In Recovery, Mixed Fortunes For Nation’s Largest Lenders

Earnings snapshot shows ongoing cuts, servicing stemmed the bleeding amidst higher rates.

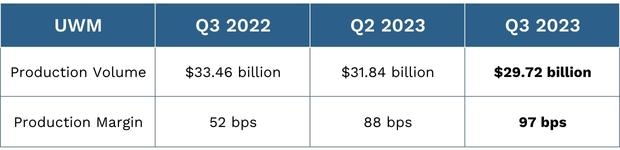

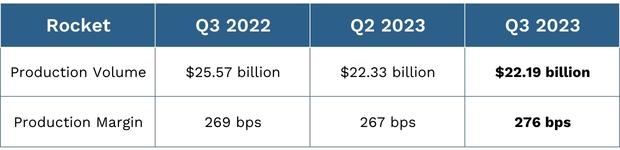

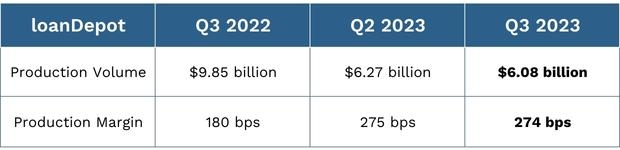

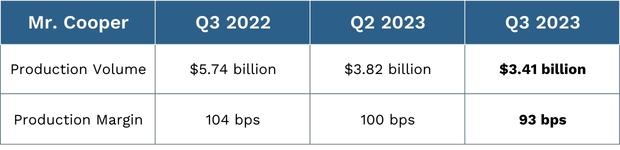

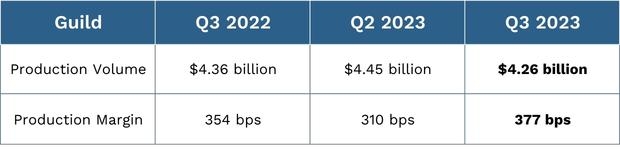

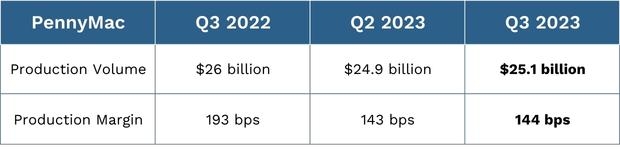

Graph 1: Comparison of top lenders production margins, or gain on sales, in 2022 Q3, 2023 Q2, and 2023 Q3. Graph 2: Comparison of top lenders production in 2022 Q3, 2023 Q2, and 2023 Q3.

Those third-quarter earnings for mortgage lenders have come in. While it looks like most have stopped the bleeding, just how much have they recovered from the same period last year?

United Wholesale Mortgage (UWM) touted its performance, and even though it may have originated more than its number one competitor, Rocket Mortgage, it has seen significant losses since last year.

Its cash on hand is down, and its net income fell about $25 million.

Of course, the company’s main focus was on its origination numbers, ensuring that it stayed ahead of its Detroit neighbor. UWM saw a total loan origination volume of $29.7 billion in Q3 2023, down from $33.5 billion in the third quarter of 2022. As for operation expenses, UWM’s Q3 2023 expenses added up to $3.75 million compared to last year’s $3.54 million.

Although Rocket’s total revenue fell 7.1% year-over-year, the lender increased its profits by nearly 20%. Rocket was able to bring in $115 million in net income on $1.2 billion of net revenue, compared to $96 million from net revenue of $1.3 billion in the third quarter last year.

As of the end of the third quarter in 2023, Rocket has nearly $1 billion cash on hand, up from $800 million in the third quarter of last year. Total operating expenses in the third quarter totaled $1,085,543, compared to $1,188,331 for the third quarter in 2022.

Rocket Mortgage had $22.2 billion in total originations for the third quarter of 2023, down 15% from $25.6 billion in the third quarter last year.

Though loanDepot has posted six consecutive quarterly losses from Q3 2022 to Q3 2023, the California-based lender has been able to slash operating expenses by nearly 30% over the past year. This year, the lender’s origination volume rose by nearly $2 billion (more than 20%) from Q1 to Q2 and only dropped by about $190 million from Q2 to Q3. The lender’s cash on hand only changed slightly, dropping by about $2 million from Q2 to Q3.

