What Recession? Revised 3Q GDP Rose 2.9%

The Bureau of Economic Analysis' original estimate was 2.6%.

- The data was released the same day Federal Reserve Chairman Jerome Powell speaks on the U.S. economy and labor market at the Brookings Institution.

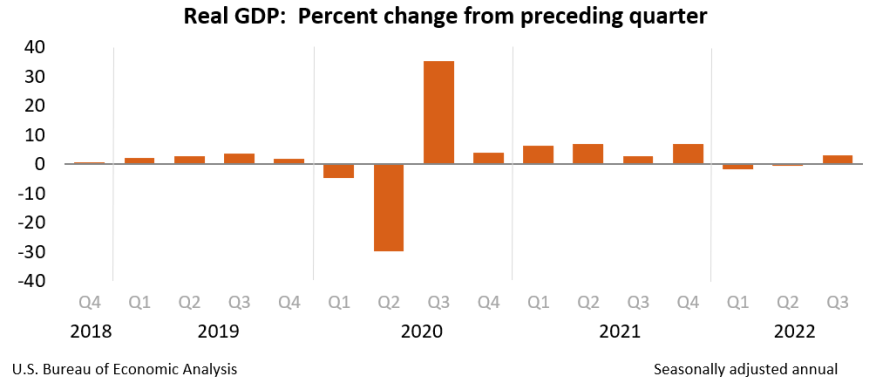

Real gross domestic product (GDP) increased at an annual rate of 2.9% in the third quarter of 2022, according to the second estimate released Wednesday by the U.S. Bureau of Economic Analysis (BEA), in stark contrast to some observers who say the U.S. economy is in a recession.

In the second quarter, real GDP decreased by 0.6%. In general, a recession is described as two consecutive quarters of negative economic growth.

The second estimate is based on more complete source data than was available for the advance estimate issued last month, the BEA said. In the advance estimate, the annual increase in real GDP was estimated to be 2.6%.

The data was released the same day that Federal Reserve Chairman Jerome Powell is set to speak on the U.S. economy and labor market at the Brookings Institution at 1:30 p.m. EST.

The BEA said the second estimate “primarily reflects upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment.” Overall, the increase reflects increases in exports, consumer spending, nonresidential fixed investment, state and local government spending, and federal government spending, it said.

Current‑dollar GDP increased 7.3% at an annual rate, or $450.5 billion, in the third quarter to a level of $25.7 trillion. That marks an upward revision of $35.7 billion from the previous estimate.

Within the realm of nonresidential fixed investment, increases in equipment and intellectual property products were partly offset by a decrease in structures. However, residential fixed investments saw a decrease, mainly led by new single-family construction and brokers' commissions. Private inventory investments also saw a decrease, mainly prompted by retail trade.

The second estimate of third-quarter GDP also follows a report from the U.S. Bureau of Statistics (BLS) earlier this month, which said the consumer price index rose 0.4% on a seasonally adjusted basis in October from a month earlier, matching the increase in September. That report prompted some economists to say inflation may have peaked.

All of this data, plus the November employment report — to be released on Friday — will be weighed by Powell and the Federal Open Market Committee as it continues its efforts to reduce inflation.