New Home Sales Surge 12% In May, Up 20% YOY

Sales of new single-family homes posts third straight monthly increase as builders broaden offerings.

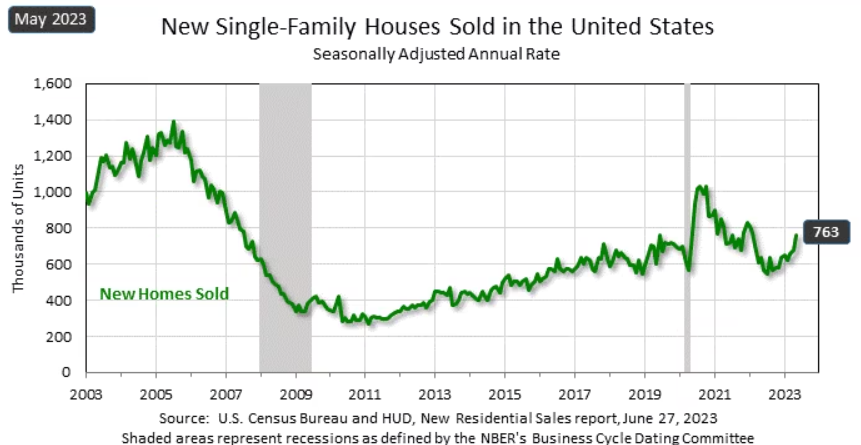

- Sales of new single‐family houses in May were at a seasonally adjusted annual rate of 763,000.

- Sales increased in May from April in all four U.S. regions.

Sales of new homes surged in May, rising more than 12% from April as sales increased in all four U.S. regions.

Sales of new single‐family houses in May were at a seasonally adjusted annual rate of 763,000, according to estimates released jointly Tuesday by the U.S. Census Bureau and the Department of Housing and Urban Development. It was the third straight month-over-month increase.

The estimate was 12.2% above the revised April rate of 680,000, and was a stunning 20% above the May 2022 estimate of 636,000. The results also beat analysts’ expectations of 677,000.

Sales increased in May from April in all four U.S. regions, led by a 17.6% increase in the Northeast. Sales also rose in the West (17.4%), South (11.3%), and Midwest (4.1%).

Year-over-year, sales rose in three of the four regions, with only the West seeing a decline (0.6%). Sales jumped 110.5% in the Northeast, 40% in the Midwest and 22% in the West.

While sales increased dramatically in May, the inventory of new homes for sale dipped. According to the report, the seasonally adjusted estimate of new houses for sale at the end of May was 428,000, down from a revised 432,000 in April.

At the current sales rate, the estimated new houses for sale in May represents a 6.7-month supply.

The median sales price of new houses sold in May was $416,300, up 3.5% from April’s median sales price of $402,400. The average sales price, however, fell 1.7% in May to $487,300 from $495,600 in April.

George Ratiu, chief economist for Keeping Current Matters, said home sales rose as buyers found more options.

“In addition, builders have been broadening their product offerings toward more affordable price segments and working with buyers on incentives to take some of the sting from elevated mortgage rates,” he said.

“Residential real estate markets are finding a renewed rhythm at the midpoint of the year,” Ratiu said. “In the wake of 2022’s one-two punch of record-high prices and surging mortgage rates, which pushed buyers and sellers back on their heels, housing markets are showing more typical seasonal patterns.”

He said demand has been resilient, as the shock of interest rates in the 6%-7% range has been wearing off, and existing inventory remains tight.

“These factors are boosting the visibility of the new home market, as homeowners looking to trade up are attracted by new floor plans, more technology, as well as higher efficiency,” Ratiu said.

First American Financial Corp. Economist Ksenia Potapov called the home sales report a “bright spot” in an otherwise glum spring homebuying season.

“A new-home sale occurs when a sales contract is signed or a deposit is accepted,” she said. “The home can be in any stage of construction — not yet started, under construction, or completed. The rise in new-home sales this month was driven by sales of homes not yet started, which increased 79% month over month.”

She noted that just 16.1% of the total new-home inventory is completed and ready to occupy, which is down from more than 20% before the pandemic. “The share of new-home supply that is under construction has fallen in recent months and is now at 60.5%, compared with nearly 70% in May 2022,” she said.

“Higher builder costs remain a headwind to building more entry-level homes,” Potapov said. “In May 2023, only 17% of new-home sales were priced below $300,000, which is up from 9% one year ago, but remains well below the pre-pandemic level of 37% in Feb. 2020.”

She added that there is still reason to “temper optimism with caution, “especially with the Federal Reserve suggesting that it may raise interest rates further later this year, but the housing market is starved for supply and new homes are crucial for meeting home buyer demand.”