Redfin: Just 1% Of Homes Have Sold This Year

Quick increase in mortgage rates has kept buyers and sellers on the sidelines.

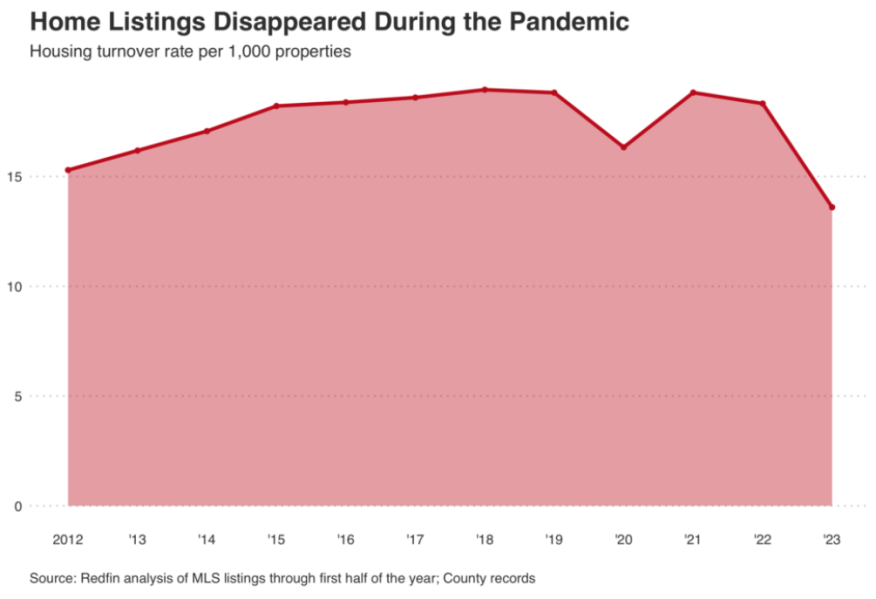

- Roughly 14 of every 1,000 U.S. homes (1.4%) changed hands during the first six months of 2023.

- That's down from 19 of every 1,000 (1.9%) during the same period in 2019.

- Turnover rate has shrunk most in the suburbs: Just 1.6% of large suburban houses have changed hands so far this year.

There are slow homebuying seasons, and then there’s the first half of 2023, when just 1.4% of homes changed hands, the lowest turnover rate in at least a decade, Redfin said Tuesday.

According to the report from the Seattle-based digital real estate brokerage, roughly 14 of every 1,000 U.S. homes (1.4%) changed hands during the first six months of 2023, down from 19 of every 1,000 (1.9%) during the same period in 2019.

In 2018, Freddie Mac estimated that about 2.5 million more homes needed to be built to meet demand, with the shortfall mainly due to a lack of construction of single-family homes, Redfin said. The homebuying boom of 2020 and 2021 — driven by record-low mortgage rates, remote work, and a surge in investor purchases — depleted already low inventory levels.

Finally, 2022's soaring mortgage rates — average rates nearly doubled from January to June — exacerbated the shortage by chaining homeowners to their comparatively low rates.

“The quick increase in mortgage rates created an uphill battle for many Americans who want to buy a home by locking up inventory and making the homes that do hit the market too expensive,” said Redfin Deputy Chief Economist Taylor Marr. “The typical home is selling for about 40% more than before the pandemic.”

Marr said mortgage rates dropping closer to 5% “would make the biggest dent in the affordability crisis by freeing up some inventory and bringing monthly payments down. But there are a few other things that would boost turnover and help make homes more affordable.”

Among those is building more housing, he said, adding that federal and local governments can help by reforming zoning and making the building process easier.

“Financial incentives, like reducing transfer taxes for home sellers and subsidizing major moves with tax breaks, would also add to supply,” Marr said.

Turnover Worst In Suburbs

According to the Redfin report, the home turnover rate has shrunk most in the suburbs: 16 of every 1,000 (1.6%) large suburban houses have changed hands through the first half of this year, two-thirds as many as in 2019, when 24 of every 1,000 (2.4%) sold.

That means buyers of large suburban homes have 33% fewer houses to choose from.

“New listings normally hit the market on Thursdays, and I have buyers who are excitedly checking their Redfin app Thursday mornings, only to find nothing new,” said Phoenix Redfin Premier agent Heather Mahmood-Corley. “That goes for buyers in every price range in every type of neighborhood. But what people want most are those move-in ready, mid-sized homes in neighborhoods with highly rated schools. Those are hardest to find, because for people to buy one, someone needs to sell one. That’s not happening, because so many of those homeowners have low mortgage rates.”

The turnover rate has dropped for every size home in every type of neighborhood over the last four years, although buyers will have an easier time finding something for sale in certain metro areas, Redfin said.

The turnover rate for condos and townhomes didn’t shrink as much as that of single-family homes during the pandemic, the report states. Supply of that home type wasn’t depleted as much because there wasn’t as much demand for them.

Modestly sized single-family homes in the city are hardest to find: Just 11 of every 1,000 two- and three-bedroom urban houses (1.1%) sold in the first half of this year

Smaller houses in the city have the lowest turnover rate of all the home types, according to Redfin’s analysis. Roughly 11 of every 1,000 two- and three-bedroom single-family homes (1.1%) in urban neighborhoods sold in the first six months of 2023, compared to 14 of every 1,000 (1.4%) during the same period in 2019.

Two- to three-bedroom homes in suburban neighborhoods are essentially tied with their urban counterparts for the lowest turnover rate, with 11 of every 1,000 changing hands this year. That’s down from 16 of every 1,000 in 2019.

Bay Area Had Lowest Turnover

Northern California has the lowest turnover rate in the U.S. Just six of every 1,000 (0.6%) homes in San Jose changed hands in the first half of 2023, the lowest rate of the 50 most populous U.S. metros.

It’s followed closely by Oakland, San Diego, Los Angeles, Sacramento, and Anaheim, all places where about eight of every 1,000 homes (0.8%) turned over to a new owner.

The pandemic exacerbated the supply shortage throughout California, with the turnover rate dropping by at least 30% in each of those metros from 2019 to 2023.

For large, suburban single-family homes, California still has the lowest turnover rate. The state historically has the lowest housing turnover because its tax laws — namely proposition 13 — incentivizes homeowners to stay put by limiting property-tax increases.

Homebuyers have the biggest pool of options in Newark, N.J., and Nashville, Tenn., where more than 23 of every 1,000 homes (2.3%) have changed hands this year

Newark has the highest turnover rate in the U.S., with 24 of every 1,000 homes (2.4%) changing hands during the first six months this year. It’s followed closely by Nashville (23 of every 1,000) and Austin, Texas (22 of every 1,000). Nashville and Austin are also two of the three metros (along with Fort Worth, Texas) with the highest turnover for large suburban, single-family homes.

But Nashville and Austin are both among the five metros with the smallest declines in turnover since 2019, posting drops of just 10% and 14%, respectively.

When it comes to large suburban houses, Nashville and Austin have the second- and third-smallest declines. That’s partly due to robust new construction in both places, Redfin said. Inventory of single-family homes for sale in both metros is made up of more than 30% newly built homes, compared to 22% nationwide, it said.

Only Milwaukee and Columbus, Ohio, which both saw overall turnover drop by about 8% from 2019 to 2023, had smaller declines in turnover than Nashville. Indianapolis was fourth, with a 14% decline. Milwaukee, Columbus, and Indianapolis have relatively stable turnover because they didn’t experience huge homebuying demand swings throughout the pandemic, the report said.