Mortgage Rates Still Moving Within A Narrow Range

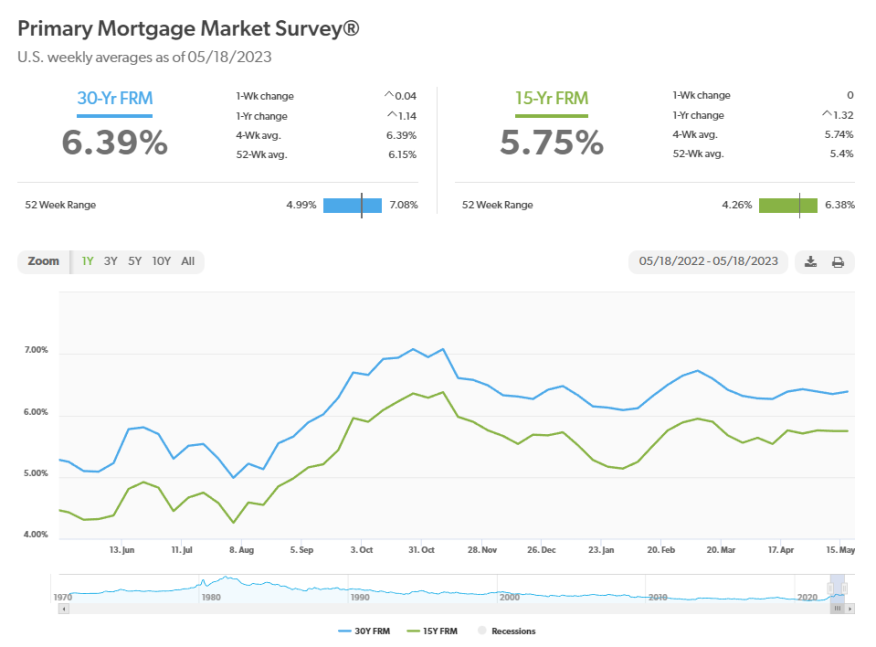

The 30-year fixed-rate mortgage average rose to 6.39%, while the 15-year rate remained unchanged.

Mortgage rates continued to hold in a narrow range this week, with the average 30-year fixed mortgage increasing 4 basis points while the average 15-year fixed loan remained unchanged.

That’s according to the Primary Mortgage Market Survey for the week ended May 18, released Thursday by Freddie Mac.

“The 30-year fixed-rate mortgage averaged 6.39% this week, as economic crosscurrents have kept rates within a 10-basis point range over the last several weeks,” said Sam Khater, Freddie Mac’s chief economist.

At 6.39%, the 30-year rate is now back to where it was a month ago. It remains about a third of a point below the peak of 6.73% reached in early March. Following that peak, the rate fell for five straight weeks. Since then, it has moved in a narrow range between 6.35% and 6.43%.

“After the substantial slowdown in growth last fall, home prices stabilized during the winter and began to modestly rise over the last few months,” Khater said. “This indicates that while affordability remains a hurdle, homebuyers are getting used to current rates and continue to pursue homeownership.”

Freddie Mac’s PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

Mortgage Rates

- 30-year fixed-rate mortgage averaged 6.39% as of May 18, up from 6.35% last week. A year ago, it averaged 5.25%.

- 15-year fixed-rate mortgage averaged 5.75%, unchanged from last week. A year ago, it averaged 4.43%

Hannah Jones, an economic data analyst for Realtor.com, said this week’s increase in the 30-year mortgage tracked along with 10-year Treasury yields.

“Mortgage rates have remained in the roughly 6% to 7% range for the last eight months and will likely remain in this range until incoming economic data makes the economy’s path forward more clear,” she said. “Buyer demand has been sensitive to the ebb and flow of mortgage rates, but near-peak home prices and elevated inflation mean many would-be buyers are still waiting on the sidelines.”

Mortgage rates, she said, have bounced within a tight range since September 2022, as the Federal Reserve’s efforts to slow the economy and tame inflation have clouded the future.

“Recent data shows signs of a stubborn, though slowing economy, suggesting that the Fed’s contractionary actions are having the intended effect,” Jones said. “However, inflation remains well above the target level and unemployment remains near all-time lows.”

The economy, she continued, “remains on fragile footing, and a U.S. default would cause an interest rate spike that could erase any progress towards a healthier housing market by cutting deeper into home sales.”

While a default remains unlikely, she said, “the closer we get to a possible event date without an increase in the debt limit, the more likely households will be affected by higher interest rates. The sooner the debt impasse is resolved, the less likely it is to negatively affect households already plagued by high prices.”

As for the housing market, Jones said those shopping for a new home continue to face the discouraging prospect of low inventory levels and higher mortgage rates.

“Many potential sellers feel ‘locked in’ by their current low mortgage rate and are hesitant to enter into a market that would require taking on a higher rate to buy a new home,” Jones said. “Constrained buyers and reluctant sellers mean the spring market hasn’t picked up as much momentum as in years past, but each improvement in affordability is met with an increase in buyer activity.”

Unfortunately, she added, “increased buyer activity has not been met with increased seller activity, and in many markets, buyers are competing for the few fresh listings available. Prices are likely to remain elevated in many markets where low inventory, especially at an affordable price point, is creating a competitive environment.”