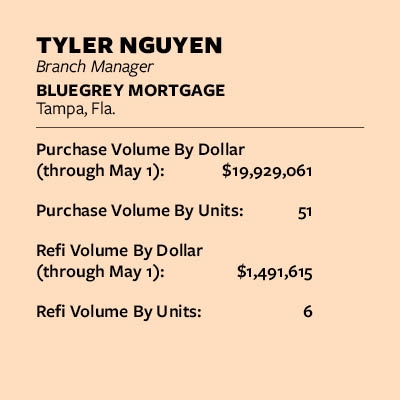

Tyler Nguyen Succeeds By Driving To The Finish Line

Tough times are not all bad for the profession

Tyler Nguyen’s path to becoming a “Mortgage Master” started when, as a Realtor, he was flipping homes. His real estate company did not have an in-house lender, so Nguyen, who always liked working with numbers, volunteered to learn the ropes.

“I took that opportunity to get my mortgage license and started my journey,” Nguyen says.

And just like that, a career was born in 2015. “It changed my life,” Nguyen, 41, says.

“Tyler is considered one of the best in the business, always finding solutions for his clients and going above and beyond to help clients obtain homeownership,” writes Pablo Cotto, Bluegrey Mortgage’s business administrator, in his nomination.

One of the traits that makes him one of the best is his perseverance. Some loans are trickier than others, Nguyen says, but he works on them until they are completed.

“I keep driving until I get to the finish line,” is how he puts it.

Nguyen says that the majority of the loans he and his team close are special in their own ways.

“This year we had a client that was referred by her son that we closed a loan for the prior year and also referred by the Realtor partner,” he recalls. “Her father passed away, and in his trust gave her the opportunity to take ownership of the home. Keep in mind, she’s in her mid 50s and never owned a home in her life.”

Nguyen acknowledges challenges during the process, but he was able to persevere and close the loan.

“She was so grateful, and we still keep in touch throughout the year,” he says. “During the loan process, what I enjoy is building rapport and getting to know the client on a personal level, and it is so satisfying once we make it to closing day.

“That’s why I chose to be a loan officer, to help these clients obtain the American dream of homeownership.”

One such satisfied client from Land O’ Lakes wrote this testimonial on Zillow in June 2022: “Tyler was a phenomenal expert mortgage broker. Him and his team getting our home closed in six weeks. Finally, we’ve got our dream home. Thank you so much!”

In a down market, Nguyen says, ”It’s important to show value to our partners. I have partaken in coaching for years now, and share that information and knowledge with my partners.”

Tough times are not all bad for the profession, he points out.

The mortgage business is all about relationships, he says. Good lenders and those just starting out should take the opportunities to forge new relationships that will endure beyond the lean years and pay off once the good times return. It is a time to master the basics of the business and how to build a client base.

“A challenging market can make you stronger in the long run,” says Nguyen, who is licensed in Florida, Colorado, Kansas (where he is originally from), Oklahoma, Pennsylvania, and Texas.