Nearly $20 Billion in U.S. Mortgage Apps Scarred by Fraud

CoreLogic has released its latest Mortgage Fraud Report, which found that at the end of the second quarter of 2014, the report shows a 3.2 percent year-over-year increase in fraud risk, as measured by the Mortgage Application Fraud Risk Index, and estimates that applications representing approximately $3.3 billion in mortgage debt contained elements of fraud or serious misrepresentations in the second quarter of 2014. For the 12 months ending the second quarter 2014, the report estimates the total value of applications with fraud or serious misrepresentations at $19.8 billion.

The analysis found that during the second quarter of 2014, approximately 11,100 mortgage applications, or 0.69 percent of all mortgage applications, contained elements of fraud, as compared with 19,700 or 0.67 percent in the second quarter of 2013, when the total application volume was substantially higher.

The CoreLogic Mortgage Fraud Report analyzes the collective level of loan application fraud risk throughout the mortgage industry. The CoreLogic Mortgage Application Fraud Risk Index is based on residential mortgage loan applications processed by CoreLogic LoanSafe Fraud Manager, which includes a predictive fraud scoring technology. The report includes detailed data for six application fraud type indices that complement the national index: Employment, identity, income, occupancy, property and undisclosed debt.

Among the highlights of the report:

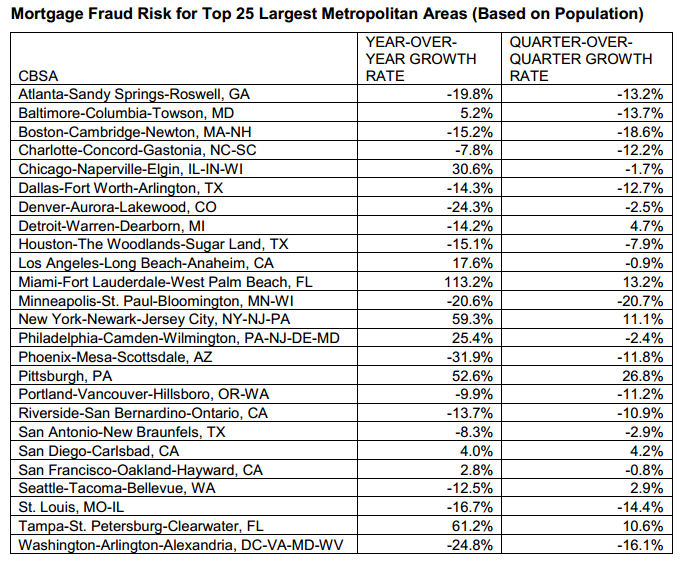

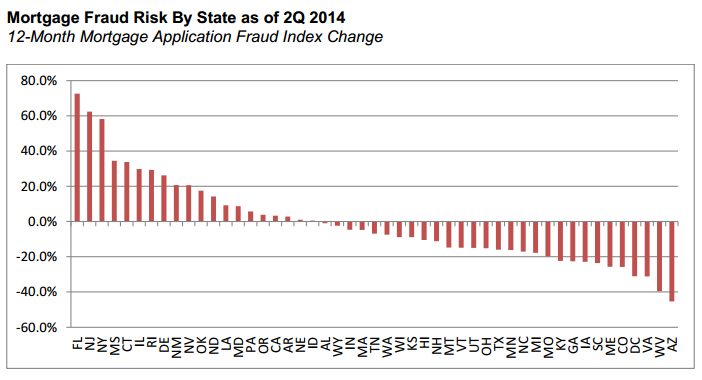

►Nationally, Florida experienced the highest year-over-year growth in mortgage application fraud risk; Arizona experienced the largest decline.

►Of the six components in the CoreLogic Mortgage Application Fraud Type Indexes, property fraud risk had the largest year-over-year percentage increase at 3.3 percent; undisclosed debt risk showed the largest year-over-year decline at 22.7 percent.

►As has been the case for the past four years, jumbo mortgages have exhibited the highest fraud risk, followed by low-downpayment mortgages.

The year over year differences are likely driven to some extent by changes to market conditions including:

►New government programs—notably the "ability to repay" rules that went into effect last January—that have placed additional scrutiny on debt and irregular income such as bonuses and rental payments;

►Over 3.2 million additional single-family properties added to the rental market since 2006, increasing both the potential for occupancy fraud as well as the number of consumers showing rental income and multiple mortgages.

►Deferred maintenance for some properties and rapid appreciation for others leading to large discrepancies in value among nearby properties, increasing opportunities for incorrect valuation and fraud-for-profit schemes. This was most often the case in judicial foreclosure states and high vacancy areas.

“Increasing home values have improved home equity, enabling many homeowners with previously marginal equity to purchase a different property, refinance, or obtain a cash-out home equity loan or HELOC,” said Michael Bradley, Ph.D., senior vice president of Analytics at CoreLogic. “Also, job creation, as well as the aging of negative credit report records from the beginning of the recession, have increased the number of consumers able to qualify for mortgages. Finally, more institutions are beginning to rely on advanced analytics to relax credit overlays and expand the credit envelope. All of these trends have expanded access to mortgage credit modestly with only a slight increase in fraud risk, as the CoreLogic Mortgage Fraud Report indicates.”