New Study Shows How To Optimize Mortgage Experience

‘State of Borrower Experience’ report uncovers pain points within mortgage process.

The mortgage experience remains stressful for borrowers, with 1 in 5 reporting an issue with their transaction, according to a new report.

New research released today from Snapdocs, a digital closing platform, and Stratmor Group, a mortgage industry advisory firm, uncovers common pain points during the mortgage process and offering recommendations for lenders to improve the borrower experience.

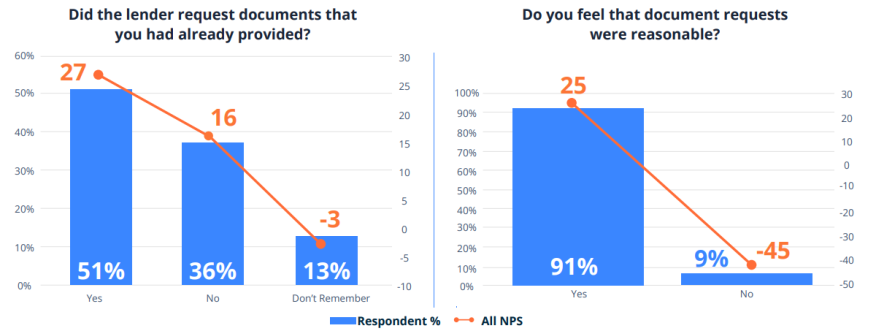

Documents cause the most pain in the mortgage process, with respondents most annoyed by unreasonable document requests. Next were closings, where 1 in 3 respondents experienced an issue during closing. Respondents cited lack of preparedness, delays, or errors in closing as the key issues impacting their experience.

“Lenders need to find new ways to compete for business in this market. While one proven strategy is to create a best-in-class borrower experience, there’s no consensus on what ‘best-in-class’ means, much less how to measure it,” said Garth Graham, senior partner at Stratmor Group. “This research provides a granular view into the key ‘moments that matter’ so that lenders can begin to build their (customer experience) strategies around empirical data.”

The report surveyed more than 7,000 U.S. borrowers, all of whom completed a mortgage transaction in the previous nine months. The findings show that investing in technology and process improvements downstream in the mortgage process can improve borrower experience.

The bright spot in the report is the application process. Fewer borrowers experienced difficulties in filling out the loan application compared to other steps in the mortgage process, with 67% of respondents rating the experience of filling out a loan application an 8 or above on a 10-point scale.