Mortgage Economic Review December 2020

BY MARK PAOLETTI | SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL

The Mortgage Economic Review summarizes recent Key Economic Indicators, Data, and Events important to Mortgage and Real Estate Professionals.

A second wave of new COVID-19 cases in November may have dampened Thanksgiving celebrations, but it hasn't slowed down the Economic recovery or cooled off the red-hot Housing Market. Even with 9,000,000 people still unemployed from COVID-19, the Economic Data continues to depict a V-Shaped recovery with all the major Economic Indicators up. GDP Data is up, Housing Data is way up, Manufacturing Data is up, Retail Sales Data is up, Employment Data is up, the Stock Markets are up - and setting record highs. Most of the Unemployment continues to be concentrated in the Hospitality and Travel Sectors as workers in Hotels, Restaurants, Bars, and Airlines are disproportionately hurt by COVID-19. This is how recoveries typically shape up - asymmetrically. Some sectors disproportionably benefit (Housing, Mortgage, and Tech) while other sectors get hurt (Hospitality and Travel). Despite the asymmetry, this is a strong recovery, which demonstrates the resolve of the US Economy.

Key Economic Data and Events in November 2020

• Joe Biden defeated Donald Trump to be the 46th President of the United States

• Successful COVID-19 Vaccine trials were announced by several drug companies

• The Stock Markets Hit a new record high with the Dow closing at 30,046

• President-elect Biden nominated Janet Yellen to be the next Treasury Secretary

• US GDP increased 33.1% in the 3rd Quarter

• The Labor Market continued to recover, adding 638,000 New Jobs in October

• The Unemployment Rate fell to 6.9% from 7.9%

• US Inflation is running at 1.2%

• New Conforming Loan Limits for 2021: $548,250 from $510,400 in 2020

Interest Rates and Fed Watch

While everyone's attention was focused on the election, the Fed held its November FOMC Meeting with no fanfare or surprises. As expected, the Fed left Monetary Policy unchanged and reiterated the same message as before: they will "remain accommodative", and continue to purchase Treasury / Mortgage Securities until the Economy has fully recovered. They are also ready to provide additional support if “risks emerge”. Joe Biden nominated former Fed Chair Janet Yellen to be the next Treasury Secretary. The markets like her because she has a lot of experience, a long track record, a unique skill set, and a solid reputation. She also leans Dovish on Monetary policy - meaning she will support low rates and stimulus programs.

Housing Market Data Released in November 2020

Housing Markets are setting new records. The all-important Existing Home Sales continued to rise in November - now at an annualized pace of 6,850,000 homes. That's the fastest pace since 2005. To put that data in perspective: in May 2020 - just 6 months ago and during the height of the COVID-19 outbreak - homes were selling at an annualized rate of 3,910,000. Like the recovery, Home Sales is also asymmetric - the suburbs benefit more than the big cities. Millennial Renters continue to vacate their urban apartments to buy homes in the suburbs. The trend is nationwide as all major metro areas watch much of their population flock to the suburbs.

• Existing Home Sales (closed deals in October) rose 4.3% to an annual rate of 6,585,000 homes, up 26.6% in the last 12 months. The median price for all types of homes is $313,800 - up a whopping 15.5% from a year ago - which is an incredible number. The median Single Family Home price is $317,700 and $273,600 for a Condo. First Time Buyers were 32%, Investors 14%, Cash Buyers 19%. Homes were on the market for an average of 21 days (a record low), and 70% were on the market for less than a month. Currently, 1,420,000 homes are for sale (record low), down 19.8% from 1,770,000 units a year ago.

• New Home Sales (signed contracts in October) fell 0.3% to a seasonally adjusted annual rate of 999,000 homes - up 41.5% YoY. The median New Home price is $330,600, and the average is $386,200. There are 278,000 New Homes for sale, which is only a 3.3 month supply.

• Pending Home Sales Index (signed contracts in October) fell 1.1% to 128.9 from 130.3, up 20.2% YoY.

• Building Permits (issued in October) rose 0.0% to a seasonally adjusted annual rate of 1,545,000 units - up 2.8% YoY. Single-Family Permits rose 0.6% to an annual pace of 1,120,000 homes, up 20.6% YoY.

• Housing Starts (excavation began in October) rose 4.9% to an annual adjusted rate of 1,530,000 units - up 14.2% YoY. Single-Family Starts rose 6.4% to 1,179,000 homes - up 29.4% in the last 12 months.

• Housing Completions (completed in October) rose 4.5% to an annual adjusted rate of 1,343,000 units - up 5.4% YoY. Single Family Completions fell 3.4% to 883,000 homes - down 4.0% in the last 12 months.

• S&P/Case-Shiller 20 City Composite Home Price Index rose 1.27% in September, up 6.6% YoY.

• FHFA Home Price Index rose 1.7% in September, now up 7.8% YoY.

Labor Market Economic Data Released in November 2020

The Economy added 638,000 Jobs in October, with the Unemployment Rate falling to 6.9%.

Another month of solid Labor Data that beat Economists' expectations. More and more workers are returning to work for the 6th straight month. As long as the Economy stays open, the Employment picture will improve. Of the 22 million workers that lost jobs due to COVID-19, roughly 13 million have returned to work. A second wave of COVID-19 infections could force the closure of businesses and impede the recovery. The Labor Data also shows a jump in Part-Time Employment. Many workers accepted part-time jobs since they couldn't find full-time work, or couldn't find child care.

