Mortgage Economic Review January 2021

The Mortgage Economic Review summarizes recent Key Economic Indicators, Data, and Events important to Mortgage and Real Estate Professionals.

Paradox. 2020 was a year full of contradictions. The end of the year finally arrived, with billions of people very happy to see 2020 come to a close. While most of the Economy was struggling, the Mortgage Business had its best year ever - closing around $4.4 Trillion in Home Loans. Interest Rates set and hovered at all-time lows, while Stock Markets set record highs. Stimulus Packages pumped Trillions of dollars into the Economy to support businesses and unemployed workers. Housing Prices rocketed higher while the cost of rent softened. Many Millennial renters abandoned their urban apartment lifestyles to buy homes in the suburbs. COVID-19 brought the Economy to a screeching halt in the 2nd quarter, but it came roaring back in the 3rd quarter. Household Net Worth rose $3.8 Trillion, while millions of Borrowers are still in mortgage forbearance. The closer you look at the data, the more you see paradoxes. Next month we'll get a better look at the year-end data, but for now, let's enjoy the newborn 2021 with guarded optimism and hope for a Happy and Healthy New Year for all.

Key Economic Data and Events in December 2020

• Stock Markets hit new record highs in the last week of December: Dow 30,606, S&P 500 3,756.07, NASDAQ 12,888.28

• COVID-19 Vaccines started to be administered to Health Professionals and high-risk groups

• Congress passed another Stimulus Package with $900 Billion in aid

• US GDP increased by 33.4% in the 3rd quarter

• The Economy created 245,000 New Jobs as the Unemployment Rate dropped to 6.7%

• US Inflation remained tame, with the CPI at 1.2% YoY

• The yield on the 10 year Treasury Security finished the month at 0.91%

Interest Rates and Fed Watch

The Fed completed its latest FOMC Meeting on December 16th with no surprises and acknowledged that the Economic Recovery is slowing down. Despite the disturbing news of a slowing recovery, Chairman Powell sounded very upbeat: “we can kind of see the light at the end of the tunnel... we’re thinking that this could be another long expansion...we’re going to keep policy highly accommodative until the expansion is well down the tracks.” Throughout December, he took several opportunities to urge Congress to pass a stimulus package because the pace of the recovery had recently slowed. The Fed's December Beige Book also reported a slowing recovery with continued risks to the Economy from a virus resurge.

Housing Market Data Released in December 2020

A lot of people want to buy a home, but they just can't find one. To be more specific, they can't find one they can afford - even at these ridiculously low Mortgage Rates. It's Classic Supply and Demand from Econ 101. Inventory problems have plagued the Housing Market for the past 5 years because builders stopped constructing New Homes after the 2008 Financial Crisis. So, the supply of available homes for sale has been tight. Now, demand is up while supply is down - prices can only go up. The FHFA Home Price Index was up a whopping 10.2% YoY, which is great news for Home Owners but bad news for Home Buyers. Home demand usually tracks with the Labor Market. People don't buy homes unless they are secure in their employment - and there are 10 million workers still unemployed due to COVID-19. Just another 2020 Paradox.

• Existing Home Sales (closed deals in November) fell 2.5% to an annual rate of 6,690,000 homes, up 25.8% in the last 12 months. The median price for all types of homes is $310,800 - up a whopping 14.6% from a year ago - which is an incredible number. The median Single Family Home price is $315,500 and $271,400 for a Condo. First Time Buyers were 32%, Investors 14%, Cash Buyers 20%. Homes were on the market for an average of 21 days (a record low), and 73% were on the market for less than a month. Currently, 1,280,000 homes are for sale (record low), down 22% from 1,640,000 units a year ago.

• New Home Sales (signed contracts in November) fell 11.0% to a seasonally adjusted annual rate of 841,000 homes - up 20.8% YoY. The median New Home price is $335,300, and the average is $390,100. There are 286,000 New Homes for sale, which is a 4.1 month supply.

• Pending Home Sales Index (signed contracts in November) fell 2.6% to 125.7 from 128.9, up 16.4% YoY.

• Building Permits (issued in November) rose 6.2% to a seasonally adjusted annual rate of 1,639,000 units - up 8.5% YoY. Single-Family Permits rose 1.3% to an annual pace of 1,143,000 homes, up 22.2% YoY.

• Housing Starts (excavation began in November) rose 1.2% to an annual adjusted rate of 1,547,000 units - up 12.8% YoY. Single-Family Starts rose 0.4% to 1,186,000 homes - up 27.1% in the last 12 months.

• Housing Completions (completed in November) fell 12.1% to an annual adjusted rate of 1,163,000 units - down 4.8% YoY. Single Family Completions fell 0.6% to 874,000 homes - down 4.5% in the last 12 months.

• S&P/Case-Shiller 20 City Composite Home Price Index rose 1.6% in October, up 7.95% YoY.

• FHFA Home Price Index rose 1.5% in October, now up 10.2% YoY.

Labor Market Economic Data Released in December 2020

The Economy added 245,000 Jobs in November, with the Unemployment Rate falling to 6.7%. Employment Data continued to trend in a positive direction, but it also shows that the Labor Market is slowing down. So far in 2020, of the 22 million workers laid off, 12 million have returned to work, leaving 10 million still unemployed. A small part of the soft data can be attributed to 93,000 temporary Census workers ending their assignments. Local Government employment unexpectedly declined due to lower tax receipts forcing States and municipalities to reduce workers. Expect the Employment data to remain soft into the first quarter of 2021 and (hopefully) resume its upward trajectory in 2Q2021.

