Advertisement

Foreclosure Activity Drops Three Percent Nationwide in July

RealtyTrac has released its U.S. Foreclosure Market Report for July 2012, which shows foreclosure filings—default notices, scheduled auctions and bank repossessions—were reported on 191,925 U.S. properties in July, a decrease of three percent from the previous month and a decrease of 10 percent from July 2011. The report also shows one in every 686 U.S. housing units with a foreclosure filing during the month.

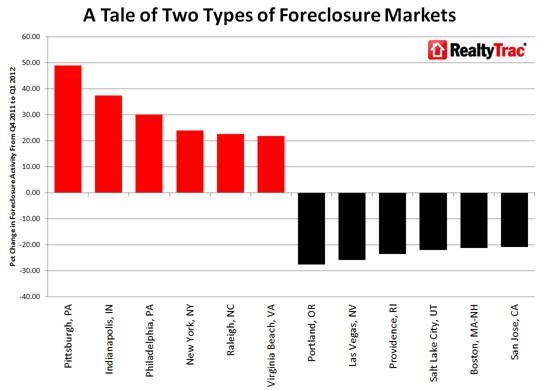

“U.S. foreclosure activity continued its uneven descent in July as the overall numbers declined on an annual basis for the 22nd straight month, but properties starting the foreclosure process increased on an annual basis for the third straight month,” said Daren Blomquist, vice president of RealtyTrac. “Recent foreclosure activity patterns vary significantly from state to state, often hinging on the level of dysfunction that exists in each state’s foreclosure process. In states like Florida, Illinois and New Jersey, where processing and procedural issues slowed foreclosure activity to a crawl last year, foreclosure numbers continue to rebound off those artificially low levels. But in states like Texas, Arizona and Virginia, where the average time to foreclose is well below the national average of 378 days, foreclosure activity continues on a long-term downward trend.

High-level findings from the report:

►Overall foreclosure activity decreased on a year-over-year basis for the 22nd consecutive month in July, dropping to its lowest level since April.

►The decline in overall foreclosure activity was driven primarily by a 21 percent year-over-year decrease in real estate-owned (REO) properties.

►Thirty-eight states and the District of Columbia posted annual decreases in REO activity, but there were some notable exceptions where REO activity increased annually, including Florida (38 percent), Ohio (25 percent), Illinois (22 percent), and New Jersey (21 percent)—all judicial foreclosure states where foreclosures are processed through the court system.

►U.S. foreclosure starts in July increased 6 percent on a year-over-year basis, the third straight month with an annual increase in foreclosure starts following 27 consecutive months of decreasing foreclosure starts on an annual basis.

►Foreclosure starts increased on a year-over-year basis in 27 states, led by Connecticut (201 percent), New Jersey (164 percent), Pennsylvania (139 percent), Indiana (83 percent), and Massachusetts (65 percent)—all judicial foreclosure states.

“Recent legislation and court rulings could lengthen the foreclosure process in some of the states with the shorter timelines, however, resulting in a temporary foreclosure lull and subsequent rebound in those states as well,” Blomquist said. “Case in point is a new Oregon law that took effect in July and gives homeowners in default—or at risk of default—the right to request mediation to avoid foreclosure. Oregon foreclosure activity dropped 42 percent from June to July, hitting a five-year low, but we would expect the Oregon numbers to trend back higher sometime in the next several months based on the pattern we’ve seen in other states with similar legislation.”

Foreclosure starts—default notices or scheduled foreclosure auctions, depending on the state—were filed on 98,174 U.S. properties in July, a six percent decrease from June but still up six percent from July 2011. Foreclosure starts increased annually in 27 out of the 50 states—16 “judicial” states where foreclosures are processed through the court system and 11 “non-judicial” states where foreclosures are processed outside of the court system.

Along with the aforementioned judicial states with substantial annual increases in foreclosure starts, the non-judicial states with the biggest year-over-year increases were New Hampshire (55 percent), Missouri (39 percent), Alabama (35 percent), Washington (30 percent), and Georgia (25 percent).

Lenders completed the foreclosure process on 53,654 U.S. properties in July, a one percent decrease rom the previous month and a 21 percent decrease from July 2011—the 21st consecutive month with a year-over-year decline in REOs.

REO activity decreased annually in 38 states and the District of Columbia. Some of the biggest REO decreases were in Nevada (71 percent), Virginia (65 percent), California (44 percent), Georgia (39 percent), and Washington (35 percent)—all non-judicial foreclosure states.

The state of California posted the nation’s highest state foreclosure rate in July despite an 11 percent decrease in foreclosure activity from the previous month and a 25 percent decrease in foreclosure activity from July 2011. One in every 325 California housing units had a foreclosure filing during the month, more than twice the national average.

Arizona foreclosure activity was also down on a monthly and annual basis, but the state still posted the nation’s second highest state foreclosure rate: one in every 346 housing units with a foreclosure filing during the month.

Florida’s foreclosure rate ranked third highest among the states in July, up from sixth highest in June thanks in part to a 14 percent month-over-month increase in foreclosure activity. A total of 25,534 Florida properties had a foreclosure filing in July, a rate of one in every 352 housing units and an increase of 14 percent from July 2011.

Along with Florida, the four other judicial foreclosure states with foreclosure rates in the top 10 all posted year-over-year increases in foreclosure activity in July: Illinois at number five (one in every 385 housing units with a foreclosure filing); Ohio at eight (one in every 528 housing units); South Carolina at nine (one in every 536 housing units); and Indiana at number 10 (one in every 665 housing units).

Along with California and Arizona, the other non-judicial foreclosure states with foreclosure rates in the top 10 all posted year-over-year decreases in foreclosure activity in July: Georgia at four (one in every 376 housing units with a foreclosure filing); Nevada at six (one in every 415 housing units); and Michigan at seven (one in every 518 housing units).

California cities accounted for nine of the 20 highest foreclosure rates among metropolitan areas with a population of 200,000 or higher in July despite year-over-year decreases in foreclosure activity in all nine metro areas.

Despite a 17 percent year-over-year decrease in foreclosure activity, the Stockton, Calif., metro area posted the nation’s highest metro foreclosure rate in July. One in every 153 Stockton housing units had a foreclosure filing during the month, more than four times the national average.

Immediately following Stockton, Calif. in the rankings were the California metro areas of Vallejo-Fairfield at No. 2 (one in every 185 housing units with a foreclosure filing); Riverside-San Bernardino-Ontario at No. 3 (one in every 187 housing units); and Modesto at No. 4 (one in every 195 housing units).

The Palm Bay-Melbourne-Titusville metro area in Florida ranked number five, with a foreclosure rate of one in every 214 housing units with a foreclosure filing during the month of July. A total of 1,261 properties in the metro area had a foreclosure filing in July, an increase of 287 percent from the previous month and an increase of 203 percent from July 2011.

Four out of the other five Florida metro areas with foreclosure rates in the top 20 posted increasing foreclosure activity both on a month-to-month and year-over-year basis. The only exception was Ocala, which ranked number 19 (one in every 302 housing units with a foreclosure filing).

Foreclosure activity in Akron, Ohio, increased 66 percent from July 2011, boosting that city’s foreclosure rate to 13th highest nationwide, while a 49 percent year-over-year increase in foreclosure activity helped the foreclosure rate in Rockford, Ill., to rank 12th highest nationwide.

About the author