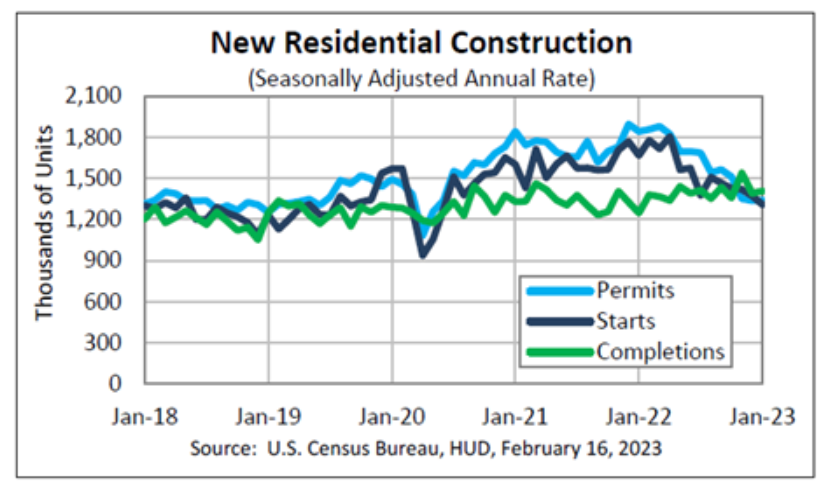

New Housing Starts Fell, Completions Up In January

Supply, labor, and cost issues hamper construction of new homes.

- Housing starts fell 4.5% in January from December.

- Single-family starts fell 4.3%, while multifamily units fell 5.4%.

- Completions increased 1% overall in January from December.

Fewer new homes were started but more were completed in January, the U.S. Census Bureau reported Thursday.

Privately owned housing starts in January were at a seasonally adjusted annual rate of 1.31 million, down 4.5% from the revised December estimate of 1.37 million. The estimate is also 21.4% below the January 2022 rate of 1.67 million

Single‐family housing starts in January fell to a rate of 841,000, 4.3% below the revised December figure of 879,000. The January rate for buildings with five or more units was 457,000, 5.4% fewer than the 483,000 rate in December, and 8.4% below the rate of 499,000 a year earlier.

While construction began on fewer houses in January, privately owned housing completions in January increased 1% to seasonally adjusted annual rate of 1.41 million, up from the revised December estimate of 1.39 million. The estimate also is 12.8% above the January 2022 rate of 1.25 million.

The increase was led by single‐family housing completions, which in January were at a rate of 1.04 million. That was 4.4% more than the revised December rate of 996,000.

The January rate for buildings with five units or more fell to an estimated 349,000, 8.6% below the revised estimate of 382,000 for December but 14.4% above the rate of 305,000 a year earlier.

The number of new housing units authorized by building permits increased slightly in January to a seasonally adjusted annual rate of 1.339 million. That was 0.1% more than the revised December rate of 1.337 million, but remained 27.3% below the 1.84 million rate a year earlier.

Authorizations of single‐family houses in January were at a rate of 718,000, 1.8% below the revised December figure of 731,000 but remained 40% below the 1.2 million rate a year earlier.

Authorizations of buildings with five units or more were at a rate of 563,000 in January, up 0.5% from the revised December rate of 560,000, but 4.1% below the rate of 587,000 from a year earlier.

Odeta Kushi, deputy chief economist for First American Financial Corp., said the results came in below the consensus expectations of analysts.

“There remains a large backlog of single-family homes under construction, as builders have been hampered by supply-side headwinds from labor shortages and high construction material costs,” she said. “Those homes are not move-in ready, and thus do not meaningfully contribute to the stock of livable homes.”

Still, she said, the increase in housing completions is worth noting.

“Single-family completions have outpaced housing starts since July 2022, and that will likely put some downward pressure on the numbers of single-family homes under construction in the months ahead,” Kushi said. “Builders will likely continue to focus on completing existing projects, rather than starting new ones. As new completed home inventory rises, it will provide some much-needed relief to a supply-starved market.”

She added that home builders still face a difficult market due to affordability challenges and supply issues.

“While mortgage rates have trended down over the last three months thanks to favorable inflation data,” she said, “rates increased recently due to market expectations that inflation will persist, thereby requiring the Federal Reserve to remain restrictive for longer. Even so, builders are hoping that we're past the mortgage rate peak and can look for some mortgage rate stability in the months to come.”