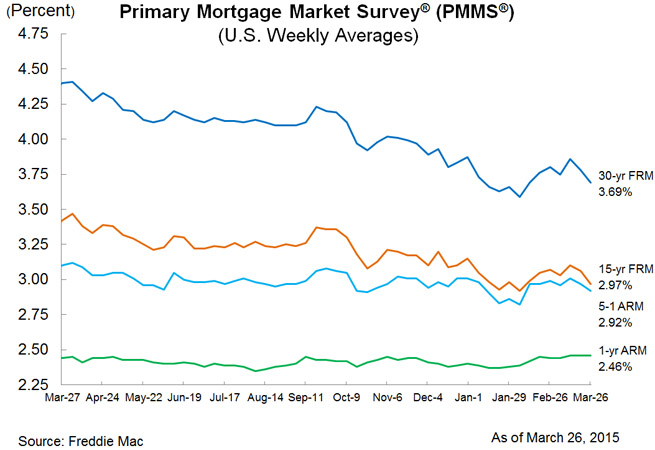

Rates Drop to 3.69 Percent as Spring Homebuying Season Begins

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing that average fixed mortgage rates moving down again across the board. Average fixed rates that continue to run below four percent will help keep affordability high for those in the market to buy a home as we head into the spring homebuying season. The 30-year fixed-rate mortgage (FRM) averaged 3.69 percent with an average 0.6 point for the week ending March 26, 2015, down from last week when it averaged 3.78 percent. A year ago at this time, the 30-year FRM averaged 4.40 percent. The 15-year FRM averaged 2.97 percent this week with an average 0.6 point, down from last week when it averaged 3.06 percent. A year ago at this time, the 15-year FRM averaged 3.42 percent.

"The average 30-year fixed mortgage rate fell to 3.69 percent this week following a decline in 10-year Treasury yields," said Len Kiefer, deputy chief economist, Freddie Mac. "Low mortgage rates are a welcome sign for those in the market to buy a home this spring season and will help to support homebuyer affordability. Existing home sales in February increased slightly, but less than expected, to a seasonally adjusted annual rate of 4.88 million units. Meanwhile, new home sales outperformed expectations and surged 7.8 percent to an annual pace of 539,000 units."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.92 percent this week with an average 0.4 point, down from last week when it averaged 2.97 percent. A year ago, the five-year ARM averaged 3.10 percent. The one-year Treasury-indexed ARM averaged 2.46 percent this week with an average 0.4 point, unchanged from last week. At this time last year, the one-year ARM averaged 2.44 percent.