A Record 25% Of Homebuyers In 4Q Sought New Metro Areas

Affordability kept overall numbers of homebuyers down in the quarter, Redfin says.

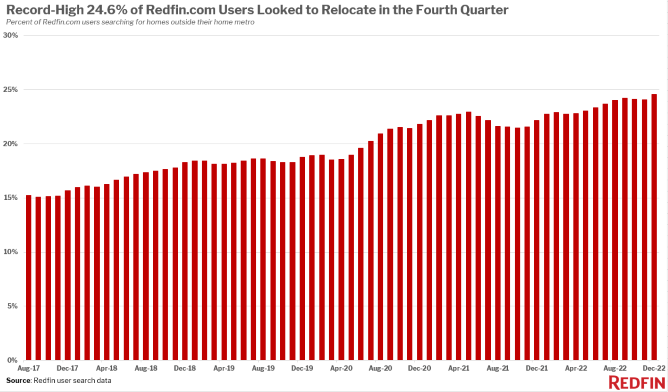

- A a record 24.6% of Redfin.com users looked to move to a different metro area in the fourth quarter, up from 22.1% a year earlier.

- Still, pending home sales fell more than 30% from a year ago at the end of 2022.

Fewer people looked to buy a home in the fourth quarter of 2022, but of those who were looking, a record percentage wanted to relocate to a different metropolitan area, Redfin said Monday.

According to a new report on fourth-quarter housing migration trends from the technology-powered real estate brokerage, a record one-quarter (24.6%) of Redfin.com users looked to move to a different metro area in the fourth quarter, up from 22.1% a year earlier and around 18% before the pandemic.

Those buying homes were relocating at an unprecedented rate, Redfin said, because higher mortgage rates, still-high home prices, and high economic uncertainty are driving many of them — especially remote workers — to more affordable areas.

All of those same factors, however, also reduced the overall pool of homebuyers, as pending home sales fell more than 30% from a year ago at the end of 2022. Many homeowners were also reluctant to sell and relocate because they didn’t want to give up their existing, and comparatively low, mortgage rate.

According to Redfin, eight of the Top 10 migration destinations in the fourth quarter all had fewer homebuyers looking to move in than a year earlier. Both Sacramento, Calif., and Las Vegas, the most popular destinations, had net inflows of around 5,500, down from about 6,500 a year earlier.

Net inflow is the number of people looking to move into a metro minus the number of people looking to leave, Redfin said.

Phoenix, the fifth-most popular destination, had a net inflow of about 4,000 in the fourth quarter, down from more than 8,000.

“Phoenix is typically a huge vacation-home market, but I’ve seen a big decline in people purchasing second homes and investment properties lately,” said Heather Mahmood-Corely, a local Redfin agent. “There are still out-of-towners buying homes and moving here full time, though that has also slowed down over the last several months as mortgage rates have risen.”

“Still,” she continued, “the cost of living in Phoenix is low compared to places like the Bay Area, Seattle, Denver, and parts of the East Coast, where many out-of-towners are coming from. I helped one client buy a home in Washington State in 2016, and it has doubled in value. She sold that home last year and used the proceeds to buy a much bigger, nicer house in Phoenix.”

Sun Soaked Cities Most Popular Destinations

After Sacramento and Las Vegas, Miami was the next most popular migration destination in the fourth quarter. It was followed by Tampa, and then Phoenix. Popularity was determined by net inflow.

Although home prices have soared in popular destinations like Las Vegas and Phoenix since the start of the pandemic as remote workers moved in, they’re still far more affordable than places like the Bay Area or New York, Redfin said.

The typical home in eight of the 10 most popular destinations was less expensive than the typical home in the most common location of origin, the company said. For example, Sacramento’s $540,000 median sale price is about 39% less expensive than the $1.4 million median in San Francisco, the top origin for out-of-towners coming to Sacramento.

The two exceptions were both in Florida: Cape Coral and North Port-Sarasota, with Chicago as the top location of origin, Redfin said.

Warm weather is also attractive to relocators, as all 10 of the top destinations are in sunny climates; five are in Florida.

Homebuyers Leave Coastal Job Centers

More homebuyers looked to leave San Francisco than any other metro in the fourth quarter, followed by Los Angeles and New York, Redfin said. The ranking for places homebuyers are moving from is determined by net outflow, a measure of how many more people are looking to leave a metro than move in.

The District of Columbia and Chicago rounded out the top five, followed by several other large northern job centers. Those are typically the places homebuyers looked to leave, as they tend to be expensive, Redfin said.

There were fewer homebuyers leaving most of those places than there were a year earlier, reflecting the slow housing market. The net outflow from seven of the Top 10 metros was smaller in the fourth quarter than a year earlier, Redfin said.