• The Economy added 638,000 new jobs during October

• The Unemployment Rate fell to 6.9% in October from 7.9% in September

• The Labor Force Participation Rate rose to 61.7% from 61.4% the previous month

• The Average Hourly Wage rose 0.1%, up 4.5% YoY

Inflation Economic Data Released in November 2020

So far, Inflation has been a non-issue during this recovery, and most Economists expect it to remain soft for the near future. According to the Fed, “weaker demand and earlier declines in oil prices” have been holding down prices and the CPI. Remember, the Fed's Inflation Target is 2.0%, and we are nowhere near that. There is some debate between Economists about the "real" Inflation Rate. Some have surmised that the current CPI underestimates actual Inflation. The Pandemic changed Consumer spending patterns, and the CPI calculation needs to be adjusted to reflect those changes. Other Economists disagree.

• CPI was unchanged, now up 1.2% in the last 12 months

• Core CPI (ex-food & energy) rose 0.2%, up 1.6% in the last 12 months

• PPI rose 0.3 %, up 0.5% in the last 12 months

• Core PPI (ex-food & energy) rose 0.1%, up 1.1% in the last 12 months

GDP Economic Data Released in November 2020

The 2nd Estimate of 3rd Quarter 2020 US GDP showed the Economy grew at a 33.1% annualized rate - unchanged from last month's estimate. There is no doubt among Economists that the Economy is recovering faster than expected. Spending increases have outpaced Employment, but that is typical in a recovery. It's now the last month of the year, and 2020 will soon be in our rearview mirror. Then we can get a better look at the data. Hindsight is always 20-20 (pun intended).

Consumer Economic Data Released in November 2020

The US Consumer continues to spend at a brisk pace, with Retail Sales rising as Consumer Confidence and Sentiment took a hit. Like the Economic Recovery, some retail sectors benefit more than others. Sales at online retailers and big-box stores have soared while small Mom & Pop stores have suffered. Other good news is that Consumers have more cash and less debt thanks to Government Stimulus and enhanced Unemployment Benefits - along with the inability to spend money at restaurants, bars, traveling. The big question is: will Consumers spend those savings this holiday season or wait until they feel more confident in the recovery? We'll know in about 30 days, but retailers may have a very Merry Holiday Shopping season.

• Retail Sales rose 0.3%, now up 10.6% in the last 12 months

• Consumer Confidence Index fell to 96.1 from 100.9 the previous month

• Consumer Sentiment Index (U of M ) fell 76.9 from 81.8 the previous month

Energy, International, and Things You May Have Missed

Oil Prices rose above $45 in November. Lower oil inventories and COVID-19 vaccine announcements spurred speculation of heightened oil demand due to increased travel in the spring.

• WTI Crude (West Texas Intermediate) is trading around $45/barrel.

• North Sea Brent Crude is trading around $48/barrel.

• Steel and Iron ore prices jumped due to strong demand from China.

• Secretary of State Mike Pompeo made a historic trip to Israel's West Bank - which marked the most senior US official to ever visit the area.

• The Chinese floated new government bonds with a negative interest rate.

• A draconian COVID-19 lockdown was imposed in South Australia, which even banned outdoor exercise and dog walking.

The Mortgage Economic Review is a concise summary of Key Economic Data that influences the Mortgage and Real Estate Industries. It is a quick read that helps Mortgage Professionals stay updated on important Economic Information that affects their industry. Feel free to share this with friends and colleagues in the Mortgage and Real Estate industries. If you would like this Mortgage Economic Review emailed to you at the beginning of every month, click here. The Mortgage Economic Calendar for each month is available here.

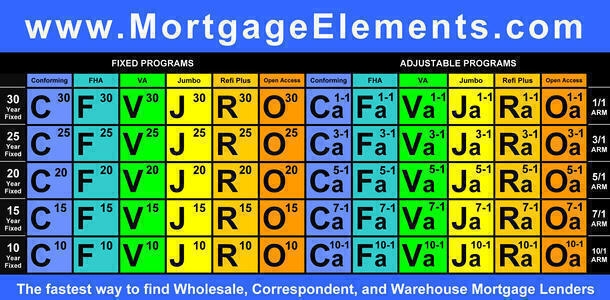

Visit MortgageElements.com and use the Mortgage Periodic Table to explore over 300 Wholesale, Correspondent, and Warehouse Mortgage Lenders from one website. You'll discover new lending opportunities - it costs nothing to use and is one of the industry's largest databases of TPO Mortgage Lenders.

Mark Paoletti, MortgageElements.com

The Mortgage Economic Review is for informational and educational purposes only and should not be construed as investment, legal, financial, or mortgage advice. The information is gathered from sources believed to be credible; some are opinion based and editorial in nature. Mortgage Elements Inc does not guarantee or warrant its accuracy or completeness, and there is no guarantee it is without errors. This newsletter is created for use by Mortgage and Real Estate Professionals and is not an advertisement to extend credit or solicit mortgage originations. © Copyright 2020 Mark Paoletti, Mortgage Elements Inc, All Rights Reserved.