Fixed-Rate Mortgages Rise Over the Four Percent Mark

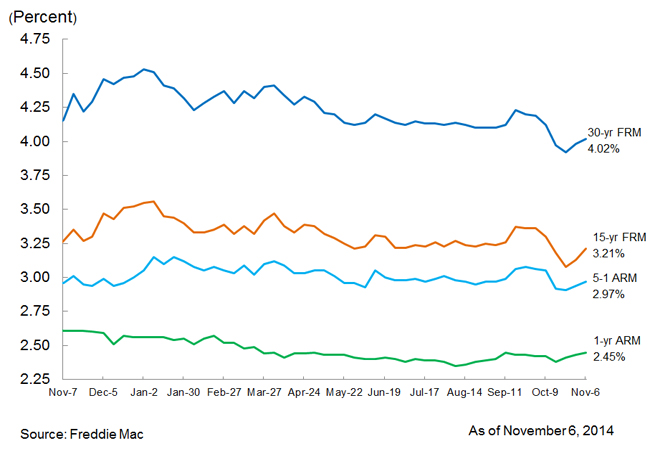

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing that average fixed-rate mortgages (FRMs) moving higher for the second consecutive week amid better than expected economic data. The 30-year FRM averaged 4.02 percent with an average 0.5 point for the week ending Nov. 6, 2014, up from last week when it averaged 3.98 percent. A year ago at this time, the 30-year FRM averaged 4.16 percent. Also last week, the 15-year FRM averaged 3.21 percent with an average 0.5 point, up from last week when it averaged 3.13 percent. A year ago at this time, the 15-year FRM averaged 3.27 percent.

"Mortgage rates continued to rise this week with the 30-year fixed-rate mortgage eclipsing the four percent mark," said Frank Nothaft, vice president and chief economist, Freddie Mac. "The rate increases coincide with real GDP beating consensus expectations of 3.0 percent growth by growing at an annualized rate of 3.5 percent in the third quarter. The ISM Manufacturing Index also beat expectations registering 59 in October, up from September's reading of 56.6."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.97 percent this week with an average 0.5 point, up from last week when it averaged 2.94 percent. A year ago, the five-year ARM averaged 2.96 percent. The one-year Treasury-indexed ARM averaged 2.45 percent this week with an average 0.4 point, up from last week when it averaged 2.43 percent. At this time last year, the one-year ARM averaged 2.61 percent.