Mortgage Credit Availability Tails Off in October

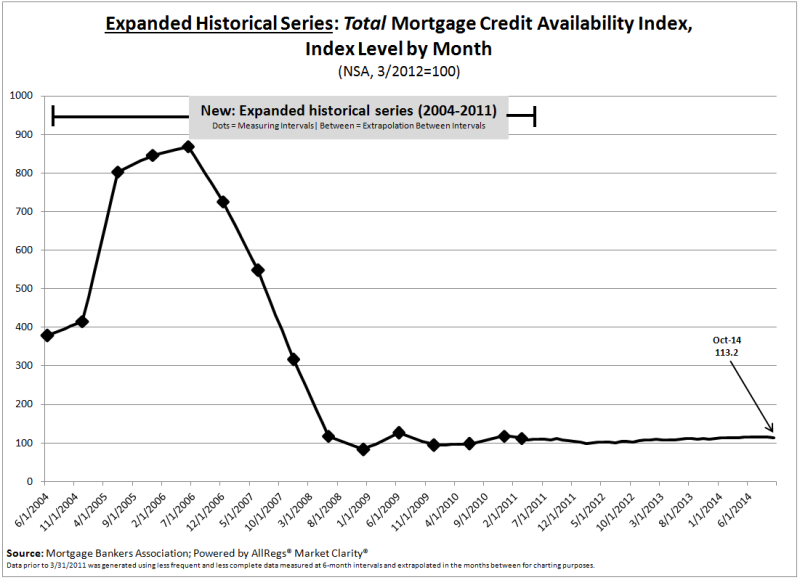

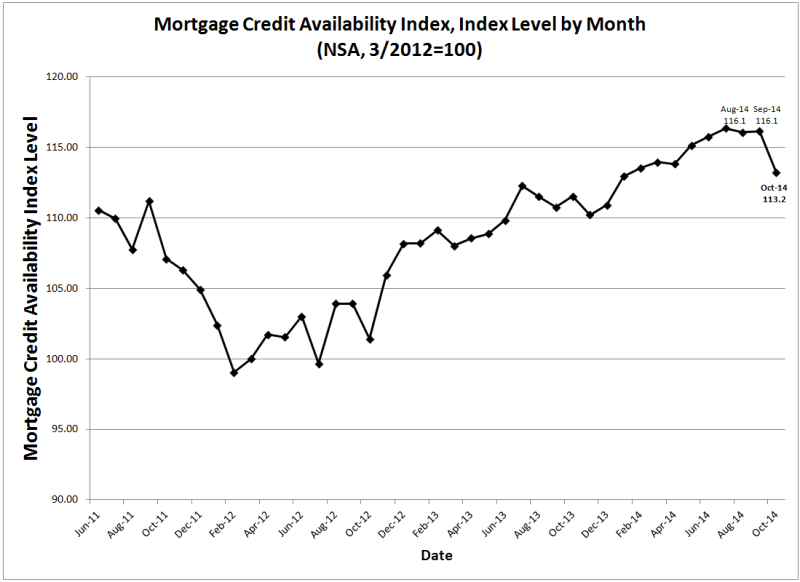

Mortgage credit availability dropped in October, according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) which analyzes data from the AllRegs Market Clarity product. The MCAI decreased 2.5 percent to 113.2 in October. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of a loosening of credit. The index was benchmarked to 100 in March 2012.

“The major cause of the decline in the credit index in October was the removal of special loan programs which only pertain to REO sales. These programs were likely discontinued due to the shrinking level of REO properties for sale on the market,” said Mike Fratantoni, MBA’s chief economist. “FHFA recently announced plans regarding efforts to expand access to conventional conforming credit through greater clarity with respect to repurchase risk and a modest expansion of higher LTV lending. These changes are not yet finalized and hence are clearly not reflected in the October data.”

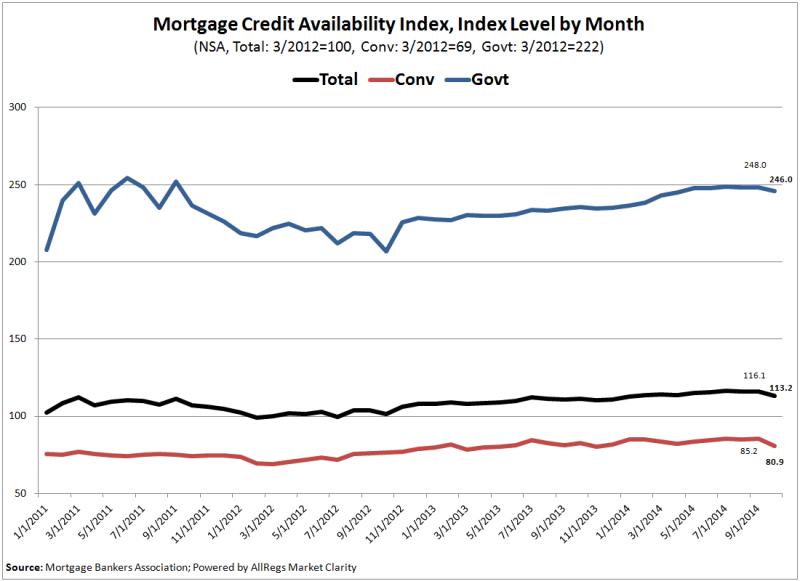

The Conventional and Government Mortgage Credit Availability Index (MCAI), component indices of the Total MCAI, are constructed using the same methodology and are designed to show relative credit risk/availability for conventional and government (FHA/VA/USDA) loan programs. The differences between the component indices and the total MCAI are first, the population of programs they examine, and second, the “base levels” to which they are calibrated. Using data from the MCAI and the Weekly Applications Survey, MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the “base period”) relative to the Total=100 benchmark.MBA now reports on two additional measures of credit availability as part of the monthly MCAI release: the Conventional Mortgage Credit Availability Index and the Government Mortgage Credit Availability Index, with historical data back to 2011.

Both the Government MCAI and the Conventional MCAI decreased in October. The Government MCAI decreased less than one percent going from 248.0 to 246.0 while the Conventional MCAI decreased 5 percent from 85.2 to 80.9.