Compliance Updates: March 2015

FHA Reduces Annual Mortgage Insurance Premiums Rates

On Jan. 9, 2015, the U.S. Department of Housing & Urban Development (HUD) has issued Mortgagee Letter 2015-01 to communicate a reduction to the annual Mortgage Insurance Premium (MIP) rates for FHA Title II forward mortgages with terms greater than 15 years.

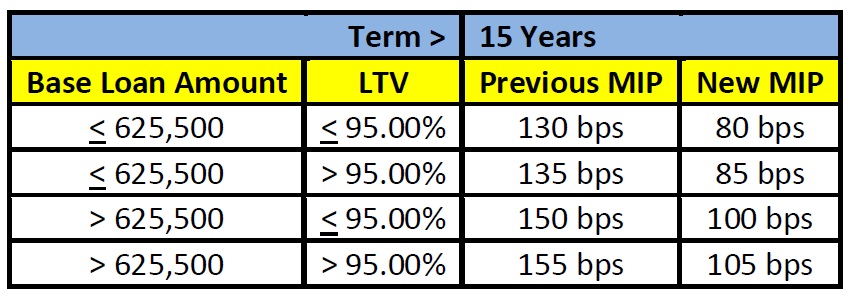

The MIP rate reduction is effective for FHA case numbers assigned on or after January 26, 2015, with the exception of Section 247 mortgages (Hawaiian Homelands) and single family forward streamline refinance transactions that are refinancing existing FHA loans that were endorsed on or before May, 31, 2009. The following table provides a breakdown of the existing and new annual MIP rates by amortization term, base loan amount and LTV ratio:

Note that the annual MIP rates specified in ML 2015-01 supersede the rates established in ML 2013-4. All other sections of ML 2013-4 remain in effect.

Massachusetts Amends Truth-In-Lending Requirements

The Massachusetts Division of Banks filed final amendments to 209 CMR 32.00: Disclosure of Consumer Costs and Terms. The amendments became effective on Jan. 2, 2015. The amendments are intended to streamline the regulation for easier compliance by providing that compliance with cited provisions of the regulations of the federal Consumer Financial Protection Bureau (CFPB) constitutes compliance with the cited provisions of 209 CMR 32.00.

As a result of the streamlining to align the State regulation to CFPB standards, there may be instances where state specific disclosures need to be altered or may no longer be required. Lenders should review its inventory of Massachusetts disclosures to validate compliance.

Matt Drottz is a compliance analyst with DocMagic Inc. Matt has more than 12 years of experience in the mortgage industry, with extensive knowledge pertaining to mortgage servicing oversight, risk management and compliance.

This article originally appeared in the March 2015 print edition of National Mortgage Professional Magazine.