Mortgage Rates Slip Below 7% Following Fed Pause

Homebuyers find relief as 30-year fixed mortgage rates fall to 6.95%, with prospects of further decline in the New Year.

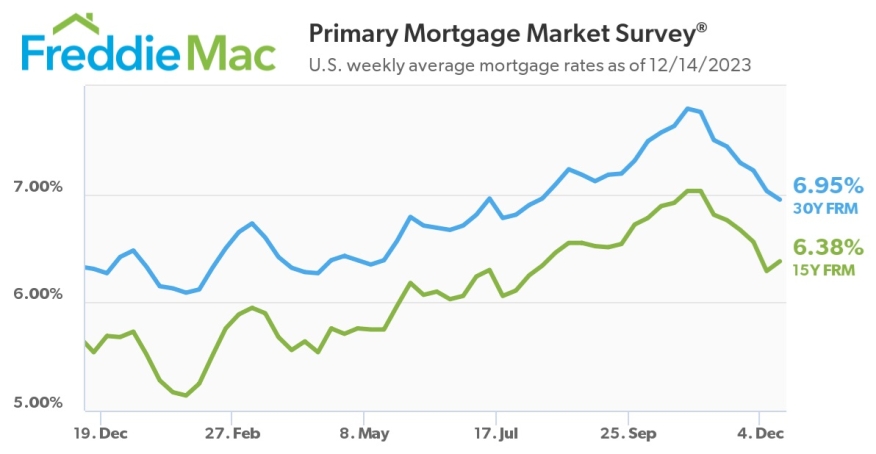

Following Wednesday's Fed meeting where it paused the federal fund rate, rates for a 30-year fixed rate mortgage dipped below 7% to 6.95%.

The last time the average rate was in the sixes was August 10. But still above where it was last year at this time which was 6.31%.

“Potential homebuyers received welcome news this week as mortgage rates dropped below 7% for the first time since August,” said Sam Khater, Freddie Mac’s chief economist. “Given inflation continues to decelerate and the Federal Reserve Board’s current expectations that they will lower the federal funds target rate next year, we likely will see a gradual thawing of the housing market in the New Year.”

The 15-year fixed mortgage rate averaged 6.38% up from last week's 6.29%. A year ago it was 5.54%.