Mortgage Rates Reach Two-Decade Peak

The 30-year fixed rate hits 7.57% amidst market turmoil; homeowners hold onto historically low rates and purchase demand plummets to 30-year lows.

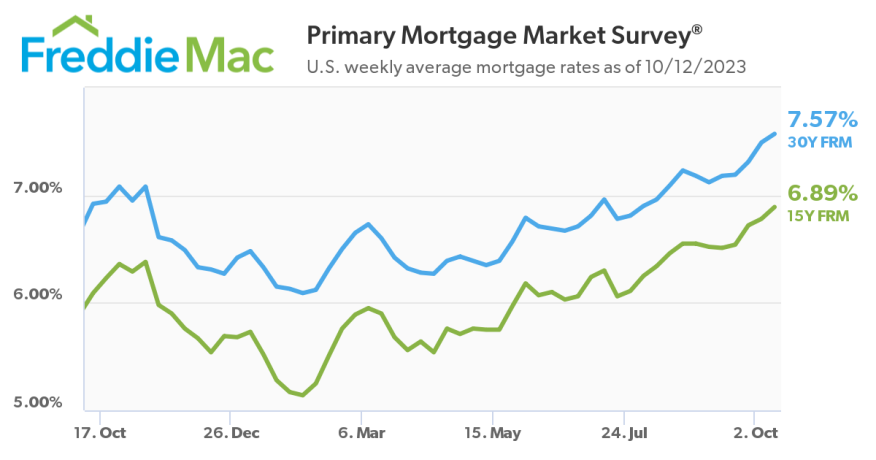

Freddie Mac's latest Primary Mortgage Market Survey revealed that the 30-year fixed-rate mortgage (FRM) has reached an average of 7.57%, a leap from last week's 7.49%. This increase in home loan borrowing costs marks the highest level in more than two decades, further diminishing the purchasing power of potential homebuyers.

“For the fifth consecutive week, mortgage rates rose as ongoing market and geopolitical uncertainty continues to increase,” said Sam Khater, Freddie Mac’s chief economist. “The good news is that the economy and incomes continue to grow at a solid pace, but the housing market remains fraught with significant affordability constraints. As a result, purchase demand remains at a three-decade low.”

Additionally, the 15-year fixed-rate mortgage, favored by homeowners looking to refinance, also experienced an uptick, averaging 6.89% compared to last week's 6.78%.

With mortgage rates significantly increasing from the 3.05% rate observed two years ago, homeowners who secured these previously record-low rates are discouraged from selling. It's been over a year since the 30-year home loan rate climbed above 6%, a level not seen since the early 2000s. The current rate now stands eerily close to the 7.65% observed on Dec. 1, 2000.

These high rates, coupled with a significant shortage of available homes, continue to drive home prices skyward, making affordability even more challenging for potential buyers.

As fixed mortgage rates hover above 7%, some homebuyers are pivoting towards adjustable-rate mortgages to temporarily counteract these towering rates, Bob Broeksmit, CEO of the Mortgage Bankers Association, said.

These escalating rates mirror the rising 10-year Treasury yield, which many lenders use as a pricing benchmark. With the central bank heightening its primary interest rate to quell inflation, current indications suggest a slower reduction in rates for the upcoming year.

As the threat of enduring high rates looms, last week's Treasury yields peaked at their highest in over a decade. Currently, the 10-year Treasury yield stands at 4.65%, a stark increase from the 0.50% witnessed early in the pandemic.