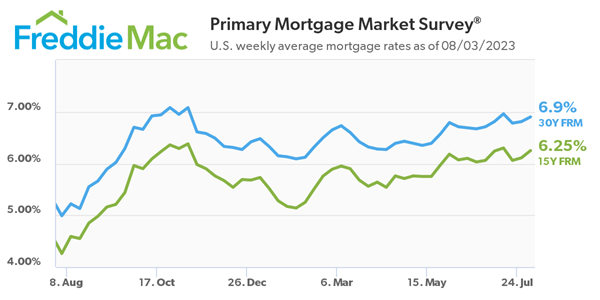

Rates for the 30-year and 15-year rise and so do home prices.

Mortgage rates rose this week on the back of upbeat economic data and the U.S. government credit rating downgrade, according to the Freddie Mac Primary Mortgage Survey.

The 30-year FRM averaged 6.90%, and the 15-year FRM averaged 6.25%.

Freddie Mac’s Chief Economist Sam Khater said the rise in mortgage rates this week resulted from positive economic data coupled with the recent U.S. government credit rating downgrade. "Despite higher rates and lower purchase demand, home prices have increased due to very low unsold inventory," Khater said.

Key Findings from the Survey

30-Year Fixed-Rate Mortgage: The 30-year FRM has increased to an average of 6.90%, up from the previous week when it averaged 6.81%. This marks a significant increase compared to the same period last year when it averaged 4.99%.

15-Year Fixed-Rate Mortgage: Similarly, the 15-year FRM averaged 6.25%, up from last week's average of 6.11%. A year ago, the rate stood at 4.26%.

The increase in mortgage rates, influenced by a mix of positive economic indicators and credit rating actions, could have broader implications for the housing market. With mortgage rates continuing to climb, potential homebuyers may find it more challenging to secure financing, potentially leading to further shifts in demand and pricing within the housing market.

These developments underscore the complex interplay of factors shaping the current mortgage landscape, with both the broader economy and specific policy actions playing a role in influencing rates.