• The Economy added 245,000 new jobs during November

• The Unemployment Rate fell to 6.7% in November from 6.9% in October

• The Labor Force Participation Rate fell to 61.5% from 61.7% the previous month

• The Average Hourly Wage rose 0.3%, now up 4.4% YoY

Inflation Economic Data Released in December 2020

Inflation continues to be a non-issue, with the CPI (1.2% YoY) and PPI (0.8% YoY) well below 2.0%. COVID-19 price disruption that started back in the spring continues today. Airfare and apparel prices tumbled, while used car and home prices soared. Those price disruptions are now normalizing as the Economy recovers, but they have still not boosted general Inflation Data. We know Inflation will be back. We don't know when, and it may be back with a vengeance.

• CPI rose 0.2%, now up 1.2% in the last 12 months

• Core CPI (ex-food & energy) rose 0.2%, up 1.6% in the last 12 months

• PPI rose 0.1 %, up 0.8% in the last 12 months

• Core PPI (ex-food & energy) rose 0.1%, up 1.4% in the last 12 months

GDP Economic Data Released in December 2020

The 3rd and final estimate of 3rd Quarter 2020 US GDP showed the Economy grew at a 33.4% annualized rate - a slight improvement over last month's estimate. Early forecasts for 2021 GDP are in the 4.0% to 5.0% range. The just passed 2nd Stimulus Package is intended to help the recovery by encouraging consumption. However, a lot of the cash from the first Stimulus Package ended up in savings accounts. Will Consumers continue to save in 2021, or will they open their wallets and ramp up spending? For the stimulus to be effective and bring 10 million unemployed workers back to work - US Consumers need to spend some of their built-up savings.

Consumer Economic Data Released in December 2020

November Retail Sales fell 1.1%, which surprised and disappointed many Economists. Consumers closed their wallets as new COVID-19 cases spiked and the lockdowns shuttered businesses. This pullback of Consumer Spending demonstrated to politicians the need for another stimulus package. Paradoxically, the Net Worth of Households hit a record high. The Fed reported that Household Net worth rose 3.2% or $3.8 Trillion dollars ($3,800,000,000,000 - that's a lot of zeros). Increased Saving, a roaring stock market, Borrowers refinancing to lower Mortgage Payments, and trillions in government stimulus all worked its way into the Consumer's balance sheet.

• Retail Sales fell 1.1%, now up 4.1% in the last 12 months

• Consumer Confidence Index fell to 88.6 from 96.1 the previous month

• Consumer Sentiment Index (U of M ) rose to 80.7 from 76.9 the previous month

Energy, International, and Things You May Have Missed

Oil Prices rose above $48 in December. Lower oil inventories and COVID-19 vaccine enthusiasm spurred speculation of heightened oil demand due to increased travel in the spring.

• As of January 4th, West Texas Intermediate crude is trading around $48/barrel, North Sea Brent Crude is trading about $51/barrel.

• Despite bitter and difficult negotiations, the UK and EU finally agreed on a Brexit Deal.

• A 90-year old British woman was the first person to get the COVID-19 vaccine.

• Boeing 737 Max planes started flying commercially again.

• Copper Prices rose to a 7 year high due to industrial demand in China and US homebuilding.

• Roughly 2,700,000 loans continue to be in Mortgage Forbearance (about 5.0%).

• Propane Tanks are in short supply as restaurants provide more outdoor seating.

The Mortgage Economic Review is a concise summary of Key Economic Data that influences the Mortgage and Real Estate Industries. It is a quick read that helps Mortgage Professionals stay updated on important Economic Information that affects their industry. Feel free to share this with friends and colleagues in the Mortgage and Real Estate industries. If you would like this Mortgage Economic Review emailed to you at the beginning of every month, click here. The Mortgage Economic Calendar for each month is available here.

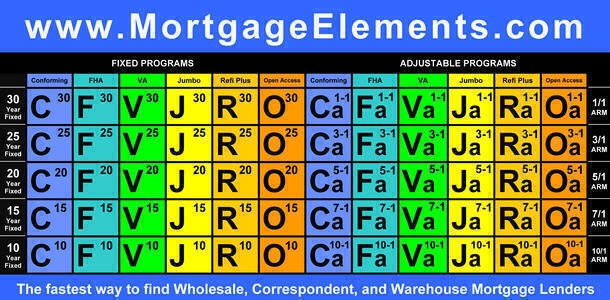

Visit MortgageElements.com and use the Mortgage Periodic Table to explore over 300 Wholesale, Correspondent, and Warehouse Mortgage Lenders from one website. You'll discover new lending opportunities - it costs nothing to use and is one of the industry's largest databases of TPO Mortgage Lenders.

Mark Paoletti, MortgageElements.com

The Mortgage Economic Review is for informational and educational purposes only and should not be construed as investment, legal, financial, or mortgage advice. The information is gathered from sources believed to be credible; some are opinion based and editorial in nature. Mortgage Elements Inc does not guarantee or warrant its accuracy or completeness, and there is no guarantee it is without errors. This newsletter is created for use by Mortgage and Real Estate Professionals and is not an advertisement to extend credit or solicit mortgage originations. © Copyright 2020 Mark Paoletti, Mortgage Elements Inc, All Rights Reserved.