Rising Home Values Propel Higher Loan Limits

FHFA Announces 5.6% Increase in Conforming Loan Limits for 2024

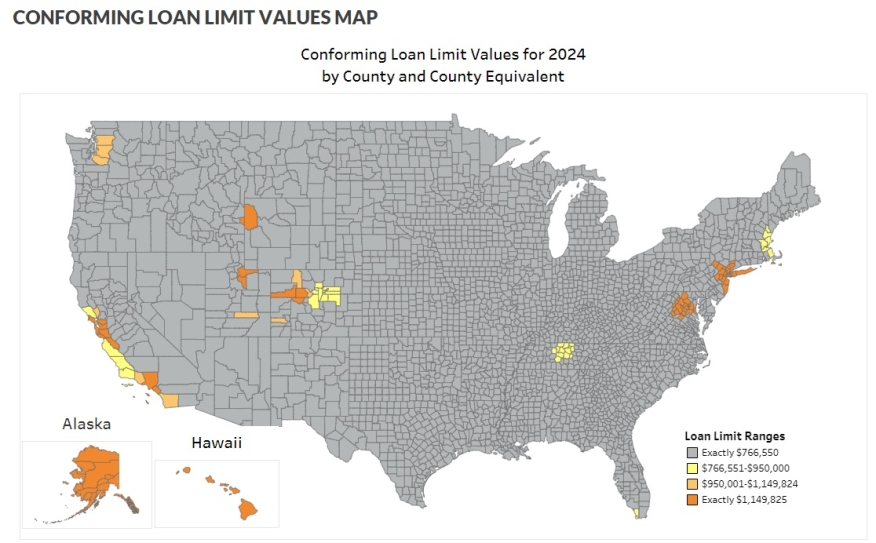

The baseline conforming loan limit for one-unit properties under government-sponsored enterprise mortgages in 2024 will rise to $766,550, marking a 5.6% increase from the current limit. In high-cost areas, the GSE loan limit for one-unit properties will reach as high as $1.15 million.

FHFA highlighted that rising home values will result in higher conforming loan limits for the majority of counties across the country in 2024, affecting all but five.

The Housing and Economic Recovery Act (HERA) mandates that FHFA adjusts the baseline CLL value annually to reflect changes in the average U.S. home price. FHFA's recently released third-quarter 2023 FHFA House Price Index (FHFA HPI) report, which tracks the average U.S. home value over the past four quarters, indicated a 5.56% increase. Consequently, the baseline CLL for 2024 will rise by the same percentage.

In high-cost areas where the local median home value surpasses 115% of the baseline CLL, the loan limit will be higher. HERA defines the high-cost area limit as a multiple of the area's median home value, with a ceiling set at 150% of the baseline limit. As median home values increased in high-cost areas throughout 2023, their CLL values also rose. The new ceiling loan limit for one-unit properties will be $1,149,825, representing 150% of $766,550.

Special statutory provisions establish distinct loan limits for Alaska, Hawaii, Guam, and the U.S. Virgin Islands, setting their baseline loan limits at $1,149,825 for one-unit properties.