When Will Mortgage Rates Come Back Down?

Mortgage rates climb for the fourth straight week after falling at the start of the year.

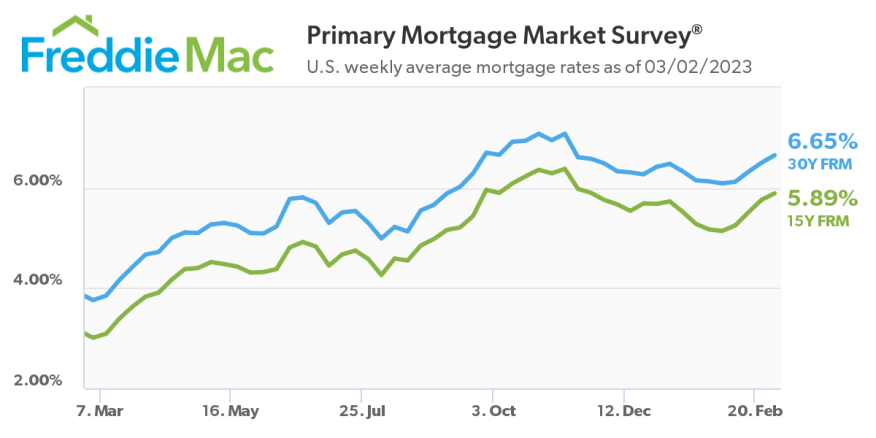

Mortgage rates continue to rise amid ongoing concerns about the economy, with the average 30-year fixed jumping 10 basis points.

Freddie Mac’s Primary Mortgage Survey said the average rate is now 6.65%, well above the recent low of 6.09% just a month earlier.

MBS Highway CEO Barry Habib said the upward trend won’t last though, and rates will eventually cool after a rocky spring.

The 15-year fixed showed a similar increase to 5.89%. Rates are now higher than they were at the start of the year, with both averages reaching their highest point since November.

“Lower mortgage rates back in January brought buyers back into the market,” Freddie Mac Chief Economist Sam Khater said. “Now that rates are moving up, affordability is hindered and making it difficult for potential buyers to act, particularly for repeat buyers with existing mortgages at less than half of current rates.”

Mortgage applications fell for the third straight week as a result, with purchase and refi activity each hitting an 28-year low.

Habib said the size of the rate jumps are an overreaction to some recent economic data. The most recent jobs report showed the U.S. economy added 517,000 jobs, sparking fears that ongoing tightness in the labor market will fuel inflation further.

Meanwhile, the Consumer Price and Personal Consumption Expenditures Price indexes both appeared to show inflation being stubborn after receding to end 2022.

Habib said those takeaways were just a reaction to headline numbers, but deeper data showed a different story.

The Bureau of Labor statistics, in part, reflected a large number of workers that weren’t counted in past surveys. ADP Payroll Services put the number of new jobs in January at 106,000.

Habib also said CPI numbers are still held up by rent prices, while PCE includes medical contracts that get updated every January.

Habib is confident both numbers will show inflation slowing, especially starting in May.

“It begins a string of what we should see is consistently improving inflation, which the bond market is going to respond to,” he said.

Habib added mortgage rates likely bounce around until May, before coming back down steadily.

“They’re going to come down and you’re going to unleash more buyers on a very tight inventory environment,” he said.

Habib said buyers who are in a position to buy should take advantage of the slow housing market. While rates remain high, buyers may be able to negotiate a lower sale price.

“I think I can take advantage of that today and be the beneficiary of that,” Habib said.

He added buyers who wait for mortgage rates to come down may once again find themselves in a competitive market with bidding wars and higher prices.