Mortgage Rates Rise Again As 30-Year Hits 6.57%

The 15-year fixed rate also increased this week.

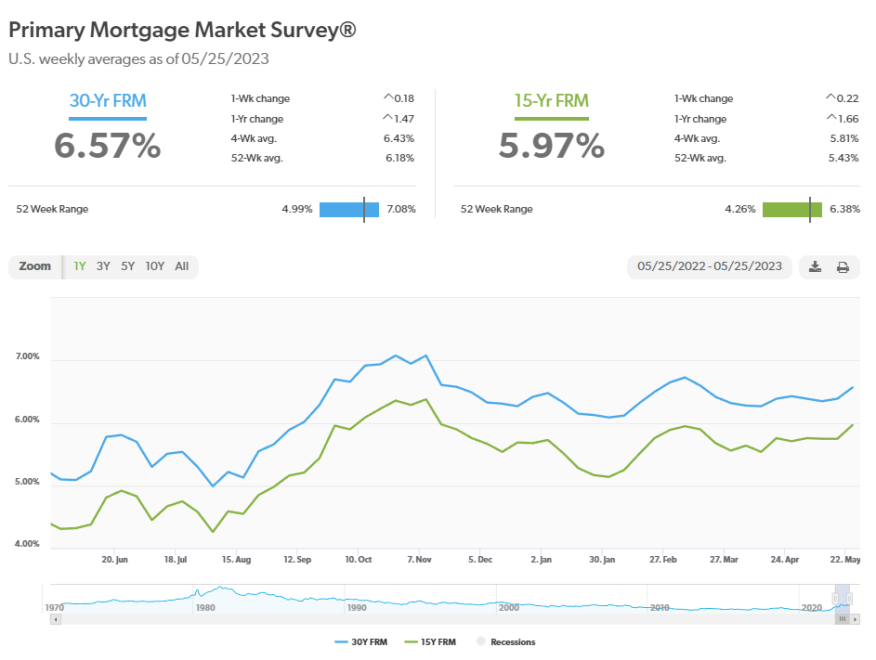

- The 30-year fixed-rate mortgage averaged 6.57% as of May 25, up from 6.39% last week.

- The 15-year fixed-rate mortgage averaged 5.97%, up from 5.75% last week.

Mortgage rates increased this week, with the 30-year fixed rate breaking out of the narrow range it has occupied for the previous five weeks, Freddie Mac said Thursday.

The government-sponsored enterprise released the results of its weekly Primary Mortgage Market Survey (PMMS), showing the 30-year fixed-rate mortgage (FRM) increased to 6.57%. The 15-year fixed-rate also increased.

The 30-year rate is now at its highest level since it was 6.6% in mid-March. For the past five weeks, it had moved in a narrow range between 6.35% and 6.43%. For the year, the rate peaked at 6.73% in early March, the highest level since it hit 7.08% in November 2022..

At 5.97%, the 15-year rate is at its highest level since mid-November.

“The U.S. economy is showing continued resilience which, combined with debt-ceiling concerns, led to higher mortgage rates this week,” said Sam Khater, Freddie Mac’s chief economist. “Dampened affordability remains an issue for interested homebuyers, and homeowners seem unwilling to lose their low rate and put their home on the market. If this predicament continues to limit supply, it could open up an opportunity for builders to help address the country’s housing shortage."

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

Mortgage Rates

- The 30-year fixed-rate mortgage averaged 6.57% as of May 25, up from 6.39% last week. A year ago it averaged 5.1%.

- The 15-year fixed-rate mortgage averaged 5.97%, up from 5.75% last week. A year ago, it averaged 4.31%.

Realtor.com Economist Jiayi Xu said the 0.18 percentage point increase in the 30-year rate mirrored the trend of the 10-year Treasury yield, “as investors closely track ongoing debt-ceiling negotiations and evaluate the prospective direction of Federal Reserve interest rate policy.”

Xu said that while the probability of a default remains low, “even the fears and panic related to a potential government default could cause creditors to ask for higher interest rates from the U.S. Treasury, resulting in a significant increase in various borrowing costs, including mortgages.”

He continued, “Resolving the debt impasse sooner rather than later would mitigate potential adverse effects on the housing market, which is already contending with high prices and elevated mortgage rates.”

Xu said an additional area of focus revolves around the release of the Federal Reserve's minutes from its May meeting.

“Although investors anticipate a pause at the upcoming meeting (set for June 13-14) after 10 consecutive rate hikes, the minutes revealed a sense of uncertainty regarding the future direction of monetary policy,” he said. “Generally, officials concurred on the importance of closely monitoring incoming economic data and maintaining flexibility leading up to the next policy meeting.”

High prices and elevated mortgage rates have prompted buyers to seek more affordable options, Xu added.

“Although the national housing market is experiencing a slow spring, there is growing competition in relatively affordable markets, particularly in the Northeast and Midwest regions,” he said. ”As more and more buyers flock to relatively affordable places, it further reduces the opportunities available for first-time home buyers. While a dip in down payments might relieve a little pressure, it remains a challenging task for first-time buyers who don’t have existing home equity to tap into, as the dollar amount of down payments continues to be significantly larger than pre-pandemic levels.”