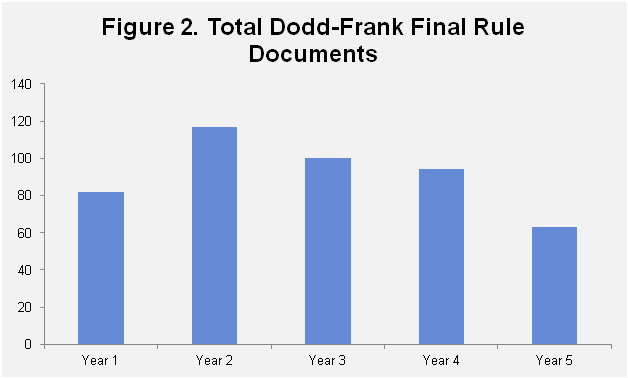

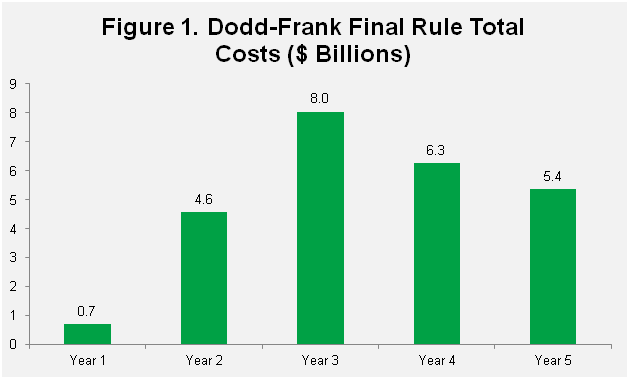

The Cost of Dodd-Frank: $24 Billion in Compliance

This year marks the fifth anniversary of the passage of the Dodd-Frank Act–and while the benefits of the sweeping legislation continue to be debated, a new report has added up the costs to $24 billion in compliance-related expenses and 61 million paperwork hours.

According to “Dodd-Frank at Five: Higher Costs, Uncertain Benefits,” published by the American Action Forum–an organization self-identified as a “21st Century center-right policy institute providing actionable research and analysis to solve America’s most pressing policy challenges”–456 final rules related to the Dodd-Frank Act have been passed since 2010. But the report noted there approximately $7.8 billion worth of pending rules–less than two-thirds of 2,300-page law has been finalized.

The report observed that the compliance expenses attached to the Dodd-Frank regulations have burdened banks of all sizes, with the costs being passed to consumers. Efforts to create safer lending brought lending to a new extreme, the report added, with increased restrictions on credit and loan products to young, low-income and non-White borrowers.

“With tightened mortgage credit, high rates of foreclosure, and weak job and wage growth, many in this economic recovery turned to renting,” the report said. “Robust multifamily starts (buildings with more than four units) have helped pushed total starts to the same level they were at the beginning or peak of the recession in December 2007. Yet single-family housing starts stand at only 84 percent of that level, now almost 90 months since the recession began. Botched initiatives to help struggling homeowners, the Dodd-Frank Act, and its failure to tackle housing finance reform have contributed to the slow recovery of the housing market when compared with the average post-war recovery.”

But while borrowers have not seen much benefit, the report determined, the regulatory oversight of the Dodd-Frank Act has created an employment boom in the nation’s capital.

“While jobs in the financial industry only increased 3.7 percent since Dodd-Frank became law, the number of jobs at federal financial regulatory agencies spiked 19.2 percent,” the report stated. “However, this understates the growth in employment in some agencies. For instance, the number of workers at the Federal Housing Finance Agency (FHFA) and employees at the entire Federal Reserve System (all Federal Reserve Banks and the Board of Governors) increased 37.1 percent and 32.2 percent since Dodd-Frank.”

The Dodd-Frank Act did not address the question of the government-sponsored enterprises, and the report added that this situation was the proverbial fuel on the Dodd-Frank fire.

“With legislation to fix the housing giants stalled in Congress, Fannie Mae and Freddie Mac remain a very real risk to taxpayers and the very definition of too-big-to-fail, matters unaddressed by the Dodd-Frank Act,” the report said. “The failure to address housing finance reform has contributed to the uncertainty surrounding the future housing market, which, when coupled with Dodd-Frank regulations, have worked to reduce the availability of mortgage credit particularly for traditionally riskier borrowers.”