When we look at the two-year picture, though, things get a little more interesting. The lender has slashed expenses by 59% since Q3 2021, yet total revenue has fallen 71.25% over the same period. So, over the past two years, they’ve lost far more revenue than they’ve been able to cut expenses.

From 2022 to 2023, loanDepot’s revenue loss mostly stagnated – only dropping by around $8.5 million, or 2.28% – while the lender was able to continue cutting expenses to the tune of nearly 30% year-over-year. So, over the past year, they’ve actually been able to stabilize revenue losses and continue cutting costs.

Mr. Cooper Group, which suffered a cyber attack after the release of their Q3 earnings, saw net income of $275 million, which is up from the $113 million in Q3 of 2022. In 2023, the company’s funded loan volume dropped from $5.7 billion in 2022 to $3.4 billion UPB in 2023.

Guild Mortgage, which has been on a buying spree, saw net income of $54.2 million in the third quarter of 2023, which is down from the $77 million it saw in the third quarter of 2022.

However, its originations were only down slightly.

In the third quarter, the company reported $4.3 billion in originations, down from $4.4 billion in the third quarter of 2022. The company’s operating cash position was also down from $162.2 million in 2022 to $114.4 million in 2023.

When it comes to PennyMac, its net income was $92.87 million, which is down significantly from $135 million in the third quarter of 2022.

The company’s operating expenses were $273.5 million for 2023, down six percent from 2022’s $290.8 million total expenses. In terms of originations and acquisitions, the company reported $25.1 billion for Q3 2023, down four percent from Q3 2022.

In the third quarter of 2023, the typical pre-tax production deficit for a mortgage loan stood at 34 basis points (bps), marking an increase from the preceding quarter's average net production loss of 18 bps and a 20 bps loss from one year ago. Over the period spanning from the third quarter of 2008 to the latest quarter, the average quarterly pre-tax production gain has been 45 basis points, as reported by the Mortgage Bankers Association.

Servicing

As far as servicing is concerned, Garth Graham, senior partner at Stratmor Group, says the balanced model for non-bank mortgage companies is always the one that works best.

“Meaning that they have retained servicing as an offset for origination (counter cyclical) and have some meaningful purchase-centric retail volume,” he said.

He said if the companies retained mortgage servicing rights in 2020 and 2021 when it was cheap to do so and invested in purchase when refinance was easier, these are the companies much better off today.

That’s evident in the servicing portfolios of the companies mentioned above.

Rocket’s servicing portfolio includes 2.4 million loans serviced, generating about $1.4 billion of recurring servicing fee income on an annual basis. The company strategically acquired mortgage servicing rights (MSR) on certain agency loans for a total consideration of $103 million, which adds $6.2 billion of unpaid principal balance for loans with a weighted average coupon well above that of their current portfolio in hopes to provide a compelling refinance opportunity when rates eventually decline.

UWM had an unpaid principal balance of MSRs of $281.4 billion with a weighted average coupon of 4.2% in the third quarter compared to $306 billion with a weighted average coupon of 3.44% on September 30, 2022.

loanDepot’s servicing fee income rose to $118.7 million in Q3 2023 from $117.7 million in the previous quarter. The unpaid principal balance for servicing in the third quarter rose 3% to $143.9 billion from last September.

Guild, for its part, has a servicing portfolio with an unpaid principal balance of $83.7 billion as of Sept. 30, 2023, up 8% compared to $77.7 billion as of Sept. 30, 2022.

Mr. Cooper Group saw its servicing unpaid principal balance (UPB) grow by 10% year-over-year to $937 billion, establishing Mr. Cooper as the nation's largest servicer.

Pennymac's servicing portfolio grew to $589.4 billion in unpaid principal balance as of Sept. 30, 2023, which is up from $530 billion in September 2022.

Ryan Kingsley, Erica Drzewiecki, Sarah Wolak, and Katie Jensen contributed to this report.