Report: Buying Is Better Than Renting In Half of The Largest Metros

Rents are up, but buying that first starter home was cheaper in most large metro areas.

With rental prices increasing, new data from Realtor.com suggest that renters who make the transition to first-time home buying could save on monthly payments.

In January, according to the Realtor.com monthly rental report, the cost of buying a starter home was more affordable than renting a similar sized unit in 26 of the 50 largest metro areas.

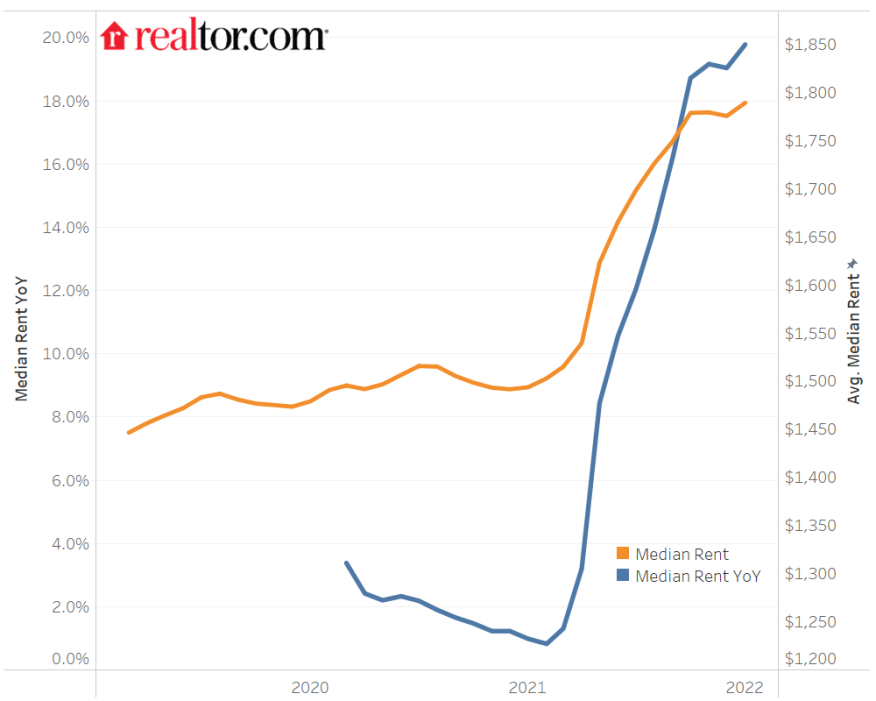

In January, the median rental price increased by double-digits for the eighth straight month, up 19.8% year-over-year. The monthly cost of buying a home with up to two-bedrooms was up only 11% year-over-year.

"While both rental and homebuying costs are rising, a number of factors could tip the affordability scale in favor of first-time buying for many Americans this year. Rents are forecasted to outpace listing price growth in 2022 and are already accelerating across all unit sizes,” Realtor.com® Chief Economist Danielle Hale, said.

More than half of the 50 largest U.S. metros favored buying in January and the gap between monthly starter home costs and rents in these areas was higher than last summer.

Across the 50 biggest U.S. metros in January the median listing price for a starter home was $295,360. The monthly starter-home costs were slightly higher than rents at the national level. In 26 of the 50 largest markets, the monthly cost of buying a starter home was an average of 20.6% lower than renting.

Many of the top buying markets are relatively affordable secondary metros that are attracting remote workers from expensive big tech cities, including first-time buyers like millennials.

Big tech cities, where real estate typically comes at a premium, dominated January's top markets that favored renting over buying a starter home, according to the monthly report. In these markets, rents have been making a strong comeback from their 2021 slowdown, partly driven by higher rent growth among studios common to big tech cities than larger units. Still, as first-time buyers face particularly limited inventory and expensive asking prices in big tech cities, renting continues to present a more affordable option.

“As mortgage rates continue climbing, those looking to buy their first home in 2022 are more likely to find lower costs now than later in the year, but home selection is expected to improve as we move toward spring, when many homeowners target listing their home for sale,” Hale said.