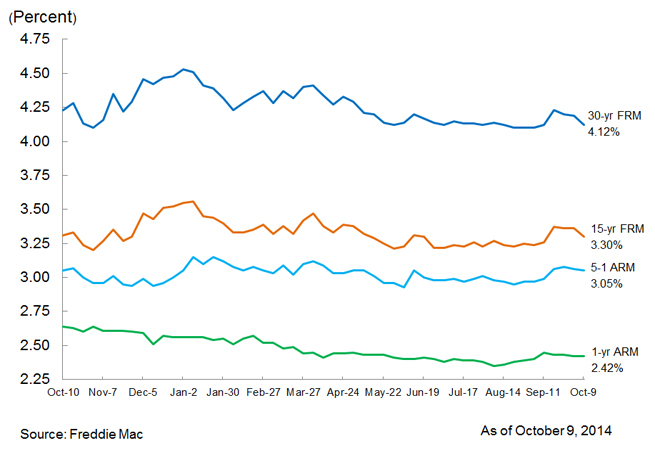

Fixed-Rate Mortgages Dip Back Down to 2014 Lows

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing average fixed mortgage rates falling back near their lows for 2014, as the 30-year fixed-rate mortgage (FRM) averaged 4.12 percent with an average 0.5 point for the week ending Oct. 9, 2014, down from last week when it averaged 4.19 percent. A year ago at this time, the 30-year FRM averaged 4.23 percent. The 15-year FRM averaged 3.30 percent this week, with an average 0.5 point, down from last week when it averaged 3.36 percent. A year ago at this time, the 15-year FRM averaged 3.31 percent.

"Fixed mortgage rates were down on a week filled with bleak forward projections from the Federal Reserve and concern over growth in Europe," said Frank Nothaft, vice president and chief economist, Freddie Mac. "Despite gloomy vernacular from the Fed, mortgage purchase applications were up two percent on the week and the labor market added 248,000 jobs, beating expectations and lowering headline unemployment to 5.9 percent."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.05 percent this week with an average 0.5 point, down from last week when it averaged 3.06 percent. A year ago, the five-year ARM averaged 3.05 percent. The one-year Treasury-indexed ARM averaged 2.42 percent this week with an average 0.4 point, unchanged from last week. At this time last year, the one-year ARM averaged 2.64 percent.