Realtor.com: Sky-High Rents Top Pre-COVID Levels By More Than 25%

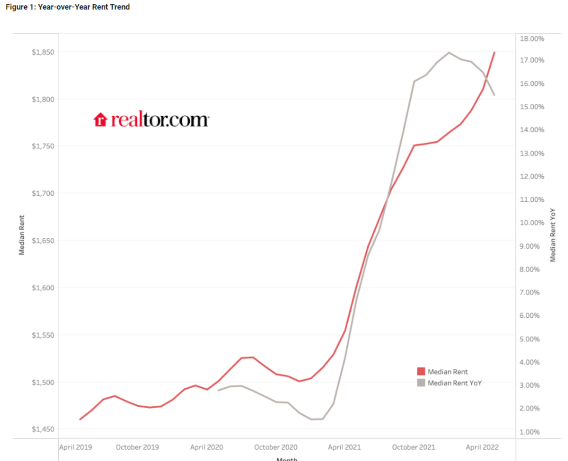

National rents grew at a double-digit annual pace for the 10th straight month in May, but by the smallest amount since fall 2021 – hinting at potential relief to come later this year.

- Median rent in the top 50 metros reached $1,849 — 15.5% higher than at this time last year and a rent record for the 15th month in a row.

- Year-over-year rent growth has decreased every month in 2022, and is at its lowest level since September 2021.

- In some metropolitan areas with healthy local economies, renting a home is relatively more appealing than buying one, compared to other metros.

- Metros with higher rental vacancy rates are generally among the least expensive metros to rent a home in.

The U.S. median rental price hit its latest new high of $1,849 per month in May, a 26.6% increase since 2019, before the pandemic began, according to Realtor.com.

The digital real estate marketplace released its Monthly Rental Report today, noting that while May was the 10th straight month of double-digit annual growth in national rents, the increase was the smallest since September 2021.

May 2022 Rental Metrics: National

Unit Size Median Rent Change From May 2021 Change From May 2020

Overall $1,849 15.5% 23.2%

Studio $1,530 16.9% 18.8%

1-bed $1,708 15.2% 22.5%

2-bed $2,076 14.8% 25.5%

“There’s no question that renters are facing sky-high prices, and with rising inflation reflecting price jumps for both rents and everyday expenses, many renters are feeling the strain on their finances,” said Realtor.com Chief Economist Danielle Hale. “Still, our May data suggests that the rent surge is beginning to lose some steam, in part because incomes can’t keep up, even in the strong job market.”

For Americans searching for rental units within their budgets, May trends offered bittersweet news, Realtor.com said. On one hand, national rents posted the smallest year-over-year gain, at 15.5%, since September 2021, the fourth consecutive month the year-over-year gain was below the January peak of 17.3%.

While rent growth remains historically high, Hale said, “the rate has been gradually cooling since January, pulling back from 2021’s feverish pace. In a bit of good news for renters, the deceleration picked up in May, which means if these trends continue, last month’s prediction of rents surpassing $2,000 sometime this summer is going to take longer to materialize.”

In fact, if rent growth continues cooling, typical asking rents may not reach that $2,000 milestone until next year, Realtor.com said.

In addition, with the for-sale housing supply recovery forecasted to accelerate in the second half of the year, an increase in first-time buying opportunities could take even more pressure off rental demand and prices, the company said.

Still, rental affordability remained a significant challenge for many renters across the country in May. The U.S. median rental price continued its record-breaking streak, hitting a new high ($1,849) for the 15th month in a row and reaching 26.6% higher than in May 2019.

All unit sizes posted double-digit rental price gains year-over-year, Realtor.com said: studio rental prices rose 16.9% to $1,530; one-bedrooms rose 15.2% to $1,708; and two-bedrooms rose 14.8% to $2,076.

Inflation is further compounding the strain on households' monthly budgets, as higher costs of rents and regular expenses continue to outpace income growth, the company said.

Regional Highlights

In May, rents increased on a year-over-year basis in all 50 of the largest U.S. metros, Realtor.com said. They also grew at a faster pace than the national rate in nearly half (21) of those markets.

The biggest annual rental price gains were registered in Miami (+45.8%); Orlando, Fla. (+28.4%); Providence, R.I. (+23.8%); San Diego (+22.7%); and Tampa, Fla. (+22.4%).

A key factor driving the ongoing rent surge is a lack of supply, as rental vacancy rates, which were already trending lower, have taken a sharp dive during the pandemic. These trends are magnified in the biggest cities, which tend to attract younger residents, many of whom are in the early stages of their careers and looking for the flexibility in their living situations.

Renting may also be a more desirable alternative to buying in these areas, where real estate has historically come at a premium. According to U.S. Census Bureau data from the first quarter of 2022, rental vacancy rates were lower inside (5.7%) versus outside (6.7%) the largest metro areas.

Realtor.com said its analysis highlights the relationship between large markets’ rental availability and prices. On one end of the spectrum, major tech hub Boston held the nation’s fifth-highest rent at $2,889 in May after posting a vacancy rate of just 2.4% in 2022-Q1.

Conversely, renters may find more affordable options in relatively smaller and less densely populated secondary metros, the company said. Of the 10 areas with the highest vacancy rates, nine were among May’s lowest-priced rental markets, led by Indianapolis with a significantly lower overall rent ($1,275) and higher vacancy rate (10.9%) than Boston.