S&P DJI: Home Price Growth Continued To Slow In June

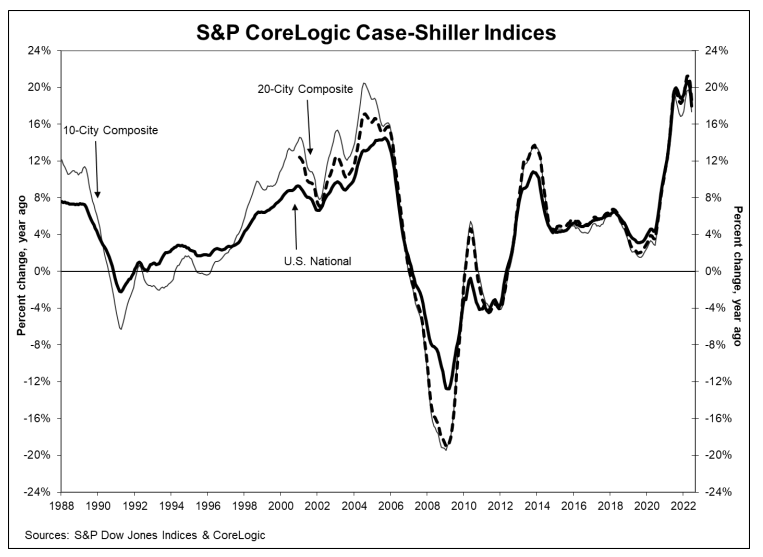

S&P CoreLogic Case-Shiller U.S. National Home Price Index for June 2022 shows that home prices continue to increase across the U.S., but at a declining rate.

- Year-over-year, the index reported an 18% annual increase in June, down from 19.9% in May.

- The 10-City Composite Index, meanwhile, posted an annual increase of 17.4%, down from 19.1% in May.

- The 20-City Composite Index also slowed, posting an 18.6% year-over-year gain in June, down from 20.5% in May

The decelerating growth in home prices continued in June, according to the latest S&P CoreLogic Case-Shlller U.S. National Home Price Index.

S&P Dow Jones Indices today released the latest results for the index, considered the leading measure of U.S. home prices. The data for June 2022 shows that home prices continue to increase across the United States, but at a declining rate.

Year-over-year, the index, which covers all nine U.S. census divisions, reported an 18% annual increase in June, down from 19.9% in May.

The 10-City Composite Index, meanwhile, posted an annual increase of 17.4%, down from 19.1% in May. The 20-City Composite Index also slowed, posting an 18.6% year-over-year gain in June, down from 20.5% in May.

Tampa, Miami, and Dallas reported the highest year-over-year gains among the 20 cities in June. Tampa led with a 35% year-over-year price increase, followed by Miami with a 33% increase, and Dallas with a 28.2% increase.

Just one of the 20 cities in the index reported higher price increases in the year ending June 2022 as compared to year ending May 2022.

Month-over-month, the indices posted slight increases. Before seasonal adjustment, the U.S. National Index posted a 0.6% month-over-month increase in June, while the 10-City and 20-City composites both posted increases of 0.4%.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.3%, and the 10-City and 20-City composites posted increases of 0.3% and 0.4%, respectively.

In June, 13 cities reported increases before and after seasonal adjustments.

“The deceleration in U.S. housing prices that we began to observe several months ago continued in June 2022,” said Craig J. Lazzara, managing director at S&P DJI. “Relative to May’s 19.9% gain (and April’s 20.6%), prices are clearly increasing at a slower rate.”

Lazzara cautioned, however, that a deceleration does not mean prices are falling.

“It’s important to bear in mind that deceleration and decline are two entirely different things, and that prices are still rising at a robust clip,” he said. “June’s growth rates for all three composites are at or above the 95th percentile of historical experience. For the first six months of 2022, in fact, the National Composite is up 10.6%. In the last 35 years, only four complete years have witnessed increases that large.”

The housing market, he said, continues to show broadly based strength.

“All 20 cities recorded double-digit price increases for the 12 months ended in June,” he noted. “In 19 out of 20 cases, however, June’s reading was less than May’s, showing the impact of deceleration at the regional level.”

He added that the economic forces beyond the housing market will also have an impact on prices.

“We’ve noted previously that mortgage financing has become more expensive as the Federal Reserve ratchets up interest rates, a process that continued as our June data were gathered,” he said. “As the macroeconomic environment continues to be challenging, home prices may well continue to decelerate.”