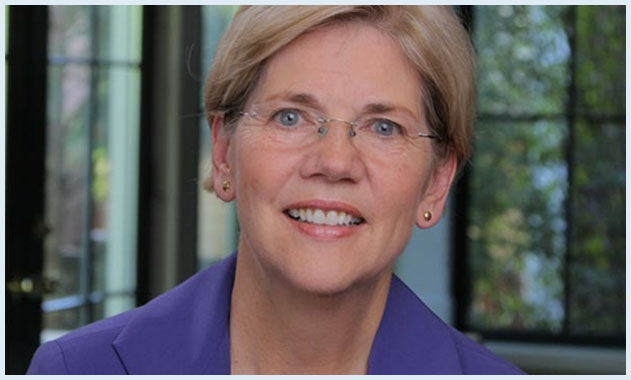

Banks May Withhold Democrat Donations Over Elizabeth Warren

Sen. Elizabeth Warren’s targeting of the nation’s major banks as being the cause of the nation’s financial woes has resulted in a pushback of sorts: several major lenders are reportedly considering the withholding of campaign donations to the Democratic Senatorial Campaign Committee as a protest against the Massachusetts senator’s pointed comments and calls to break up the Wall Street financial institutions. But for her part, Warren is using this news to launch a new fundraising effort aimed at her base.

According to a Reuters report, representatives from four major Wall Street banks—Citigroup, JPMorgan, Goldman Sachs and Bank of America—had conversations during a recent Washington meeting that discussed the possibility of refusing to make campaign donations to the Democratic Senatorial Campaign Committee in order to send a protest over Warren’s high-profile attacks on the financial services sector. While Goldman Sachs has already made a $15,000 contribution—the maximum amount allowed by law—to the Democrat’s committee for this year, JPMorgan only donated one-third of that amount while Citigroup and Bank of America have yet to contribute any funds.

No bank executive would go on the record to confirm Reuters’ report—the news agency claimed that its story was provided by “sources familiar with the discussions” between the banks. Nor was there any indication that this alleged boycott would include halting donations to the presumptive campaign by Hillary Clinton as the Democrats’ presidential candidate.

Warren, however, is using this news to increase her fundraising efforts. In a blog post titled “Wall Street Isn’t Happy With Us,” she singled out Citigroup and JPMorgan in an effort to silence her political agenda while urging her followers to pony up $30,000 in donations.

“I’m not going to stop talking about the unprecedented grasp that Citigroup has on our government’s economic policymaking apparatus,” she wrote. “I’m not going to stop talking about the settlement agreements that JPMorgan makes with our Justice Department that are so weak, the bank celebrates by giving their executives a raise. And I’m not going to pretend the work of financial reform is done, when the so-called ‘too big to fail’ banks are even bigger now than they were in 2008. The big banks have issued a threat, and it’s up to us to fight back. It’s up to us to fight back against a financial system that allows those who broke our economy to emerge from a crisis in record-setting shape while ordinary Americans continue to struggle. It’s up to us to fight back against a regulatory system that is so besieged by lobbyists—and their friends in Congress—that our regulators forget who they’re working for.”