Lone Star LO

Only Lone Star LO gets the job done. We roundup the data, insight and products that let Texans win the mortgage rodeo.

Mortgage Slingers

This is one distinction the Lone Star State would like to turn down: Texas is the toughest state to close a mortgage in, according to research by Lone Star LO. In this issue, we also highlight Kristin Stark, who is one tough cookie; Frost Bank’s return to mortgages; and so much more.

At or away from the closing table, Kristin Stark is in it to win it

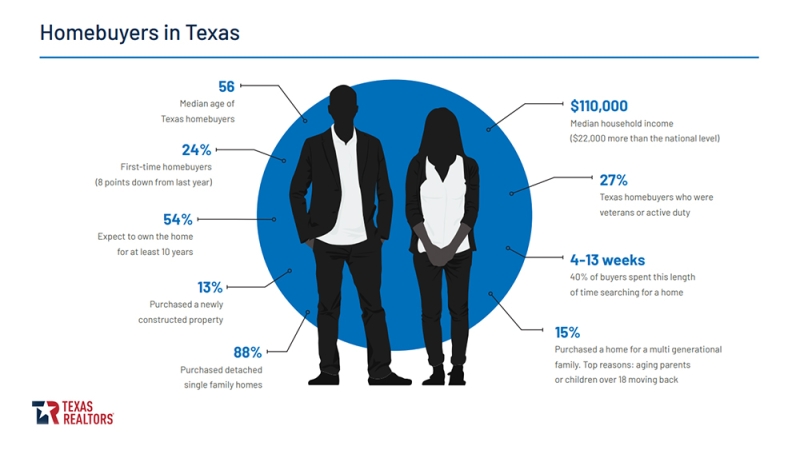

Number of first-time home buyers continues to drop; buyers getting older

An empowering community-focused lending initiative helps a relentless texas woman transform her life

The capital city is being revamped into a premier place for young tech workers

Lone Star LO analysis shows Texas was the toughest state for mortgage closings in 2022

Lone Star State’s birthrate largely responsible for the benchmark

New rules in place on releasing liens, local inconsistencies, and data breaches

Frost Bank targets almost $2 billion in mortgage originations

As high-interest rates shake the market, originators redefine their game plans, tackling challenging terrain with innovation and resilience

Texas is one big state, and it takes a big reach to keep its mortgage origination pros in the game. Only Lone Star LO gets the job done. We roundup the data, insight and products that let Texans win the mortgage rodeo.