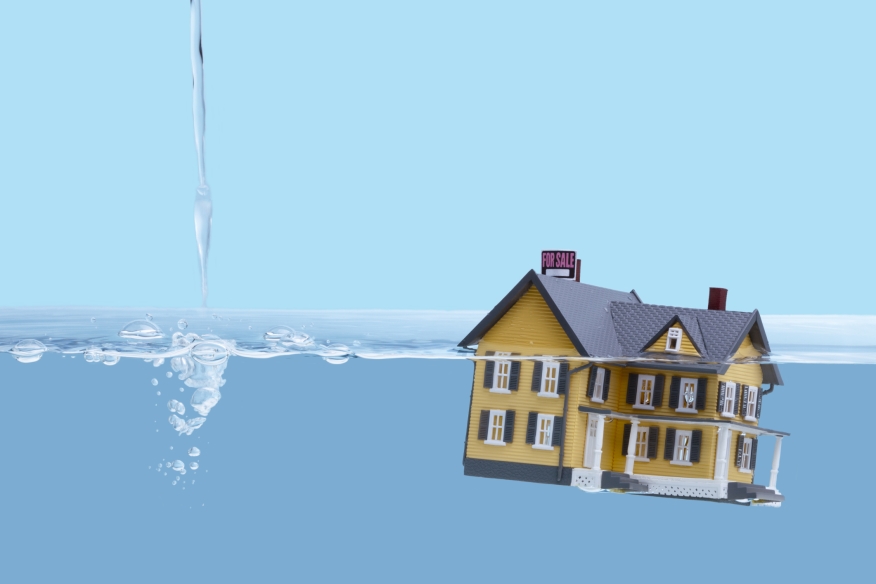

Underwater Mortgages Bubble to Surface in Supreme Court Case

One of the most significant cases before the U.S. Supreme Court is Bank of America v. Caulkett, which may have a major impact on how the industry handles underwater mortgages.

At issue is whether Section 506(d) of the Bankruptcy Code will allow the courts to void a second mortgage on a residential property that is underwater. The genesis of the case is Florida homeowner David Caulkett, who bought a house in 2006 for $249,500 and paid for it with two mortgages, one for $199,600 and one for $49,000. Caulkett filed for Chapter 7 bankruptcy in 2013, and at the time he owed $183,000 and $47,000 on his two mortgages—far more than the $98,000 valuation that his house carried. Caulkett sought to have the second mortgage lien voided in bankruptcy court because his house’s value was significantly less than his first mortgages.

To date, Caulkett has emerged victorious in the courts—most recently in a unanimous ruling by the Eleventh Circuit Court of Appeals. Arguing against Caulkett is Bank of America, which stated that the Supreme Court’s 1992 Dewsnup v. Timm case outlawed the process of stripping off a second mortgage on an underwater property as unsecured debt in a bankruptcy case. But the Eleventh Circuit Court did not agree, stating that the Dewsnup case did not apply if the collateral on a second mortgage did not did not possess enough value. A similar case brought by another underwater mortgage borrower in Florida, Edelmiro Toledo-Cardona, has been linked to Caulkett’s for the Supreme Court decision.

Which way will the Supreme Court rule on this case? Several prominent real estate attorneys offered mixed views.

“I believe that the U.S. Supreme Court should not overturn the decision made by the 11th Circuit Court of Appeals in Bank of America v Caulkett,” said Les R. Kramsky of the Marlboro, N.J.-headquartered Law Offices of Les R. Kramsky LLC. “It is my opinion that the homeowners should be able to erase underwater second mortgages though Chapter 7 bankruptcy. If we do not allow the discharge of these underwater second mortgages then second mortgage holders could simply block any bankruptcy settlement between the homeowner and the first mortgage holder, which may not only allow the homeowner to keep their home, but this can also benefit the first mortgage holder.

“The rationale is that if the underwater property goes to foreclosure then the second lien holder is going to get wiped out any way so why allow them to possibly block a reasonable bankruptcy settlement,” Kramsky said. “Moreover, if a mortgage is wholly underwater then no component of the mortgage is secured in bankruptcy so it should be permitted to be stripped down in Chapter 7 bankruptcy. This U.S. Supreme Court case will decide the fate of millions of underwater debtors and I believe that allowing the discharge of the wholly underwater second mortgages will best serve the public interest.”

Yet Adam Leitman Bailey, a New York-based real estate attorney, disagreed with Kramsky’s forecast.

“Ruling against Bank of America in this case would not only be a loss for all lenders, but also a loss for America,” he said. “Lenders would be wise to limit making second mortgages as losing would have bankruptcy courts strip lenders of all possible equity or monetary value in the subject home. Many of these loans are needed to one day get back to the level of home ownership we had in 2005. Hopefully, the court will recognize the importance lenders have on keeping the American Dream of home ownership for the middle class alive.”

And a third opinion came from Michael R. Pfeifer is the managing partner of Orange, Calif.-based Pfeifer & De La Mora LLP and general counsel of the California Mortgage Bankers Association (CMBA), who noted that forecasting the outcome would be difficult because of the fundamental dissimilarities between the Supreme Court of the Dewsnup era and today’s justices.

“The court has a different composition at this point in time,” he said. “They make look at this from a different perspective.”

The court’s ruling is expected later this spring, though no date has been set for the announcement. In the meanwhile, the industry is waiting for this latest turn in how origination and servicing will be conducted.

“This will have a dampening effect on second mortgages with higher loan-to-value,” said John Councilman, CMC, CRMS, president of NAMB—The Association of Mortgage Professionals and president of Fort Myers, Fla.-based AMC Mortgage Corporation. “They will ultimately cost more. And it could trickle down to first mortgages, which would be another thing that could prevent private equity from coming back into the market.”

Logan Mohtashami, an Irvine, Calif.-based senior loan manager at AMC Lending Group and a financial blogger at LoganMohtashami.com, noted that the Caulkett case could also be seen through the spectrum of no-good-deed-goes-unpunished.

“As part of the robo-signing settlement, Bank of America tried to get people to write-off their second mortgages,” Mohtashami said. “But they couldn’t get people to do it—maybe less than two percent responded.”

Mohtashami added, with a laugh, that some people have asked him whether their second lien write-offs would be voided in Bank of American won the case. But he observed that no matter the outcome, the market has changed dramatically to avoid any wide disruptions.

“We don’t see second lien write-offs happening as much today,” Mohtashami said. “No one is getting second liens in this cycle. In the next cycle, we’ll see more traditional foreclosures and short sales, with second liens as part of the short sales.”