Rising Rates Reduce Quality Refi Candidates To 3.8M

Black Knight says that with rates rising to levels not seen since May 2019, millions of borrowers are losing 'rate incentive' to refinance.

- Freddie Mac says 30-year, fixed-rate mortgage averaged 3.92% last week; Black Knight says its daily rate tracking shows rate climbing to 4.17%.

- As rates rise, affordability becomes a big hurdle for home buyers and refinancing.

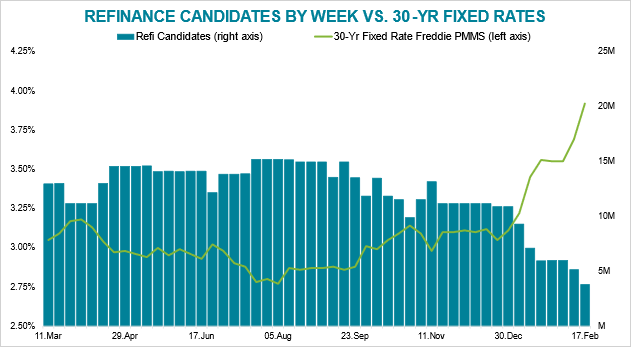

- The 3.8M is down from 11M at the start of 2022 and from 20M last year.

As of Thursday, less than 4 million “high-quality” candidates for refinancing their mortgages remain nationwide, according to an analysis by Black Knight.

The mortgage technology and data provider developed that figure following Freddie Mac’s Primary Mortgage Market Survey (PMMS) this week, which showed that mortgage rates had jumped again due to high inflation and stronger-than-expected consumer spending.

According to Freddie Mac, the 30-year, fixed-rate mortgage averaged 3.92% this week, reaching a level not seen since May 2019.

Black Knight, meanwhile, said its Optimal Blue Market Mortgage Indices (OBMMI), which unlike Freddie Mac’s weekly PMMS tracks interest rates daily, showed similar “but more specific” findings, with Thursday’s average 30-year rate climbing to 4.17%.

“As rates and house prices rise,” Freddie Mac said, “affordability has become a substantial hurdle for potential homebuyers, especially as inflation threatens to place a strain on consumer budgets.”

Rising rates also have dire implications for homeowners hoping to refinance their loans, Black Knight said.

“The latest numbers from Freddie have cut the number of high-quality refinance candidates significantly,” to about 3.8 million, said Mitch Cohen, director of public relations for Black Knight. “The population continues to dwindle, with millions of borrowers having lost rate incentive to refinance in the last month and a half.”

The 3.8 million that remain, Cohen said, is down from about 11 million at the start of 2022, and from as high as nearly 20 million in 2020.

Of the 3.8 million that remain, they still could benefit from a combined potential savings of $1 billion, or about $284 per month per borrower, Cohen said.

“Drilling deeper into the data,” he added, “we see just 750,000 candidates remain who could save at least $400 per month by refinancing, with less than half a million borrowers left who could save $500 or more per month.”

Black Knight defines high-quality refinance candidates as 30-year mortgage holders with a maximum 80% loan-to-value (LTV) ratio and credit scores of 720 or higher, who could shave at least 0.75% off their current first-lien rate by refinancing.

Black Knight’s LTV ratio and credit score assumptions “are conservative by design,” Cohen said. “There are non-cash-out refi products available for borrowers with even higher LTVs and lower credit scores.”

Therefore, if you disregard Black Knight’s conservative eligibility criteria, he said, “roughly 6.9 milion mortgage-holders are ‘in the money,’ with current interest rates at least 0.75% above today’s rate.”

That, of course, will change as rates continue to rise in the coming weeks, especially with the Federal Reserve expected to raise the target range for its benchmark rate next month as it attempts to tame inflation.