New Home Purchase Mortgage Applications Jump 26% YOY

Applications, however, fell 5% from May, due in part to rising mortgage rates.

- June's applications declined 5% from May

- The 30-year fixed-rate mortgage averaged close to 6.8%.

- The average loan size for new homes decreased from $403,581 in May to $400,281 in June.

The housing market showed signs of resilience in June, with new home purchase mortgage applications jumping 26.1% year-over-year, the Mortgage Bankers Association said Thursday.

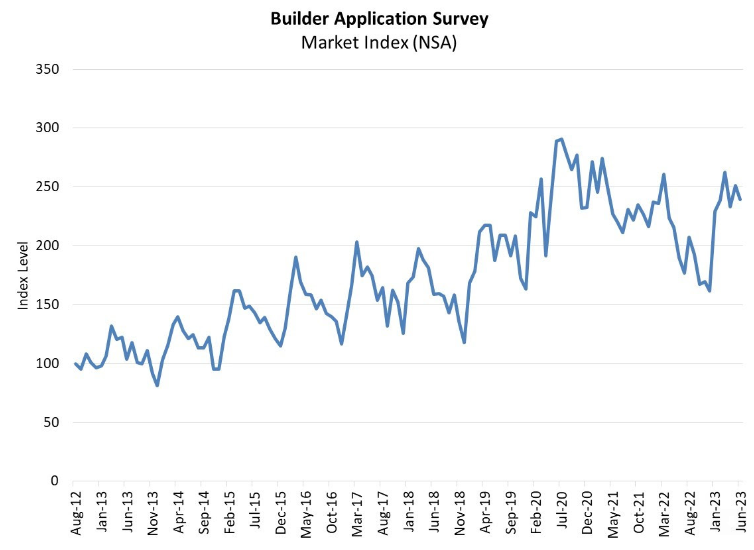

The MBA’s Builder Application Survey (BAS) also showed that the surge in applications indicates a continued demand for newly built homes.

Joel Kan, MBA's vice president and deputy chief economist, emphasized the positive trend in new home purchase activity.

"New home purchase applications and sales both saw a boost compared to the previous year, demonstrating the appeal of newly constructed properties,” he said. “As existing home inventory remains limited due to hesitant homeowners, potential buyers are turning towards new builds instead."

Despite the annual growth, June's applications did decline 5% from May. The MBA clarified that this variation did not account for typical seasonal patterns, which often influence housing market trends.

One possible reason for the drop in applications from May could be rising mortgage rates, the MBA said. The 30-year fixed-rate mortgage averaged close to 6.8%, potentially causing some prospective buyers to delay their purchases. Still, the data revealed that applications for new home purchases have maintained a steady upward trajectory for five consecutive months, a sign of the underlying strength in the market.

The MBA also provided an estimate of new single-family home sales, a key indicator used to gauge the U.S. Census Bureau's New Residential Sales report, which will be released July 26. Based on BAS data and various assumptions about market coverage and other factors, the MBA projected a seasonally adjusted annual rate of 687,000 units for new single-family home sales in June 2023.

While the estimate indicates a 9% decrease from May's pace of 755,000 units, the MBA clarified that on an unadjusted basis, there were still 60,000 new home sales in June, a decrease of 6.3% from the previous month.

A breakdown of mortgage applications by product type revealed that conventional loans made up the majority, comprising 65.5% of all home purchase loan applications. FHA loans accounted for 24.1%, while RHS/USDA loans represented just 0.3%. VA loans, designed for veterans and service members, constituted 10% of the applications.

In addition to the surge in new home purchase applications, the average loan size for new homes decreased slightly from $403,581 in May to $400,281 in June. This decrease could indicate a broader trend of prospective buyers seeking more affordable housing options, the MBA said.