Surprising Surge In Mortgage Customer Satisfaction, J.D. Power Study Reveals

Study found first-time homebuyers were harder to satisfy, customers don't just shop rates.

It goes without saying that this has been a tough year for the mortgage industry, and maybe in spite of those challenges a survey of more than 9,000 borrowers found customer satisfaction had improved over last year.

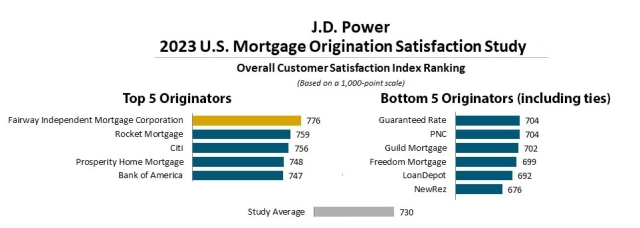

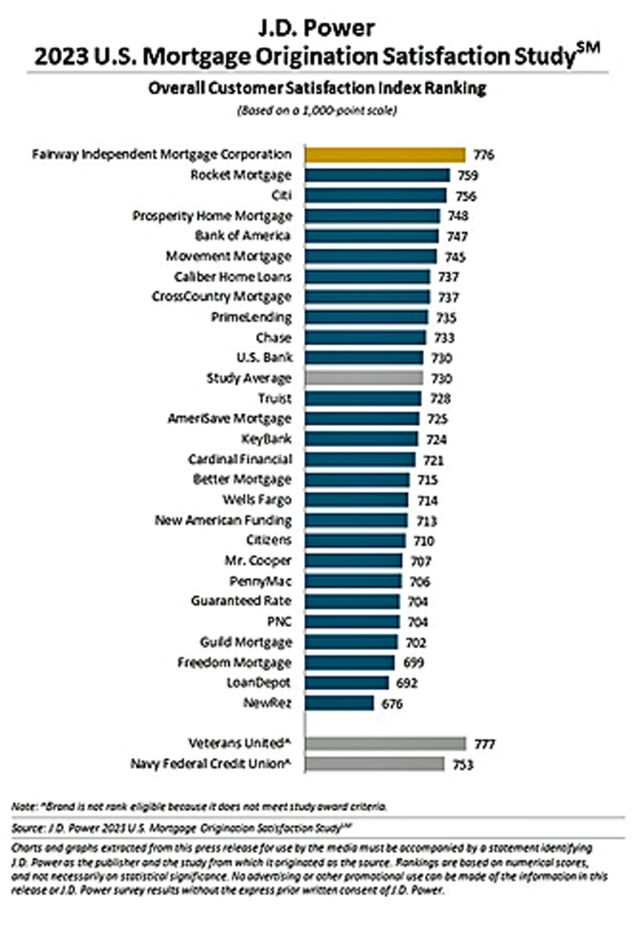

The J.D. Power 2023 U.S. Mortgage Origination Satisfaction Study reveals a surprising uptick in overall customer satisfaction despite record mortgage rates and lack of inventory.

The survey demonstrates that lenders have successfully adapted to the shifting landscape, particularly in catering to a purchase-heavy market. As a result, customer satisfaction has significantly improved, with a score of 730 on a 1,000-point scale — 14 points higher than the previous year.

However, sustaining this level of service may pose challenges, with aggressive cost-cutting measures taking effect, and unfavorable market conditions expected to persist.

“Two years ago, the mortgage market was an ultra-low-rate goldmine in which lenders were making big profits and the primary challenge was keeping up with demand,” said Craig Martin, executive managing director and global head of wealth and lending intelligence at J.D. Power. “It’s the opposite today with high rates and a lack of affordable homes leading to a limited number of eligible borrowers. To effectively compete in the future, lenders need to set themselves apart by focusing on addressing customers’ unique challenges and meeting their needs rather than selling a product.”

Key findings include:

Beyond Rates: While 31% of mortgage customers chose their lender solely based on the lowest interest rate, 69% considered other factors, such as personalized service and assistance in navigating the loan market.

Early Engagement: Engaging borrowers earlier in their homebuying journey helped retain customers. Approximately 38% of mortgage customers started working with a lender when first contemplating buying a home. However, 40% of borrowers believed their loan representative should have been more involved.

Struggling First-Time Homebuyers: While overall satisfaction increased, it was primarily driven by repeat buyers. First-time homebuyers reported significantly lower satisfaction levels, reflecting the complexities and challenges they face.

The mortgage origination landscape is evolving, with lenders shifting from instant approvals and rapid processing to offering helpful advice and creative problem-solving. Successfully managing this transition can help lenders build customer goodwill and loyalty in the current market.

In the study rankings, Fairway Independent Mortgage Corporation secured the highest score of 776 in mortgage origination satisfaction, followed by Rocket Mortgage (759) and Citi (756).

The 2023 study collected responses from 9,191 customers who originated a new mortgage or refinanced within the past 12 months between November 2022 and August 2023.