CoreLogic Reports 45,000 Completed Foreclosures in August

CoreLogic has released its August National Foreclosure Report, which provides data on completed U.S. foreclosures and foreclosure inventory, which found that there were 45,000 completed foreclosures nationally, down from 58,000 in August 2013, a year-over-year decrease of 22.2 percent. On a month-over-month basis, completed foreclosures were up slightly by 1.1 percent from the 44,000 reported in July 2014. As a basis of comparison, before the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month nationwide between 2000 and 2006.

Completed foreclosures are an indication of the total number of homes actually lost to foreclosure. Since the financial crisis began in September 2008, there have been approximately 5.2 million completed foreclosures across the country.

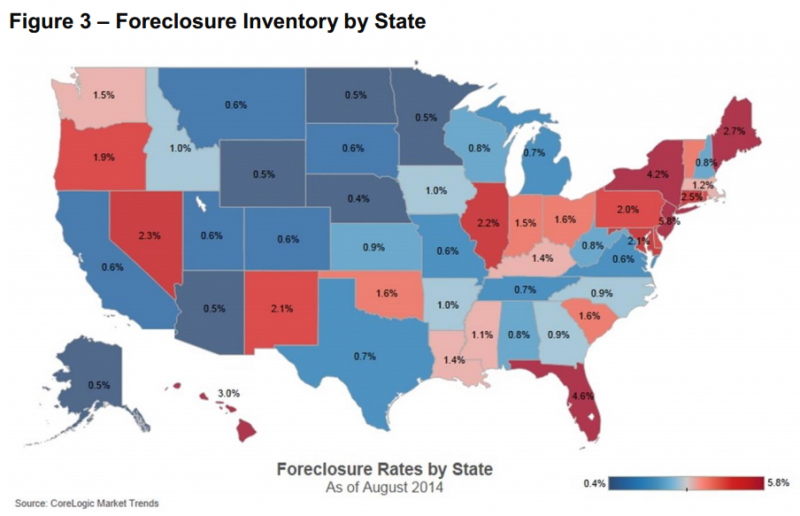

As of August 2014, approximately 629,000 homes nationally were in some stage of foreclosure, known as the foreclosure inventory, compared to 936,000 in August 2013, a year-over-year decrease of 32.8 percent. The foreclosure inventory as of August 2014 made up 1.6 percent of all homes with a mortgage, compared to 2.4 percent in August 2013. The foreclosure inventory was down 2.6 percent from July 2014, representing 34 months of consecutive year-over-year declines.

“Clearly there has been a large improvement in the market the last few years, but five years into the economic expansion the foreclosure inventory remains at nearly three times the normal level,” said Sam Khater, deputy chief economist at CoreLogic. “Since homeownership rates peaked in the second quarter of 2004, there have been 7 million completed foreclosures, which account for 15 percent of all mortgages.”

“The number of foreclosures completed during the last 12 months is at the lowest level since November of 2007,” said Anand Nallathambi, president and CEO of CoreLogic. “At current foreclosure rates, the shadow inventory could fall below 500,000 units by year-end which could provide a solid boost to the recovery in housing in 2015.”

Highlights as of August 2014:

►August represents 19 consecutive months of at least a 20-percent year-over-year decline in the national inventory of foreclosed homes.

►All but two states posted double-digit declines in foreclosures year over year. The District of Columbia saw a 2.5-percent decline and the state of Wyoming saw a 13.4-percent increase in foreclosures year over year.

►Twenty-eight states show declines in year-over-year foreclosure inventory of greater than 30 percent, with Utah and Idaho experiencing the largest declines at 46 percent each.

►The five states with the highest number of completed foreclosures for the 12 months ending in August 2014 were: Florida (121,000), Michigan (43,000), Texas (36,000), California (32,000) and Georgia (28,000).These five states account for almost half of all completed foreclosures nationally.

The four states and the District of Columbia with the lowest number of completed foreclosures for the 12 months ending in August 2014 were: South Dakota (65), the District of Columbia (110), North Dakota (296), West Virginia (462) and Wyoming (650).

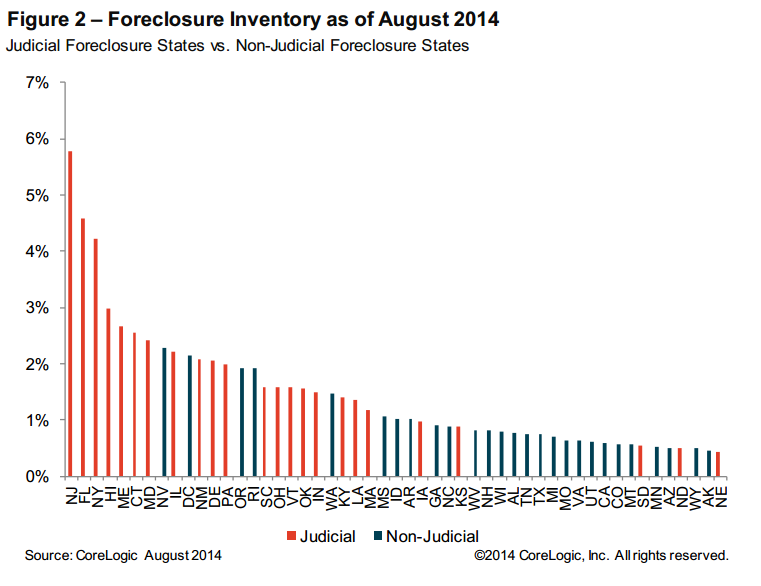

►The five states with the highest foreclosure inventory as a percentage of all mortgaged homes were: New Jersey (5.8 percent), Florida (4.6 percent), New York (4.2 percent), Hawaii (3 percent) and Maine (2.7 percent).

►The five states with the lowest foreclosure inventory as a percentage of all mortgaged homes were: Nebraska (0.4 percent), Alaska (0.5 percent), Arizona (0.5 percent), North Dakota (0.5 percent) and Wyoming (0.5 percent).