Redfin: Higher Rates Mean Fewer Million-Dollar Homes

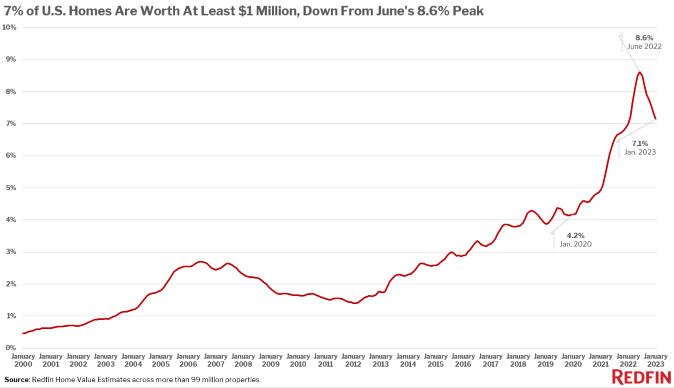

Share of U.S. homes worth at least $1 million has fallen to 7% from 8.6% last June.

- Redfin economist: "Buying an $800,000 home today would cost more per month than buying a million-dollar home a year ago.”

- The share of homes valued at seven figures is falling quickest in the San Francisco Bay Area.

- Roughly 1 in 7 (14.4%) of Miami homes are worth at least $1 million, up from 11.5% a year ago.

Just over 7% of U.S. homes are worth $1 million or more, according to a new report from Redfin.

The digital real estate brokerage said that percentage is, as of January, the most recent data available. The share fell from June 2022’s all-time high of 8.6%, and remains essentially unchanged from a year earlier — but it’s up from 4.2% just before the pandemic began.

Million-dollar-plus homes making up a smaller portion of the homes for sale than they did last spring is indicative of a cooling market. Home values and prices have dropped from record highs as 6.5%-plus mortgage rates curb homebuying demand.

That, Redfin said, has pushed a certain portion of homes that would have been worth seven figures at the peak of the pandemic homebuying frenzy below the million-dollar threshold.

Some of the decline from June's peak is due to seasonality, as home prices typically decline in the second half of the year, but the June-to-January drop noted in the Redfin report is much bigger than usual.

“Home values are coming down from their peak and fewer sellers could fetch seven figures — but that doesn’t mean buyers are getting a break,” said Redfin Economics Research Lead Chen Zhao. “The typical homebuyer’s monthly mortgage payment is even higher than it was when home values peaked in the spring because rates are so much higher, and although home prices have come down, they certainly haven’t crashed.”

She added, “Now isn’t the time for buyers who need to take out a loan to get a good deal. Buying an $800,000 home today would cost more per month than buying a million-dollar home a year ago.”

With today’s 6.6% mortgage rates, a buyer who made a 20% down payment would pay $5,241 monthly for an $800,000 home. With the 3.5% rates common in early 2022, that same buyer would pay $5,034 for a $1 million home, Redfin said.

The portion of U.S. homes worth seven figures has nearly doubled since before the pandemic, and the typical home is still worth significantly more. That’s due mostly to home prices soaring as demand skyrocketed during the pandemic, and partly to the general uptick in home values over time.

By Region

The share of homes valued at seven figures is falling quickest in the San Francisco Bay Area and other expensive coastal regions. Just over 80% of San Francisco homes are worth at least $1 million — the biggest share of the 99 most populous U.S. metros, but down from 86.3% a year ago, Redfin said.

Located across the bay from San Francisco, Oakland, Calif. — where 44.8% of homes are worth $1 million or more, down from 50% a year ago — experienced the next-biggest decline. It was followed by Seattle (27.5%, down from 30.9%); New York (29.5%, down from 32.5%); and San Jose, Calif., the center of Silicon Valley, (79.2%, down from 81.7%).

The Bay Area has seen outsized price drops because home prices there have dropped more than in other places, Redfin said. San Francisco’s median sale price fell 9.4% year over year in January, while Oakland’s fell 7.8%, two of the three largest declines in the U.S.

Rising mortgage rates have hit expensive markets particularly hard because homes there are so expensive that small bump in rates translates to a big increase in monthly mortgage payments, Redfin said.

Using a variation of the example above, even a nearly 10% drop in San Francisco’s prices doesn’t cancel out the impact of high mortgage rates. The typical San Francisco home buyer would pay $8,372 for today’s median-priced ($1,278,000) home with a 6.6% rate. A year ago, a buyer would have paid $1,410,000 for the typical home, but the monthly payment would have been much lower: around $7,100 with a 3.5% rate, based on Redfin's research.

The prevalence of tech workers is another reason for falling prices in those places. There isn’t as much demand for homes as there once was because of the popularity of remote work. Stumbling stocks and the surge of layoffs in the industry means fewer people can afford to buy, the company said.

Still, the vast majority of homes in the Bay Area are worth at least $1 million, and more than a quarter of homes in Seattle and New York hit that mark.

Big Growth In Florida

Roughly 1 in 7 (14.4%) of Miami homes are worth at least $1 million, up from 11.5% a year ago, the biggest increase of the metros in this analysis, Redfin said. The next-biggest increases are in North Port, Fla., (11.3%, up from 9.1%); Anaheim, Calif. (54.2%, up from 52.2%); Nashville, Tenn. (8.4%, up from 6.4%); and West Palm Beach, Fla. (12.8%, up from 11.1%).

Million-dollar homes are making up a larger chunk of Florida’s housing stock because many parts of the Sunshine State are still seeing substantial increases in home values and prices. Florida was home to six of the 10 metros with the biggest home-value increases last year, and Miami, North Port, and West Palm Beach all saw 5%-plus annual price increases in January.

Florida homes held their value because there’s still healthy demand from buyers, especially out-of-town remote workers moving in from more expensive parts of the country. Five of the nation’s 10 most popular migration destinations are in Florida, despite its status as the most hurricane-prone state in the U.S. Redfin agents report that homebuyers typically move in for the state’s relatively affordable homes, beaches, warm weather, and lack of a state income tax.

All in all, the portion of homes worth at least $1 million dollars is up from a year earlier in 70 of the 99 most populous U.S. metros. It’s unchanged in 11, and down in the remaining 18.