'Perfect Storm' In Q4 Causes IMBs Net Production Losses

Expenses Reach Second-Highest Level Ever Recorded, says Mortgage Bankers Association

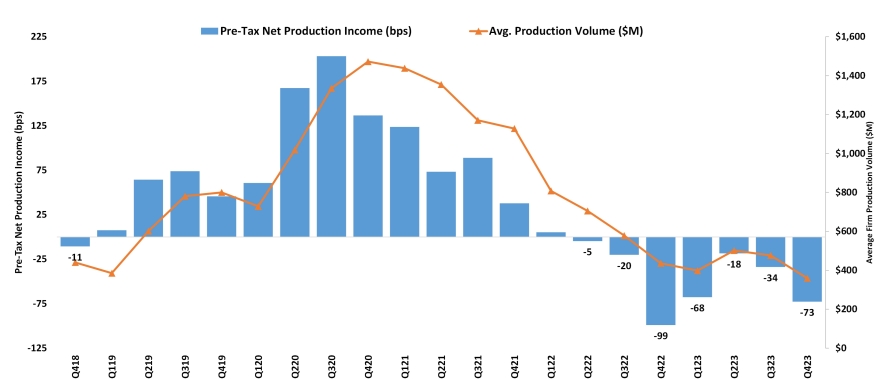

Last year didn’t end positive for independent mortgage banks (IMBs), which along with mortgage subsidiaries of chartered banks, reported a pre-tax net loss of $2,109 on each loan originated in the fourth quarter of 2023 — the result of a 'perfect storm,'" according to the Mortgage Bankers Association.

The MBA newly released Quarterly Mortgage Bankers Performance Report indicated this was an increase from the reported loss of $1,015 per loan in the third quarter of 2023.

“The fourth quarter of 2023 was about as challenging as it could get for mortgage lenders to generate a production profit,” MBA’s Vice President of Industry Analysis Marina Walsh said. “The fourth quarter is typically the slowest pace of purchase activity for the year. This year was exacerbated by the current lack of housing inventory and mortgage rates that increased to their highest levels of the year, keeping refinancing volumes low. These factors contributed to a ‘perfect storm’ that resulted in a decline in production volume for the quarter that reached the lowest level for this report since 2014.”

Production revenues increased by five basis points, but expenses were up more than $1,000 per loan from the prior quarter, Walsh noted.

Total loan production expenses, including commissions, compensation, occupancy, equipment, and other production expenses and corporate allocations, increased to $12,485 per loan in the fourth quarter, up from $11,441 per loan in the third quarter of 2023.

“At the same time, productivity metrics deteriorated, suggesting that there may still be excess capacity even after substantial employee reductions over the past two years. Despite tough market conditions, some companies have been able to weather seven consecutive quarters of net production losses through cash reserves or infusions and strong servicing cash flows.”