NMP's Economic Commentary: Historical Perspective on Mortgage Rates

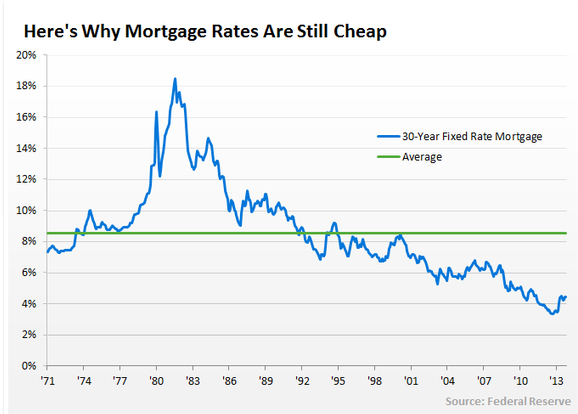

Rates on home loans have risen during the past year. Yet, every time this trend is reported in the media, we also hear that rates are historically low. So, what does “historically low” actually mean? Does it mean that we are a little under the norm, or way under for the historic average?

The chart below covers rates on 30-year mortgages over the past 40-45 years. You can see that rates have actually averaged slightly over eight percent over that time period. The high was over 18 percent and the low was in the "mid-threes" during 2013. In 2014, rates have averaged in the "mid-fours" and have only been at that level one other time within the past 40-plus years. If you look at the past decade, even during tough economic times and in the middle of the financial crisis, rates averaged above five percent.

For the average prospective homeowner, these extraordinarily low rates can be promising, but still leaves us to answer the following questions: How affordable is homeownership today as compared to renting, and how does owning today compare to owning in the past? In early 2014, Trulia reported in their Rent vs. Buy Report that ownership of homes costs less than renting in all 100 large U.S. metros. And according to Trulia, a 30-year fixed rate of 4.5 percent, buying is 38 percent cheaper than renting nationally. Almost 40 percent cheaper to own? That is a very significant statistic.

Secondly, how do the numbers compare if we continue to go back in time? According to the National Association of Realtors (NAR), in 1990, the average home price was a little less than half what it is today and rates were slightly over eight percent, which is near the historical average. So let's say you get a $300,000 home loan today at 4.5 percent versus a $150,000 loan in 1990 at eight percent. What would the difference in payments be? The $150,000 loan would be approximately $1,100 and the $300,000 loan would be approximately $1,520. That is an increase of approximately 38 percent in 25 years. The U.S. Census Bureau reports average rents rose close to 60 percent during the same time period. Basically, mortgage payments should have more than doubled in the past 25 years. Instead, they increased 38 percent.

Keep in mind, when comparing a mortgage payment to rent, rent is not tax deductible and the majority of a mortgage payment (interest and taxes) are deductible. Plus part of the mortgage payment goes to pay down the principal of the loan which is a forced payment plan, while the entire rent payment goes to the landlord. Consider this … if you took out a 30-year loan in 1990, the loan would be almost paid off today.

Finally, a mortgage payment will rise more slowly than rent in the future because the entire rent payment is subject to inflation while only small portion of the mortgage payment (tax and insurance) is subject to inflation. The cost of a mortgage may be reduced by 40 percent or more when taxes and principal reduction are taken into consideration and the discount rises to over 50 percent over time due to inflation.

The conclusion? Today or 40 years ago, homeownership has been a bargain when compared to renting. And today's "historically low" interest rates makes homeownership even more of a bargain for prospective homeowners.

Dave Hershman is a top author in the mortgage industry with seven books published. He is also the founder of the OriginationPro Marketing System, and currently the director of branch support for McLean Mortgage. He may be reached by e-mail at [email protected] or visit www.originationpro.com.