PennyMac Financial Q1 Profit Down 82.5% YOY

Loan originations are down but servicing portfolio continues to grow.

For PennyMac Financial Services Inc., originations are down but servicing is up, prompting Chairman and CEO David Spector to be “very excited” for the company’s future.

That’s the takeaway from the independent mortgage company’s first-quarter earnings report, released Thursday, which showed the company’s profits are down more than 80% year over year.

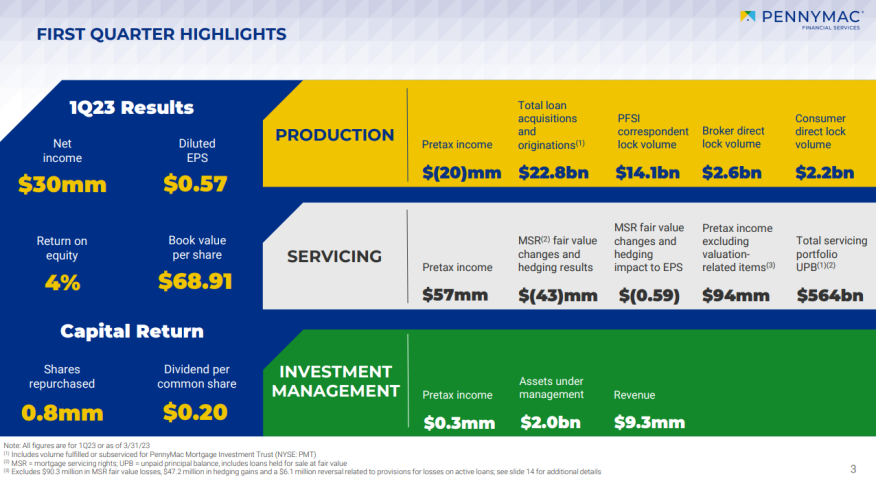

According to the report, PennyMac had consolidated net income of $30.4 million, or 57 cents per diluted share, down 19% from net income of $37.6 million, or 71 cents per diluted share, in the fourth quarter of last year.

Profits were also down 82.5% from $173.6 million, or $2.94 per diluted share a year earlier.

Net revenue was also down dramatically, totaling $302.9 million in the first quarter, down 11% from the fourth quarter and down 54% year over year.

The production segment reported a pretax loss of $19.6 million, which compared to a pretax loss of $9 million in the previous quarter and pretax income of $9.3 million a year earlier. Total loan acquisitions and originations, including those fulfilled for PennyMac Mortgage Investment Trust, were $22.8 billion in unpaid principal balance (UPB), essentially unchanged from the fourth quarter but down 32% year over year.

The servicing segment, meanwhile, reported pretax income of $57.4 million, down 24% from $75.6 million in the fourth quarter and down 74.5% from $225.2 million in the first quarter of 2022.

Still, PennyMac’s servicing portfolio grew to $564.5 billion in UPB, up 2% from the fourth quarter. The company said the increase was driven by production volumes, which more than offset prepayment activity.

“In one of the most challenging mortgage origination markets in recent history, PennyMac Financial delivered solid net income and continues to distinguish itself as a best-in-class mortgage company,” Spector said.

“We saw improved margins in our broker direct and correspondent lending channels although production volumes remained low due to seasonality,” he continued. “We are optimistic about the return to profitability in this segment, as we enter the typical home-buying season and given the work we completed last year to prudently resize our capacity to the current market environment.”

In a conference call with analysts, Spector said the “primary contributor to [PennyMac’s] strong financial performance in recent periods has been has been its large and growing servicing business. We have demonstrated that even in a challenging origination environment, our large servicing portfolio, multi-channel production capabilities, and balanced business model have positioned the company well to continue making progress towards achieving its long term goals.”

He added, “I am very excited for PennyMac Financial's future. Our servicing portfolio continues to grow and our competitive position within the correspondent and broker direct lending channels has never been better. We are increasingly seeing new correspondents and brokers turn their attention to PennyMac and its best-in-class mortgage platform, as a trusted and innovative business partner.”