Advertisement

Number of Housing Markets Showing Improvement Exceeds the 100 Mark

The list of housing markets showing measurable improvement expanded slightly to include 101 metropolitan areas in April, according to the latest National Association of Home Builders/First American Improving Markets Index (IMI). Thirty-five states (including the District of Columbia) are now represented by at least one market on the list. The IMI identifies metropolitan areas that have shown improvement from their respective troughs in housing permits, employment and house prices for at least six consecutive months. The 101 markets on the April IMI represent a net gain of two from March, with 13 metros being added and 11 markets slipping from the list while 88 markets retained their places on it. Among the new entrants, areas as diverse as Rome, Ga.; Coeur d'Alene, Idaho; Greenville, N.C.; Brownsville, Texas; St. George, Utah; and Huntington, W. Va., are now represented on the IMI.

"While housing markets across the country continue to struggle under the weight of overly tight lending conditions and other challenges, the April IMI indicates that at least 101 individual metros are showing measurable and consistent signs that they are headed in the right direction," said NAHB Chairman Barry Rutenberg. "A total of 35 states are now represented on the list, with 10 states having four or more entries. This positive news is in line with what our builder members have observed regarding firming conditions and improved buyer interest in certain locations."

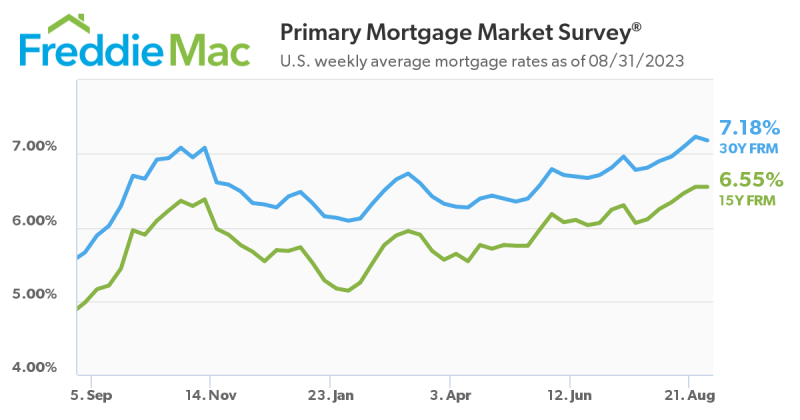

The IMI is designed to track housing markets throughout the country that are showing signs of improving economic health. The index measures three sets of independent monthly data to get a mark on the top improving Metropolitan Statistical Areas (MSAs). The three indicators that are analyzed are employment growth from the Bureau of Labor Statistics (BLS), house price appreciation from Freddie Mac, and single-family housing permit growth from the U.S. Census Bureau. NAHB uses the latest available data from these sources to generate a list of improving markets. A metropolitan area must see improvement in all three areas for at least six months following their respective troughs before being included on the improving markets list.

"After five consecutive months of gains, the IMI recently began to plateau, with many markets holding steady and a few experiencing the ups-and-downs that are typical in a choppy recovery," said NAHB Chief Economist David Crowe. "The IMI is designed to highlight markets that are showing consistent improvement, and those markets that have registered the smallest gains are more susceptible to dropping off the list due to a minor setback in prices, permits or employment."

About the author