 7% interest rate range as the new normal.

“At the same time, they are still working through the challenges brought about by higher borrowing costs and prices,” Ratiu said. “At today’s rate, the mortgage payment for a median-priced home is about $2,300, a 13% premium compared with last year’s peak-price period. The significant increase in borrowing costs is outpacing inflation, which is running at a more modest 3.1%, keeping housing affordability a principal challenge for many households today.”

While many buyers have adjusted their purchase budgets downward over the past year, the tight housing inventory is keeping upward pressure on prices.

"In many relatively affordable areas of the country, buyers are still contending with an unexpected return of multiple offers," Ratiu said. "The surprising rebound in pricing, although nowhere near the frenzied pace of 2021, is a sign that seasonality is returning to markets as we traverse the busier summer selling season. We can expect prices to follow historical trends as we move into the fall and winter seasons.”